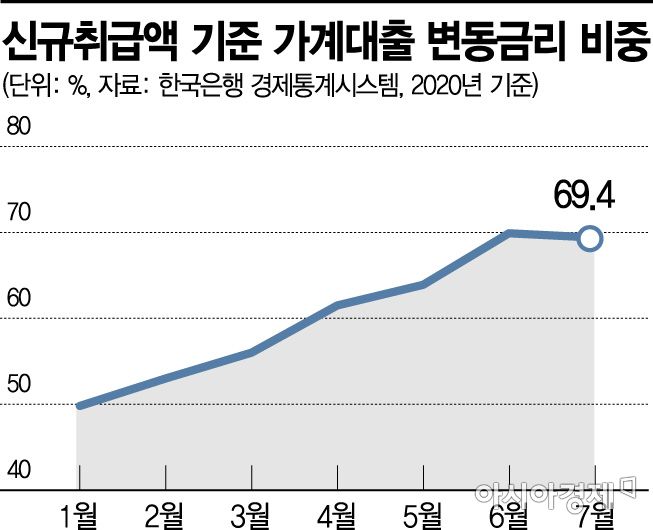

Steadily Rising to 69.4% in July

Low Interest Rate Benefits to Continue for Now

But Interest Rate Hike Will Burden Both Households and Banks

[Asia Economy Reporter Kim Min-young] The proportion of variable interest rates in household loans has recently surged. Choosing a variable interest rate allows borrowers to benefit from the ongoing low-interest environment and save on interest costs for the time being. However, if interest rates start to rise, the quality of household debt could deteriorate rapidly, posing a burden for both households and banks, experts warn.

According to the Bank of Korea and financial authorities on the 21st, the share of variable interest rates in new household loans reached 69.4% at the end of July. This marks a 19.6 percentage point increase from 49.8% in January of this year.

The proportion of variable interest rates has especially increased sharply since March, when the Bank of Korea significantly cut the base interest rate to counter the economic downturn caused by the novel coronavirus disease (COVID-19). The variable interest rate share was 56.0% in March, rose to 61.5% in April?surpassing 60% for the first time this year?and continued to climb steadily to 63.9% in May, 69.9% in June, and 69.4% in July.

Target is 50%, Actual Approaching 70%

The Financial Supervisory Service set a target for fixed-rate loans to account for 50% of household loans by the end of this year as part of comprehensive household debt management measures announced earlier this year. This target is 2.0 percentage points higher than last year's goal of 48.0%.

The target for ‘non-grace’ installment loans, where principal and interest are repaid simultaneously, was also raised from 55.0% last year to 57.5%. Grace period repayments, where only interest is paid for a certain period, reduce the burden on households but are intended only for financial consumers who can repay both principal and interest from the start. Increasing fixed-rate loans and non-grace loans helps prevent the deterioration of the quality of household loans.

The share of variable interest rates, which rose from 50-60% in 2012-2013 to the 70% range in 2017-2018, maintained the low 50% range last year but has surged again this year. Due to the base rate cuts, commercial bank loan interest rates have fallen significantly, causing an interest rate ‘inversion’ where variable rates are cheaper than fixed rates. In particular, variable rates on mortgage loans have dropped to the low 2% range annually, prompting many consumers to seek variable rate products.

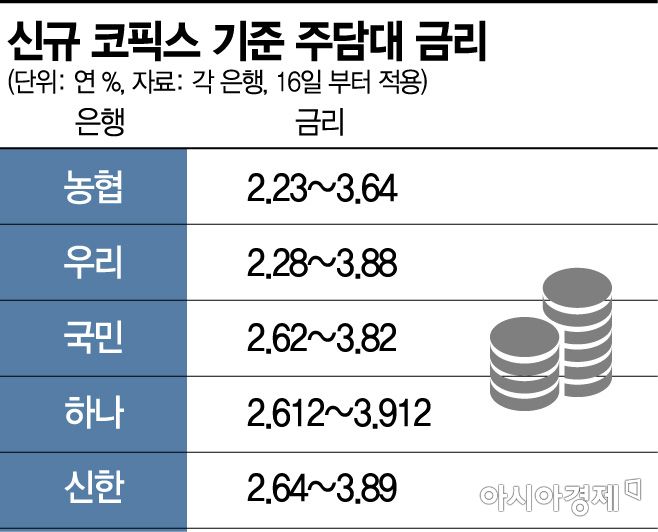

Variable Rates Rising Slightly Despite Low Interest Rates

According to the banking sector, NH Nonghyup Bank applies new COFIX (Cost of Funds Index)-based mortgage loan rates ranging from 2.23% to 3.64% annually. Woori Bank sets the same loan product rates between 2.28% and 3.88%, with the lowest rate in the low 2% range. Hana Bank (2.61%), KB Kookmin Bank (2.62%), and Shinhan Bank (2.64%) also have minimum rates in the mid-2% range.

Fixed-rate (hybrid type: fixed for 5 years then variable) products at the five major banks are understood to range from a minimum of 2.35% to a maximum of 4.14%. A bank official stated, “Even with preferential rates applied, fixed-rate loans are actually issued at just over 3%.”

The problem is that variable rates can rise sharply once the interest rate hike cycle begins. Generally, variable rates are advantageous during periods of falling rates, while fixed rates are preferable during rising rate periods. Moreover, even under low interest rates, commercial banks are gradually raising the minimum variable rate bands, making variable rates less advantageous. Despite an additional cut in the COFIX rate last month, some mortgage variable rates were raised simultaneously.

A financial sector official pointed out, “While the interest benefits of variable rates seem significant for now, interest burdens could increase if the rate trend reverses to an upward trajectory.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.