Kang Dayeon, Research Fellow at Financial Research Institute, "Regional Banks Must Find Breakthroughs Through Expansion and Institutional Improvement"

Roundtable Hosted by Gyeongsilryeon and Financial Industry Union Held in Busan

[Asia Economy Reporter Kim Min-young] A proposal has been made to expand the business scope of regional banks and improve the system to help them overcome the crisis. This diagnosis is based on the fact that the existing role of regional banks has been drastically reduced and they have faced a crisis due to regional imbalances, weakened lending capacity to local companies, changes in the financial environment, and disparities in fiscal independence among local governments.

Kang Da-yeon, a research fellow at the Financial Economy Research Institute, stated this on the 22nd at a joint meeting held in Busan with the Citizens' Coalition for Economic Justice and the National Financial Industry Labor Union titled "Enhancing the Role of Regional Banks and System Improvement for Regional Balanced Development and Regional Economic Revitalization."

In her presentation on strengthening the competitiveness of regional banks for balanced regional development, Kang pointed out that regional banks based locally provide about 60% of their won-denominated loans to small and medium-sized enterprises (SMEs), playing a supporting role in the regional economy, but still face difficulties competing with large commercial banks.

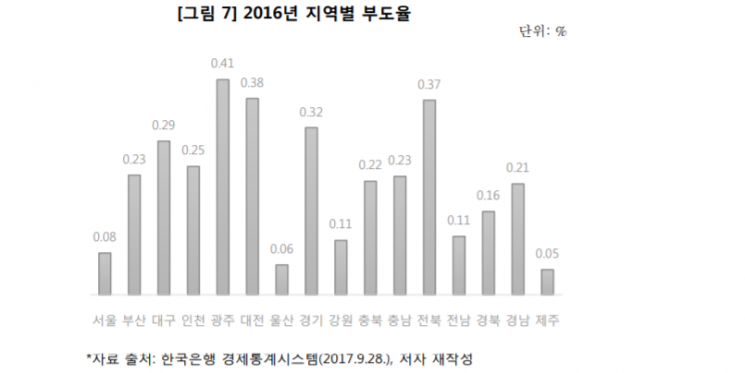

She also cited rapid changes in the financial environment and deterioration of the regional economy as causes of the regional banks' crisis. The manufacturing-centered regional economy has worsened, population decline and prolonged low-interest trends continue, and digital environment changes centered on the Seoul metropolitan area have led to a crisis. She added that a lack of interest from the government or local governments in regional banks, unfair competition with general commercial banks, and the erosion of the original purpose of establishment have made it difficult for regional banks to sustain their existence.

Regional Economy at Its Worst... Proliferation of Insolvent Companies Worsens Regional Banks' Business Base

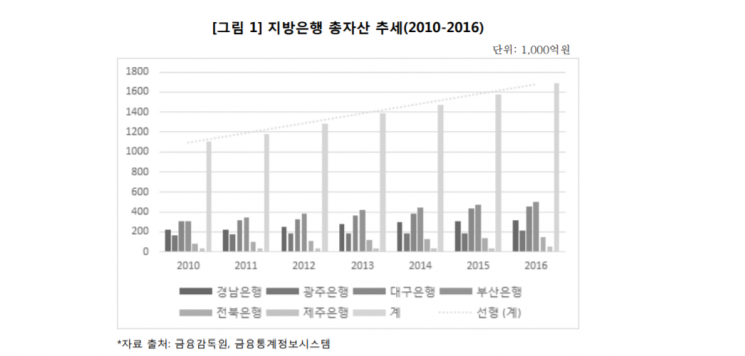

In fact, as the main industries in the bases of six regional banks have mostly fallen into recession, the business base of regional banks is further deteriorating. Since the 2008 global financial crisis, the low-interest phenomenon has prolonged, and amid intensified interest rate competition between commercial banks and regional banks, the relatively vulnerable fund intermediation function of regional banks is inevitably shrinking.

The emergence of new fintech companies is also expected to make it even harder for regional banks. Starting with new internet-only banks, fintech companies could reduce the market share of regional banks in traditional banking areas such as deposits, loans, and remittances.

Kang also pointed out problems with the SME loan ratio system that has been in place since July 1997. She argued that this system harms the management efficiency of regional banks. To comply with the SME loan ratio, commercial banks must lend 45% of the increase or decrease in loans to SMEs, while regional banks must lend 60%. Although there are public institutions and relational finance for regional balanced development, the government has not established separate policies to foster regional banks, leaving them to face increasingly intense competition.

Regional Banks Need to Expand Business Scope

She emphasized that to strengthen competition, regional banks should improve profitability by expanding their business scope, such as utilizing digital finance and accelerating overseas expansion in non-interest sectors. She also mentioned the need to eliminate inefficiencies in relational finance and establish concrete guidelines that can provide incentives to regional banks.

Kang said, "Regional banks should be given opportunities to participate in bidding for main bank contracts of public institutions relocated to the regions," adding, "This will strengthen the role of regional fund intermediation."

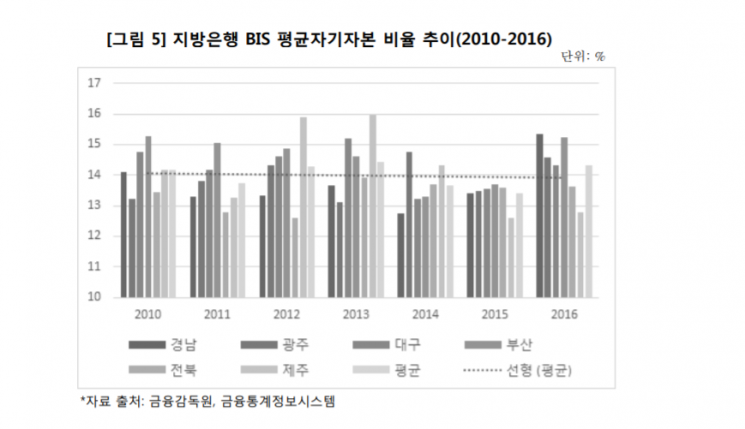

At the discussion held that day, Lee Byung-yoon, senior research fellow at the Korea Institute of Finance, said, "Regional banks have a higher mandatory SME loan ratio compared to commercial banks, so they have a higher proportion of SME loans, which tend to have relatively higher default rates than household loans," but added, "However, the profitability, soundness, and capital adequacy of regional banks appear to be almost on par with commercial banks." Lee also pointed out, "Regarding the expansion of banking services in areas where regional banks have not yet entered, consideration of countermeasures is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.