Falling More Than the Index Decline

Double-Digit Drops Including Hanwha Solutions

[Asia Economy Reporter Oh Ju-yeon] Amid the recent continuous weakness in the domestic stock market, the decline of Green New Deal-related stocks, which surged following the government's 'New Deal Policy' announcement earlier this month, has been prominent.

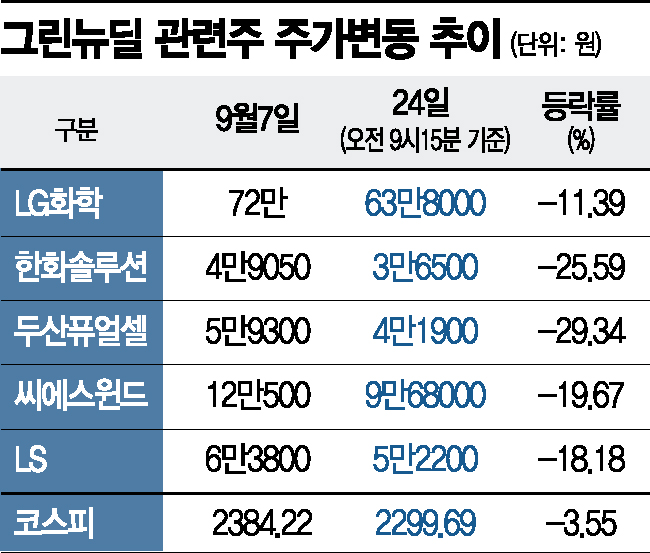

According to the Korea Exchange on the 24th, as of 9:15 a.m., the KOSPI fell below the 2300 mark to 2299.69. Compared to the 2435.92 recorded on the 16th, it dropped more than 100 points in just one week. The index decline rate reached 5.59%. However, related stocks that had sharply risen due to expectations from the government's New Deal Policy earlier this month, such as the 'K-New Deal Index,' fell at levels significantly exceeding the index decline rate.

The government announced the 'Korean New Deal Comprehensive Plan,' which includes investing 160 trillion won by 2025 to create 1.9 million jobs. Among the two main pillars, 'Digital New Deal' and 'Green New Deal,' which accelerates eco-friendly and low-carbon transitions, investors focused on the Green New Deal this month and began aggressively buying eco-friendly related stocks. As of the 7th, when the New Deal Index was announced, these related stocks surged collectively.

LG Chem, related to the 'Eco-friendly Future Mobility' policy task in the Korean New Deal, fell 11.39% from 720,000 won at the close on the 7th to 638,000 won on this day. Individual investors had high expectations, placing LG Chem as their top net purchase stock until early this month, but turned away due to the battery business spin-off issue.

Hanwha Solutions is one of the most purchased stocks by individuals this month and is considered a representative stock with significant investment losses among Green New Deal-related stocks. Hanwha Solutions is expected to benefit from the expansion of 'Green Energy' in the Korean New Deal Policy, as the government plans to generate 2.5GW of solar power demand annually by 2025 under its renewable energy expansion plan. Additionally, the value of Nikola shares rose, pushing the stock price above 50,000 won intraday on the 7th, but the current price has dropped 25.59% in half a month to 36,500 won.

The decline rate of Doosan Fuel Cell is even greater. Benefiting from expectations of hydrogen economy activation and increased demand for eco-friendly (renewable, low-carbon) energy, Doosan Fuel Cell closed at 59,300 won on the 7th but plunged 29.34% to 41,900 won on this day. BS Wind, which is expected to structurally rise due to the global wind power market growth spillover effect, also fell 19.67% from 120,500 won to 96,800 won during the same period, and LS slid 18.18% from 63,800 won to 52,200 won, with all Green New Deal-related stocks showing double-digit declines.

An industry insider said, "The price decline is mainly occurring in stocks that had risen sharply so far," adding, "Since this momentum is not a short-term issue, it is necessary to take a longer-term view."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.