KB Chooses Stable Innovation

Consolidating the Growing Subsidiaries' Capabilities to Solidify Position as Leading Financial Group

"Ensuring KB Financial Becomes Number One in Financial Platforms as Well"

[Asia Economy Reporter Park Sun-mi] "KB Financial Group will have a concrete plan and execute it step by step to become number one in the financial platform sector as well."

Yoon Jong-kyu, Chairman of KB Financial Group, has successfully secured a stable 'third term.' This achievement reflects his success in steadily managing the organization over the past six years and growing KB into a leading financial group. Chairman Yoon is expected to lead KB once again until 2023, focusing his efforts on solidifying its position as a 'leading financial group,' strengthening Environmental, Social, and Governance (ESG) management, expanding global business, and enhancing internal communication.

On the morning of the 17th, Chairman Yoon expressed his ambition to become the 'number one financial platform company' during his commute to the KB Financial headquarters while speaking with reporters. This is interpreted as his determination not to fall behind big tech companies like Naver and Kakao in the digital finance competition by leveraging KB’s unique strengths. He stated, "Compared to big tech companies, we have the capability to provide comprehensive services, cover both online and offline channels simultaneously, and possess personnel with professional service capabilities," adding, "We must maximize customer convenience and benefits while leveraging KB Financial's strengths." He explained that the low stock price of KB Financial reflects concerns about the competitiveness of traditional financial companies facing big tech firms in the non-face-to-face era. He also left open the possibility of collaboration with big tech companies to become number one in the financial platform sector.

KB Financial's Asset Size Doubled Since Chairman Yoon Jong-kyu Took Office

◆Strong yet gentle leadership extended for 3 more years= The KB Financial Group Chairman Candidate Recommendation Committee held a meeting the day before and selected Chairman Yoon as the final candidate for the next chairman. Chairman Yoon is expected to be appointed as chairman for a three-year term at the extraordinary shareholders' meeting scheduled for November 20.

Chairman Yoon was recognized for his achievement in steadily managing the organization over the past six years and establishing KB as a leading financial group. Sunwoo Seok-ho, chairman of the recommendation committee, stated, "He has shown excellent performance by laying the foundation for revenue diversification through successful mergers and acquisitions (M&A) in non-banking and global sectors." He added, "He has built the group's future growth foundation through digital financial innovation and holds a unique philosophy and conviction regarding ESG. The committee members agreed that Chairman Yoon should lead the organization for another three years to continue sustainable growth."

One of the most highly evaluated aspects is KB Financial's solidified position as a leading financial group under Chairman Yoon's leadership. Since Yoon took office as KB Financial chairman in November 2014, KB Financial's asset size has nearly doubled from 308 trillion won to 567 trillion won as of the end of the first half of this year. KB Financial's second-quarter performance this year recorded a net profit of 980 billion won, surpassing the previous leader Shinhan Financial Group (873.1 billion won) to reclaim the top spot.

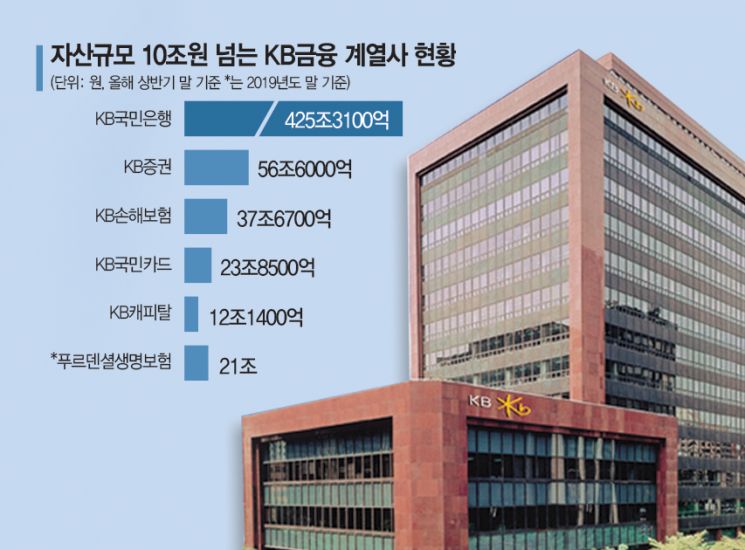

The size of subsidiaries has also grown. In 2014, the only group affiliates with assets exceeding 10 trillion won were KB Kookmin Bank (275.45 trillion won) and KB Kookmin Card (15.88 trillion won), but now there are six: ▲KB Kookmin Bank (425.31 trillion won) ▲KB Securities (56.6 trillion won) ▲KB Insurance (37.67 trillion won) ▲KB Kookmin Card (23.85 trillion won) ▲KB Capital (12.14 trillion won) ▲Prudential Life Insurance (20.81 trillion won).

Solidifying Position as Leading Financial Group

Challenging Number One in Financial Platforms Amid Big Tech Attacks

Strengthening Globalization

Finding Suitable Heads for Subsidiaries Also a Task

◆Chairman Yoon's future challenges= The recommendation committee members deeply evaluated strategic tasks for overcoming crises in the new normal era, digital transformation strategies to gain competitive advantage over platform companies, global expansion plans, trust-building methods with various stakeholders including customers, shareholders, and employees, and ESG promotion strategies. These questions reflect the concerns about the direction KB will take over the next three years.

KB Financial faces the challenge of securing new revenue sources in an ultra-low interest rate era with benchmark rates falling to the 0% level, while solidifying its position as a 'leading financial group' and fending off attacks from big tech companies targeting the financial industry. Since Chairman Yoon has included influential companies as financial affiliates through active M&A, it is expected that he will focus on consolidating the capabilities of subsidiaries to secure the top position. In this regard, smoothly integrating the recently acquired Prudential Life Insurance into the group to generate synergy is considered an urgent task for Chairman Yoon.

Chairman Yoon also needs to pay attention to selecting CEOs for group affiliates to maximize group capabilities. Heo In, president of KB Kookmin Bank, the largest affiliate within KB Financial, will see his '2+1' term expire in November. Heo, who took office in 2017 and successfully renewed his term for one year last year, is highly regarded for his performance and compatibility with Chairman Yoon. Whether he is reappointed or transferred to another affiliate, he is expected to play a role in generating group synergy as a close associate of Chairman Yoon.

Most CEO terms of the seven affiliates renewed last year will expire by the end of this year, deepening Chairman Yoon's concerns about appointments. ESG management is also expected to be an area where Chairman Yoon will take an active role. In March this year, he emphasized his commitment to ESG management and launched the KB Financial ESG Committee, composed of all internal and external directors (a total of nine members), including himself. As the ESG Committee serves as the control tower for setting KB Financial's ESG strategy and overseeing its implementation, this indicates Chairman Yoon's intention to personally oversee ESG strategy. Additionally, delivering results based on recently acquired overseas financial companies, such as Indonesia's mid-sized bank Bukopin, where KB Financial secured management rights, is another task Chairman Yoon must manage.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.