55.6% of This Year's Supply Target of 3.4 Trillion Won

Low Credit and Low Income Borrowers Account for 91.8% of Loans

[Asia Economy Reporter Park Sun-mi] The banking sector supplied approximately 1.9 trillion KRW in Saehee Hope Loan, a livelihood financial product for low-credit and low-income individuals, in the first half of this year.

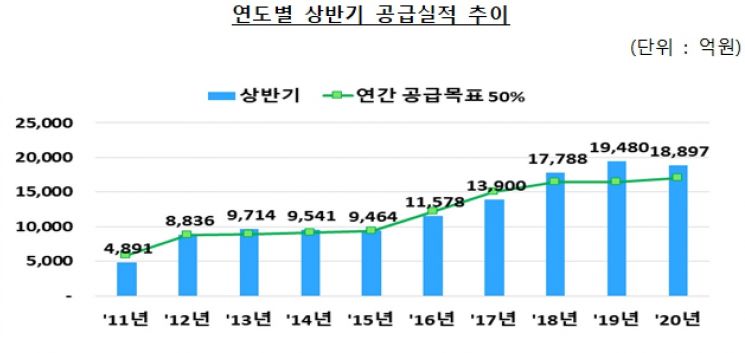

According to the Financial Supervisory Service on the 23rd, the supply performance of Saehee Hope Loan by 15 banks (excluding Industrial Bank and Export-Import Bank) in the first half of this year was 1.8897 trillion KRW (111,844 people). This corresponds to 55.6% of this year's supply target of 3.4 trillion KRW.

Saehee Hope Loan is a banking financial product for the low-income class, lending up to 30 million KRW at an interest rate of 10.5% or less annually to those with an annual income of 35 million KRW or less, or those with a credit rating of 6 or lower and an annual income of 45 million KRW or less. Loans to low-credit (credit rating 7 or lower) or low-income individuals (annual income 30 million KRW or less) accounted for 91.8%, maintaining a consistently high level.

By bank, Shinhan Bank had the largest supply amount at 346.9 billion KRW, followed by NH Nonghyup Bank (326.5 billion KRW), Woori Bank (310.7 billion KRW), Kookmin Bank (269.5 billion KRW), and Hana Bank (246.5 billion KRW). The top five banks' performance of 1.5 trillion KRW accounted for 79.4% of the total performance. In particular, NH Nonghyup Bank's supply amount increased by 57.5 billion KRW compared to the same period last year, showing an increasing trend for three consecutive years.

The average interest rate for Saehee Hope Loan (newly issued) in the first half was 6.15%, down 1.07 percentage points from 7.22% in the same period last year. Following the downward trend in interest rates, the average interest rate for Saehee Hope Loan has maintained a declining trend: 6.59% in January, 6.31% in February, 6.22% in March, 6.16% in April, 6.03% in May, and 5.73% in June. The gap between the average interest rate of Saehee Hope Loan and household credit loan interest rates is also continuously narrowing.

The Financial Supervisory Service stated, "Saehee Hope Loan contributes to improving banking accessibility for low-income and vulnerable groups struggling due to COVID-19," and added, "If the current trend continues, this year's supply target is expected to be exceeded."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.