AXA Sonbo Acquisition Battle Faces Red Light

Leading Candidates Shinhan and KakaoPay Absent

Kyobo Life Sole Participant... Attention on Whether It Will Regain After 13 Years

[Asia Economy Reporter Oh Hyung-gil] The anticipated showdown between big tech and big banks over the acquisition of the French insurance company AXA손해보험 (AXA Sonhae Boheom) ultimately did not materialize. Contrary to expectations, Shinhan Financial Group and Kakao Pay withdrew from the AXA손보 (AXA Sonbo) acquisition battle, resulting in a failed bidding process. Instead, Kyobo Life Insurance entered the fray. Attention is focused on whether Kyobo Life can return to this market after 13 years since selling Kyobo Auto Insurance in 2007.

According to the insurance industry on the 20th, Shinhan Financial Group and Kakao Pay, both mentioned as potential bidders, did not participate in the preliminary bidding for AXA손보 conducted by the sales agent Samjong KPMG on the 18th. Kyobo Life Insurance participated alone in the bid.

Notably, Shinhan Financial Group, which showed strong intent by selecting EY Han Young as its advisory firm and Deloitte Anjin for accounting advice during its acquisition review, ultimately decided not to participate after much deliberation until the last moment. Although Shinhan Financial Group owns two life insurance companies, it does not have a non-life insurance company. Therefore, Shinhan Financial Group was strongly considered a likely participant to strengthen its non-banking sector.

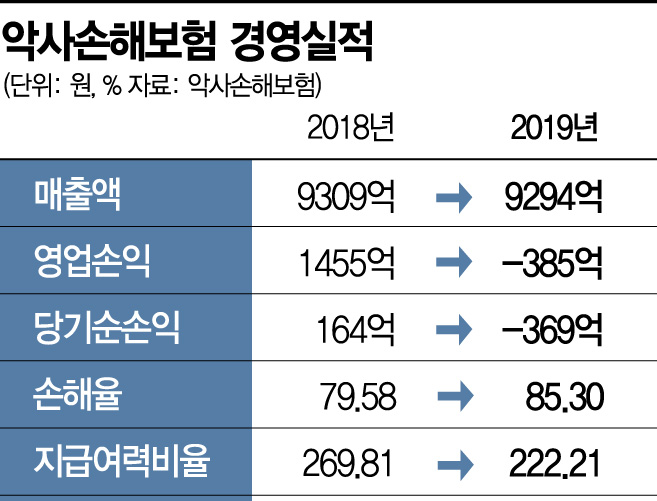

However, it declared withdrawal after judging that AXA손보’s market dominance was not significant. In fact, AXA손보, which focuses mainly on direct auto insurance, suffered a severe deterioration in automobile insurance loss ratio last year, resulting in an operating loss of 38.5 billion KRW. Its insurance premium income ranked 12th in the non-life insurance industry in the first half of the year.

With the bidding excitement fading, if Kyobo Life Insurance acquires AXA손보 as the sole bidder, it will be repurchasing the company 13 years after selling Kyobo Auto Insurance to the AXA Group in 2007. Kyobo Life is expected to acquire AXA손보 and promote digital non-life insurance business alongside its subsidiary and online life insurer Kyobo Lifeplanet. However, potential conflicts between Kyobo Life Chairman Shin Chang-jae and the financial investor (FI) Affinity Consortium over the exercise price of Kyobo Life’s stock put option may pose a burden.

The market price for AXA손보’s sale is rumored to be around 200 billion KRW. This is because recent mergers and acquisitions (M&A) of non-life insurers have typically been conducted at about 0.7 to 0.8 times the price-to-book ratio (PBR). Based on this, AXA손보’s expected sale price is estimated to be between 170 billion and 190 billion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.