Hansung University Global Economic Research Institute Announces Korea's First Analysis on Social External Costs of Smoking

Excessive Taxation on Heated Tobacco Products, Urgent Reform Needed for Differential Tax System Based on Tax Equity

Assuming Equal Harmfulness... Appropriate Tax on Heated Tobacco Products Should Be 493.7 Won Lower Than Current Level

[Asia Economy Reporter Lee Seon-ae] There is a claim that the current tobacco tax system imposes relatively excessive taxes on heated tobacco products, and therefore, to improve tax equity, it is necessary to further differentiate the taxation between conventional cigarettes and heated tobacco products. In particular, the basis for this claim is a study that, for the first time in Korea, estimated the external costs of smoking by category and found a significant difference in the external costs between conventional cigarettes and heated tobacco products.

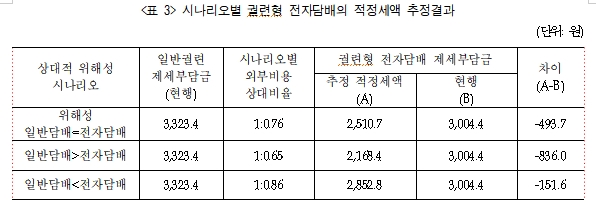

According to the report titled "A Study on Estimating the External Costs of Smoking and Rational Tobacco Taxation Measures (2020)" published on the 22nd by the Global Economic Research Institute of Hansung University (Professor Park Young-beom, Hong Woo-hyung, Lee Dong-gyu team), assuming that the harmfulness of all tobacco products is the same, the appropriate tax amount for heated tobacco products is estimated to be 2,510.7 KRW, which is about 493.7 KRW lower than the current tax. This report contains the first domestic analysis and empirical evidence showing a significant difference in the external costs between conventional cigarettes and heated tobacco products by estimating the external costs of smoking by category.

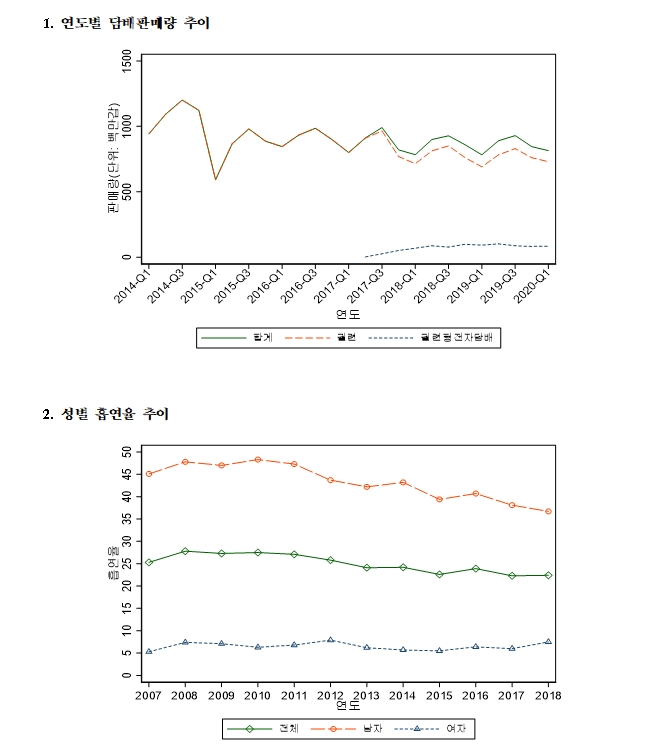

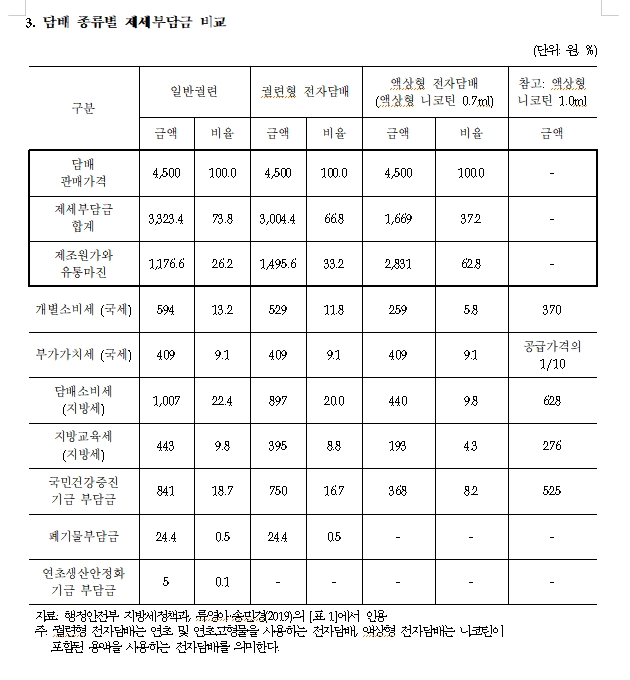

The Global Economic Research Institute cited the rapid increase in demand for electronic cigarettes and the fact that under the current tax system, the tax burden on conventional cigarettes and heated tobacco products is imposed at similar levels, as the background for this study. The issue of tax equity between conventional cigarettes and heated tobacco products has been continuously raised. From the perspective of tax equity, the theoretical justification for tobacco taxation can be found in corrective tax theory, and the appropriate tax standard should be set based on the external costs of smoking. According to the theory of corrective tax, it is socially desirable to tax tobacco products according to the magnitude of their external costs, which can effectively guide tobacco consumption.

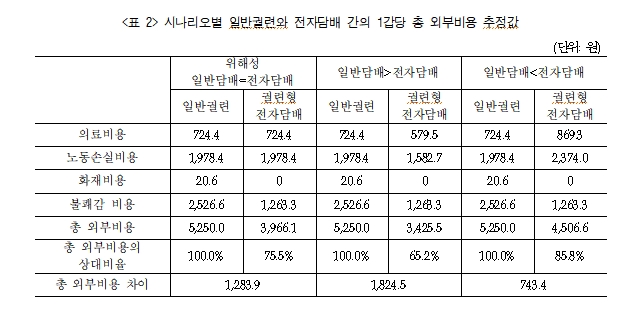

The study categorized the social external costs of conventional cigarettes and heated tobacco products into medical and labor loss costs, fire costs, and discomfort costs, and estimated each cost. Previous studies on the external costs of smoking mainly focused on medical costs (meaning medical expenses incurred by non-smokers due to secondhand smoke and increased health insurance premiums for non-smokers due to smokers' increased medical expenses) and labor loss costs (opportunity costs due to loss of labor and productivity related to smoking). However, this study also scientifically analyzed and rigorously estimated fire costs (costs of human and property damage and firefighting expenses caused by fires from cigarette butts) and discomfort costs (estimated as the willingness to pay for cleanliness due to discomfort non-smokers feel from cigarette odor), which the research institute explained as a significant contribution.

First, according to the study, assuming that the health risks of conventional cigarettes and heated tobacco products are equal, the relative ratio of total external costs is conventional cigarettes : heated tobacco products = 1 : 0.76, indicating that the total external costs of heated tobacco products are relatively lower. The research team estimated that, assuming the current tobacco tax on conventional cigarettes is maintained, the appropriate tax for heated tobacco products is 2,510.7 KRW per pack, about 493.7 KRW lower than the current tax (3,004.4 KRW).

In particular, the study is based on a survey and analysis of the social costs of smoking conducted on about 4,500 general citizens (2,158 smokers and 2,356 non-smokers). According to the survey results, smokers rated their own medical costs relatively higher regarding the social costs of smoking, while non-smokers rated medical costs due to secondhand smoke relatively higher. Regarding discomfort from cigarette odor, non-smokers and heated tobacco product smokers rated the costs relatively higher compared to conventional cigarette smokers.

Professor Park Young-beom of the Department of Economics at Hansung University said, "The government's stance on the tobacco tax system has so far been based on the premise that conventional cigarettes and heated tobacco products are 'the same tobacco,' but this study found that the social costs caused by conventional cigarette smoking are higher than those of electronic cigarettes." He emphasized, "Looking at major advanced countries, tobacco regulations and tax rates are applied proportionally to the harmfulness of each tobacco product. The Korean government also needs to seriously consider introducing tobacco regulation policies proportional to tobacco harmfulness, such as 'strengthening regulations on more harmful tobacco and relaxing regulations on less harmful tobacco.'"

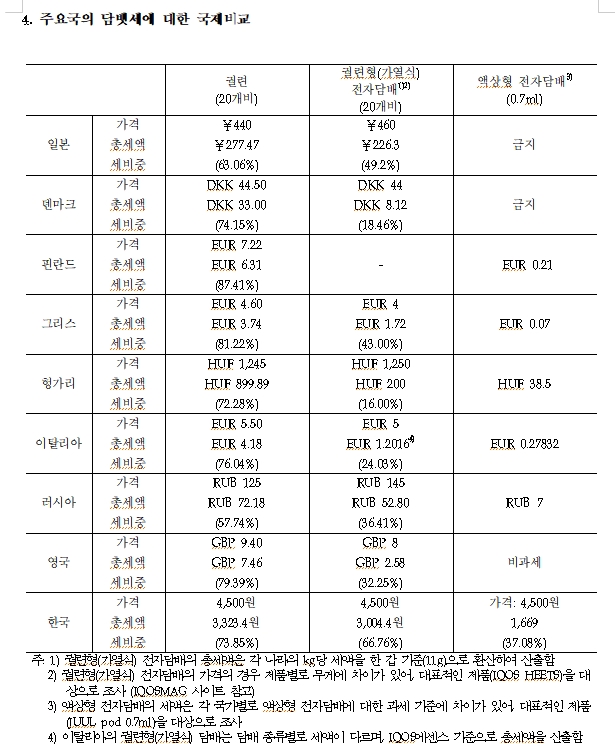

Meanwhile, the tax burden ratio of heated tobacco products compared to conventional cigarettes is 90.4% (conventional cigarettes : heated tobacco products = 1 : 0.90), which is the highest level among major countries. Japan has the highest tax burden ratio among major countries at 78.0%, Russia is about 63.1%, Greece about 52.9%, and other countries have even lower ratios of only 20 to 40%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)