New York Stock Market Closes Lower Across the Board on the 21st... Concerns Over COVID-19 Resurgence and US Political Conflicts

Safe-Haven Assets Mixed: Dollar Strengthens, Gold Hits Lowest Since July

Travel, Leisure, and Energy Stocks Lead Declines... Delta and Lufthansa Down Over 9%

[Asia Economy New York=Correspondent Baek Jong-min, Reporter Jung Hyun-jin] The fear of a resurgence of the novel coronavirus infection (COVID-19) has once again shaken the international financial markets, following March. After the UK considered re-implementing movement restrictions due to the COVID-19 resurgence, political conflicts over the nomination of a Supreme Court justice candidate in the US raised concerns in the market that it would be difficult to reach an economic support bill to overcome COVID-19. Risk assets such as stocks plunged, and gold and international oil prices also fell sharply. The safe-haven asset, the dollar, showed relative strength.

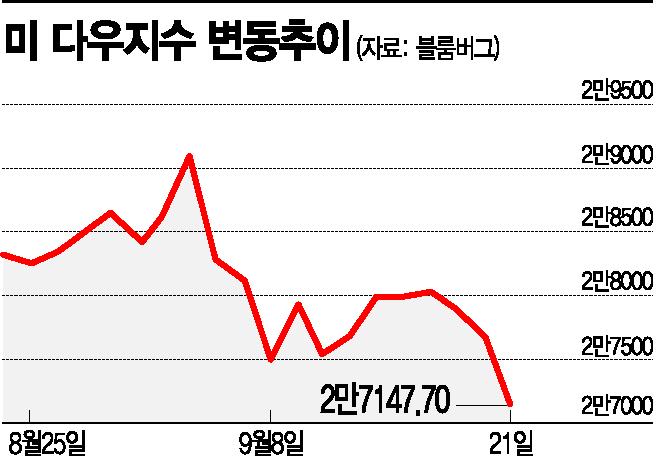

On the 21st (local time) in the New York stock market, the Dow Jones Industrial Average fell 509.72 points (1.84%) to close at 27,147.70, the S&P 500 index dropped 38.41 points (1.16%) to 3,281.06, and the Nasdaq index declined 14.48 points (0.13%) to 10,778.80. The Dow index showed its largest drop since June, falling more than 3% at one point during the session.

The stock market decline was greatly influenced by concerns over the COVID-19 resurgence. The Dow Jones, which consists of traditional companies, was significantly affected, reflecting expectations that if COVID-19 resurges, companies in traditional sectors included in the Dow would be the first to suffer damage. The Wall Street Journal (WSJ) reported that stocks of airlines, retail, and energy-related companies, which had the hardest time during the pandemic this year, were the most affected in this week's decline. Delta Air Lines fell 9.2% to $29.82, and energy supplier Halliburton's stock dropped 8.5%. In the European stock markets that closed that day, travel and leisure stocks also showed notable declines. Germany's DAX index plunged 4%, marking its worst day since June, with Lufthansa's stock falling 9.5%.

Expectations that the US political sphere would neglect economic support due to issues such as the Supreme Court nominee also became a negative factor for the stock market. Scotiabank expressed concerns in an investor note that "President Donald Trump's insistence on pushing through the Supreme Court nominee lowers the likelihood of passing the economic support bill. Even if the situation ends early, the Democrats' willingness to cooperate with the Republicans will inevitably decrease."

Financial stocks such as JPMorgan and American Express were also hit. The International Consortium of Investigative Journalists (ICIJ) analyzed Suspicious Activity Reports (SAR) from the US Financial Crimes Enforcement Network (FinCEN) and revealed that global banks have conducted large-scale suspicious illegal transactions amounting to about $2 trillion over a long period, intensifying the downward trend. Shares of the UK's Lloyd Banking Group and Barclays also fell, and Deutsche Bank's stock dropped 8%, marking its largest single-day decline since April.

The renewed escalation of US-China tensions was also analyzed to have negatively impacted the stock market. Edward Park, Deputy Chief Investment Officer at Brooks Macdonald, said, "Concerns are spreading that China may begin to retaliate against sanctions," adding, "This was really not on the market's radar."

Funds exiting the stock market moved into the safe-haven asset, the dollar. As the British pound plummeted due to the UK considering movement restrictions amid the COVID-19 resurgence, the dollar rose. The Dollar Index, which shows the value of the dollar against major currencies, rose 0.66% to 93.5 that day. Along with the dollar, US Treasury bonds, another representative safe-haven asset, also strengthened. The yield on the US 10-year Treasury note fell to as low as 0.649% during the day. A decline in bond yields means a rise in bond prices.

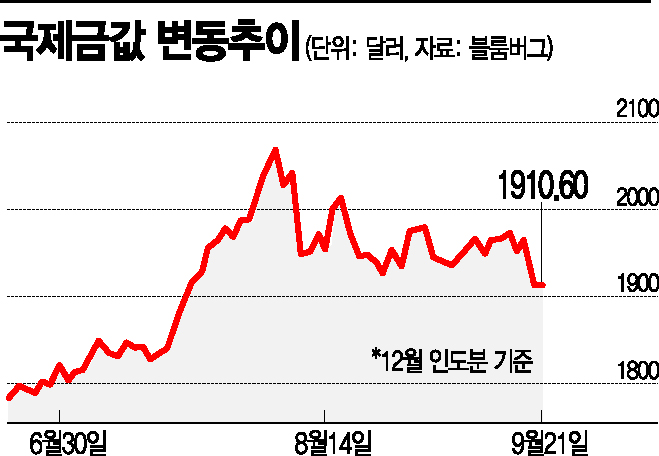

Due to the strong dollar effect, prices of commodities such as gold, silver, and crude oil have been falling one after another. Gold prices, which had been soaring for several months, fell to their lowest level since July. On that day, December delivery gold prices on the New York Mercantile Exchange closed at $1,910.60 per ounce, down 2.6%. Gold prices, which had surpassed the $2,000 mark in August, fell intraday to $1,888.8, showing a downward trend. The closing price was the lowest in over two months since July 23 ($1,917.40).

The pattern of a strong dollar and falling gold prices is similar to when COVID-19 rapidly spread in the US and Europe in March. Janet Mirasola, Executive Director at Sekden Financial, explained, "As risk-asset avoidance sentiment spread, stocks fell and the dollar strengthened," adding, "Gold became a victim of the strong dollar."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)