Key Points for Preliminary Bidding on the 18th

Shinhan and KakaoPay "Under Review"... Kyobo Life 'Uncertain'

Auto Insurance Loss Ratio and Digital Synergy Are Crucial

[Asia Economy Reporter Oh Hyung-gil] As the sale of AXA Insurance, a French non-life insurance company, is gaining momentum, attention is focused on whether a showdown between financial holding companies and big tech will take place.

With Shinhan Financial Group and Woori Financial Group already in the market and Kakao expected to join, a major shake-up is anticipated in the non-life insurance market, where rankings have remained unchanged for decades. On the other hand, some predict that AXA Insurance's reliance solely on auto insurance will limit the impact to a 'storm in a teacup.'

According to the insurance industry on the 17th, AXA Group, the largest insurer in France, has appointed Samjong KPMG as the lead manager for the sale of AXA Insurance and plans to hold a preliminary bidding on the 18th of this month.

It is expected that financial holding companies such as Shinhan and private equity funds (PEFs) will participate in the bidding. Kakao Pay, which has been preparing to enter the non-life insurance business, has also been named as a candidate.

Shinhan Financial is considered the most likely acquirer, having even engaged Deloitte Anjin for accounting advisory services. The fact that it lacks a non-life insurance subsidiary among its affiliates and can complete the final puzzle of a comprehensive financial group adds to its appeal.

A Shinhan Financial official said, "We are currently reviewing this as part of a study," adding, "While price is important, we are focusing on potential business synergies going forward." Woori Financial, which urgently needs to expand its business portfolio, is also mentioned as a potential buyer.

Kakao Pay, which recently failed in its attempt to launch a digital non-life insurer after working with Samsung Fire & Marine Insurance, could instantly acquire a comprehensive non-life insurance license by purchasing AXA Insurance. However, some believe that the possibility of Kakao Pay bidding for AXA is low, given that its own digital non-life insurer establishment is imminent.

Among insurers, Kyobo Life Insurance, which previously operated an online auto insurance business with AXA Group, is considering participating in the acquisition. Synergies are expected in the digital sector alongside its online life insurer, Kyobo Lifeplanet, but it is uncertain whether Chairman Shin Chang-jae will make bold investments amid ongoing arbitration litigation with financial investors (FIs).

Some reports indicate that private equity funds that received acquisition proposals are reluctant to participate in the preliminary bidding, suggesting that the AXA Insurance acquisition battle may be less competitive than expected. Although AXA Insurance stood out as the first in Korea to introduce direct auto insurance and mileage models, recent profitability deterioration points to a lack of new growth drivers.

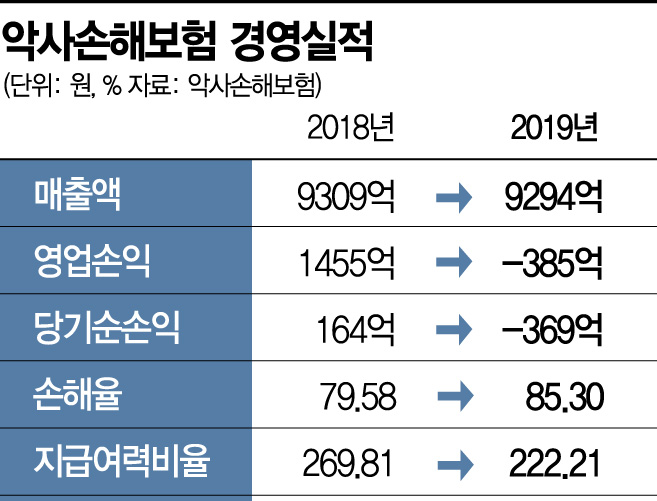

After recording a net profit of 41 billion KRW in 2016, profits declined to 27.5 billion KRW in 2017 and 16.4 billion KRW in 2018, and last year it posted a net loss of 36.9 billion KRW. In April, the company internally conducted voluntary retirement to streamline its workforce, but business performance improvement remains slow.

The limited business portfolio also acts as a constraint. Most of the earned premiums depend on auto insurance, and the sales structure focuses on telemarketing (TM) and cyber marketing (CM) rather than agents or general agencies (GA).

An industry insider said, "The core auto insurance business is loss-making, and it is difficult to sell long-term insurance through TM or CM, so short-term performance improvement will be challenging," adding, "Since its sales power is not strong and market share is low, aside from the benefit of obtaining a non-life insurance license, it does not seem to have much merit."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.