Statement Reflects 'No Interest Rate Hike Even if Inflation Exceeds 2%'

Powell "Asset Purchases to Remain at Current Level"

WSJ Evaluates "Raised Bar for Interest Rate Hikes"

[Asia Economy New York=Special Correspondent Baek Jong-min, Reporter Kim Eun-byeol] The U.S. central bank, the Federal Reserve (Fed), announced its intention to keep interest rates at 'zero (0)' level through 2023 along with a rate freeze. This is the first time the Fed has released its interest rate outlook through 2023. The statement also added language indicating that the current rate level will be maintained even if inflation exceeds 2%, clearly signaling its intention not to raise rates for a considerable period.

On the 16th (local time), the Fed announced the results of the Federal Open Market Committee (FOMC) meeting containing this information. The benchmark interest rate was held steady at 0.00?0.25%. According to the released dot plot, 16 out of 17 FOMC members supported maintaining zero interest rates through 2022, and 13 members believed that the current low rate should continue into 2023.

This FOMC meeting was the first since Fed Chair Jerome Powell announced at the virtual Jackson Hole symposium at the end of last month that the previous practice of preemptively raising rates to curb inflation would be abandoned. Powell introduced an average inflation targeting framework, stating that inflation could be allowed to exceed the 2% target for some time.

Accordingly, the Fed added language to the statement that it is appropriate to maintain the current rate until ▲ labor market conditions align with the FOMC’s assessment of maximum employment and ▲ inflation reaches a trajectory that moderately exceeds 2% for some time.

The Wall Street Journal (WSJ) described the Fed’s policy as "raising the hurdle for rate hikes." Some even interpreted it as the Fed signaling zero rates for the next 4 to 5 years.

Powell also stated that asset purchases for quantitative easing would continue at the current pace.

"Accommodative stance until inflation overshoots" = At the press conference held immediately after the FOMC meeting, Powell said, "It will take a long time for the economy to expand, and sectors like airlines and hotels will face even greater difficulties," adding, "We will maintain an accommodative policy stance even if inflation overshoots the target for some time to support employment recovery."

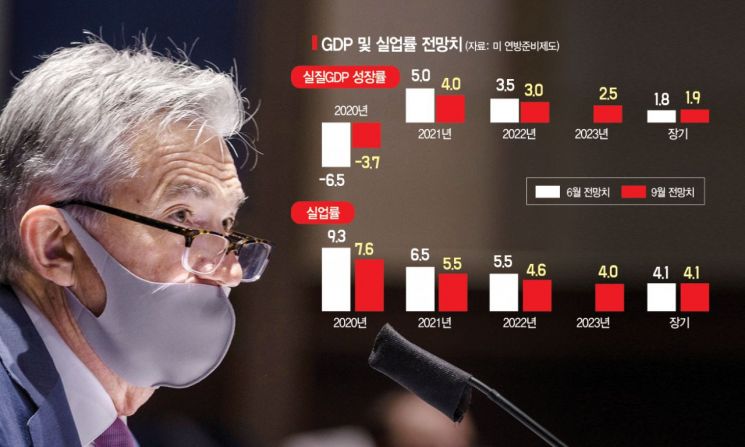

This statement came as the Fed revised upward its U.S. growth forecast for this year, seeing a faster-than-expected improvement, but still assessed overall economic activity as sluggish. The Fed raised its U.S. economic growth forecast for this year to -3.7% from the June projection of -6.5%, but lowered growth forecasts for the years after. The unemployment rate forecast for this year was revised down from 9.3% in June to 7.6%.

Recent U.S. economic indicators show a clear slowdown in employment and consumption recovery. August retail sales, announced by the U.S. Department of Commerce on the day, increased by only 0.6% month-over-month, falling far short of the 1.1% expected by experts surveyed by Dow Jones. Although the unemployment rate has improved, about 11 million of the approximately 22 million jobs lost due to the COVID-19 crisis remain vacant.

Deflation fighter in words only? = The problem is that the Fed’s expression of intent remains just that?an expression. While FOMC members’ dot plots suggest no rate hikes for three years, they did not mention any additional measures beyond the rate freeze. Asset purchases will be maintained at the current level, and none of the members advocated introducing 'negative interest rates' to raise inflation. The Fed only stated it would pursue accommodative policies "until maximum employment and 2% inflation targets are achieved over a long period," but specifics on what constitutes maximum employment or the averaging period for the 2% inflation target remain unknown. Wells Fargo predicted, "The likelihood of the Fed introducing negative policy rates is low," but added, "If inflation fails to rise, the Fed may accelerate asset purchases." BNP Paribas also noted, "There are no specific figures linked to employment and inflation targets, so monetary policy discretion remains, and asset purchases remain unchanged," evaluating that "the accommodative policy stance is consistent with the July FOMC."

While major central banks such as the European Central Bank (ECB) and the Bank of Korea have become deflation fighters after the COVID-19 crisis, they have not issued specific responses to the Fed’s recent measures and are instead watching cautiously. Recently, within the government, there has even been talk that the Bank of Korea should raise inflation to escape the recession caused by COVID-19. Since it is difficult to collect more taxes, rising prices would naturally increase tax revenues. Bank of Korea Governor Lee Ju-yeol also stated, "In the current situation where deflation is a concern, we face the question of whether the current inflation target framework is appropriate or needs to be changed." However, internally, the stance is that it is not too late to respond after confirming the Fed’s specific measures and market reactions.

Unprecedented liquidity could only fuel bubbles = There is also concern that the Fed’s policy could ultimately only inflate bubbles. Since the COVID-19 outbreak, liquidity injections have caused stock markets worldwide, including the U.S., to surge. Experts point out that despite the Fed’s dovish messages, the financial market will be shaken again when the market loses trust. Emerging markets, including Korea, are particularly vulnerable to shocks when liquidity withdraws first.

Another issue is that while the Fed keeps the benchmark rate unchanged, it is purchasing large amounts of corporate bonds, potentially creating zombie companies. Recently, the U.S. corporate bond market has seen a surge in junk bond issuance, increasing corporate debt. Over time, moral hazard among companies and inefficiencies in support allocation may become apparent.

Some interpret Powell’s message on the day not as the Fed introducing additional accommodative policies but as a warning to the political sphere. The Wall Street Journal (WSJ) explained the existing effects of the Fed’s accommodative policies and interpreted the message as a reminder to politicians. WSJ stated, "The Fed has already provided substantial loan-type financial support through the financial sector and is seeing effects," adding, "It was a reminder of the importance of reaching an agreement on the 'COVID-19' fiscal support bill, which remains unresolved."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.