[Asia Economy Reporter Su-yeon Woo] As the three foreign-affiliated automakers?Korea GM, Renault Samsung Motors, and Ssangyong Motor?are pushed to the brink of collapse, concerns are growing that the wave of bankruptcies among parts suppliers will become a reality after September. Chronic deficits, labor and legal risks, and sluggish domestic and export sales due to the novel coronavirus disease (COVID-19) have combined to cause severe liquidity paralysis throughout the domestic automotive ecosystem.

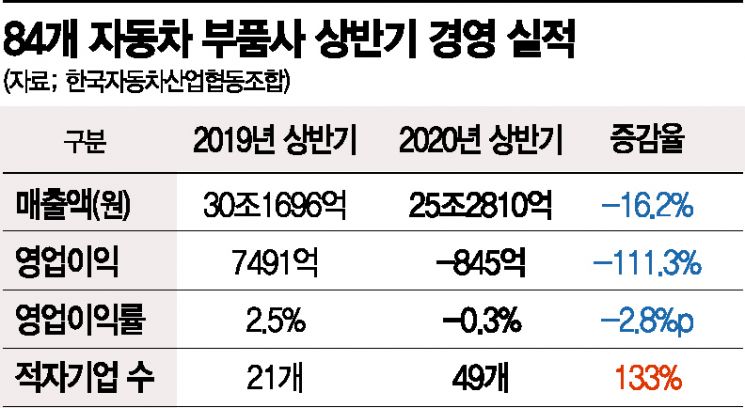

According to internal analysis data from the Korea Automobile Industry Cooperative on the 24th, the operating loss of 84 listed automotive parts companies in the first half of this year was 84.5 billion KRW, representing a 111% decrease in profit compared to the same period last year. Parts companies that had posted profits exceeding 700 billion KRW until the first half of last year have turned to massive losses starting from the second quarter of this year. The operating profit margin plunged sharply from 2.5% to -0.3%. The number of loss-making companies more than doubled from 21 in the first half of last year to 49 in the first half of this year.

While Parts Suppliers’ Profits Fell 111% Year-on-Year, Employment Dropped Only 3%

This reflects that the COVID-19 impact received by automakers from the second quarter of this year has been fully transmitted to their parts suppliers. Moreover, while the operating profits of parts companies have plummeted by more than 100%, employment has remained at a level similar to last year, exacerbating management difficulties. According to the Korea Employment Information Service, as of the first half of this year, employment in automotive parts companies was 222,638, a decrease of only 3.6% compared to the previous year.

Jung Manki, chairman of the Korea Automobile Manufacturers Association, said in an interview with Asia Economy, "The fact that employment has decreased by only about 3% despite large-scale deficits indicates that parts companies have made efforts to maintain employment beyond what they could bear," adding, "We must overcome this difficult period well and maintain the entire automotive ecosystem to properly respond to expanded supply during the demand recovery phase."

In particular, as the poor performance of the three foreign-affiliated automakers?Korea GM, Renault Samsung Motors, and Ssangyong Motor?continues, the difficulties faced by their parts suppliers have reached a desperate level beyond mere crisis. Their export performance from January to August this year compared to the previous year decreased by 73% for Renault Samsung, 34% for Ssangyong Motor, and 27% for Korea GM, and the factory operating rates of parts suppliers have also sharply declined due to the plunge in exports.

Chairman Jung said, "Since there is about a three-month lag in parts payment, the impact of the export plunge in May and June is gradually appearing in August and September," expressing concern that "if the payment gap during this period is not resolved, the liquidity crisis of parts suppliers could become a reality after September."

Jung Manki, President of the Korea Automobile Manufacturers Association / Photo by Yoon Dongju doso7@

Jung Manki, President of the Korea Automobile Manufacturers Association / Photo by Yoon Dongju doso7@

Suppliers with Low Credit Ratings Among the Three Companies... Government Support Blind Spots

Although the government supports various loan programs through the Korea Credit Guarantee Fund and the Korea Technology Finance Corporation, these are out of reach for parts suppliers of the three foreign-affiliated companies with low credit ratings. Through the mutual growth guarantee program of the Credit Guarantee Fund and Technology Finance Corporation, about 420 automotive parts companies have received loan guarantee benefits so far, but only about 3 to 4 of these are suppliers to the three foreign-affiliated companies. This is because the poor performance of the primary contractors inevitably lowers the creditworthiness of their parts suppliers.

In addition to export sluggishness, the possibility of strikes by the primary contractors is also a latent risk. If automaker factories proceed with strikes during the annual wage negotiation period, parts suppliers have no choice but to halt operations.

Currently, the Korea GM labor union is awaiting the results of the Central Labor Relations Commission’s labor dispute mediation application to secure the right to strike. Moreover, it has recently become embroiled in various labor lawsuits and is required to deposit 200 billion KRW in cash as a bond. Chairman Jung said, "200 billion KRW is a huge amount that could alleviate the financial difficulties of parts companies struggling due to COVID-19," adding, "It is not easy for management to put out such a large sum of cash all at once."

Renault Samsung, which suffered sales losses exceeding 450 billion KRW due to strikes last year, has not even started main negotiations for this year’s wage talks and will suspend operations at its Busan plant from the 25th of this month to the 18th of next month due to sluggish domestic sales. Ssangyong Motor, which managed to reach a no-strike agreement early this year, now stands at a crossroads between sale and court receivership. The U.S. automotive distributor HAAH has made an acquisition proposal, but it remains uncertain whether the current major shareholder Mahindra will accept a capital reduction and successfully finalize negotiations with creditors.

Chairman Jung pointed out, "The number one risk cited by foreign companies investing in Korea is the backward labor-management relations," emphasizing, "In particular, the annual labor-management negotiations have become the biggest obstacle to attracting investment." He added, "To overcome this, establishing an advanced labor-management culture, such as biennial wage negotiations, is the top priority."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)