CDFG Regains Top Spot with 3.3 Trillion KRW Sales in First Half

Active Support from Chinese Government Amid COVID-19...Mixed Optimism and Pessimism

[Asia Economy Reporters Im Hye-seon, Cha Min-young] Despite the impact of the novel coronavirus disease (COVID-19), China ranked first in the global duty-free market in the first half of the year. The Korean duty-free market, which has built a solid foundation over 20 years based on the opening of Incheon International Airport, the Korean Wave, and price competitiveness, is now at risk of collapse.

China Rises from 4th to 1st in Global Duty-Free Market

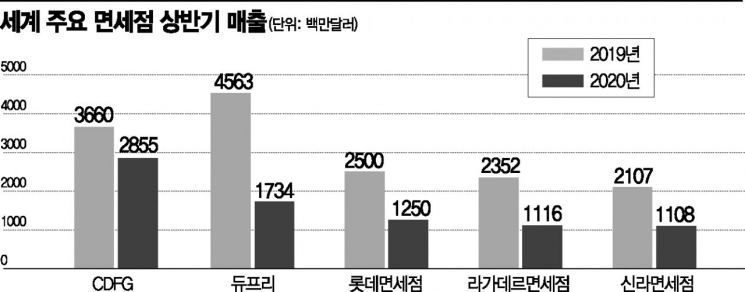

According to Moody's report on the 22nd, China Duty Free Group (CDFG) recorded sales of $2.855 billion (approximately 3.3 trillion KRW) in the first half of this year, surpassing Switzerland and South Korea to reclaim the top spot as the first Chinese company to do so. CDFG, which was ranked 4th last year behind Dufry, Lotte Duty Free, and Shilla Duty Free, climbed three places to overtake Dufry, the previous number one.

CDFG's first-half sales were 22% lower than the same period last year, but it performed relatively well compared to the duty-free industry, which was hit hard with over a 50% decline. Dufry, which was the overall number one last year, saw its first-half sales drop 62% to $1.734 billion (2.02 trillion KRW), falling to second place. South Korea's Lotte Duty Free recorded a 50% decrease to $1.25 billion (1.455 trillion KRW), and Shilla Duty Free saw a 47% decline to $1.108 billion (1.2897 trillion KRW). France's Lagard?re Duty Free sales fell 55% to $1.116 billion.

Impact of Chinese Government Support Amid COVID-19

CDFG's strong performance is attributed to the effects of COVID-19. While passenger demand sharply declined and duty-free sales plummeted worldwide, the Chinese government relaxed duty-free policies aiming to develop Hainan. Last year, the duty-free purchase limit for domestic and international tourists departing from Hainan was raised from 10,000 yuan (1.71 million KRW) to 30,000 yuan (5.14 million KRW), and domestic visitors were allowed to purchase duty-free goods online for 180 days. From July 1, the Chinese government expanded the overseas duty-free shopping limit in Hainan to 100,000 yuan (17 million KRW) per person annually, more than tripling the previous limit.

The number of duty-free product categories increased from 38 to 45, and the individual product duty-free limit of 8,000 yuan (1.36 million KRW) was removed. As a result, duty-free sales on Hainan Island surged. According to Chinese media, from July 1 to August 18, sales at four duty-free stores in Hainan exceeded 5 billion yuan (870 billion KRW). Meanwhile, the number of "daigou" (代工, proxy buyers) visiting South Korea sharply declined, creating mixed fortunes.

No Fundamental Change but Clear Threat

Some argue that China's duty-free companies ranking first does not signify a fundamental change in the duty-free industry. Professor Byun Jeong-woo of Kyung Hee University's Department of Tourism said, "Although Chinese duty-free companies temporarily rose to first place, this is a phenomenon caused by China's intentional domestic demand stimulation policy under abnormal circumstances. Considering the nature of the duty-free industry targeting foreigners and the competitiveness gap between Korea and China, the duty-free industry will return to normal once the COVID-19 issue is resolved."

However, the prevailing view is that the growing Chinese duty-free market, supported openly by the government, poses a threat to the Korean duty-free market, which heavily depends on Chinese sales. The Korean duty-free market size exceeds 2.4 trillion KRW. Korea's global market share in duty-free is about 23%. Excluding manufacturing, the duty-free industry is the only service sector that has reached the top globally.

Government Must Actively Support Duty-Free Industry

Experts argue that for Korea to survive as a strong player in the duty-free market, the government must first implement policies to minimize damage caused by the COVID-19 crisis. Professor Lee Hoon of Hanyang University said, "The tourism distribution industry requires experience, know-how, business history, and domestic and international networks, so once it collapses, it takes a lot of time and cost to recover. Now, active support is needed to maintain the duty-free industry ecosystem (personnel and structure)."

A duty-free industry insider said, "If our tourism infrastructure is not prepared when the COVID-19 situation ends and overseas travelers and the MICE industry become active again, it will be a regrettable loss of opportunity. From a mid- to long-term perspective, if China, with its strong buying power, brings in more global top brand inventory than Korea, the Korean duty-free industry, which has held the world number one position for several years, will soon have to relinquish that crown."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.