Filling Content Preference Gaps

Increase in Multiple Subscriptions Like Netflix+Watcha, Wavve·Tving+Netflix

[Asia Economy Reporter Kim Heung-soon] Office worker Lee Yuna (28, female) is a Netflix subscriber. After starting to use it last year, she began additionally subscribing to the domestic online video service (OTT) Watcha from early this year. Lee said, "I joined OTT because I was drawn by the word of mouth about Netflix originals like 'Kingdom,'" adding, "There are also well-known movies or overseas dramas that Netflix does not provide, so I ended up using multiple services like Watcha." When subscribing to additional OTTs, Lee sought advice from online community members with similar interests. Through this, she learned that there are quite a few 'multi-subscribers' who use major domestic OTTs such as Netflix, Wavve, TVING, Watcha, and Season together. Some communities use abbreviations like 'Netcha (Netflix + Watcha)' and 'Wavflix (Wavve + Netflix)' to discuss the pros and cons and comparisons of using multiple OTTs and refer to these when subscribing.

Domestic Mobile OTT Users Subscribe to an Average of 1.3 Services

80-90% of US OTT Subscribers Use Multiple Netflix Services

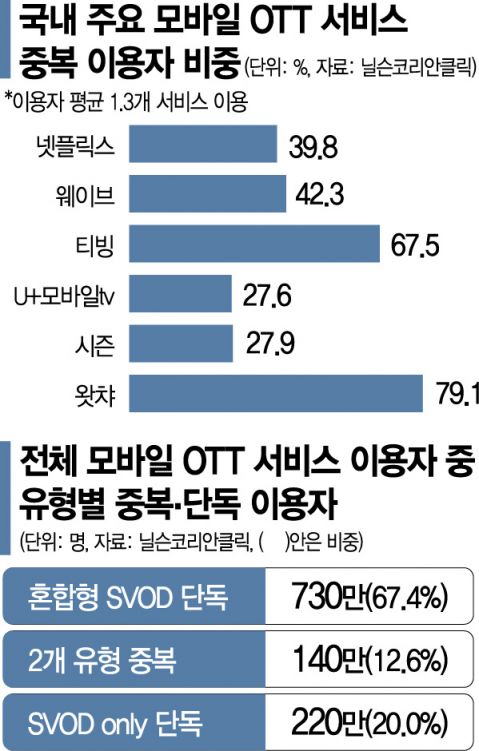

According to industry sources on the 17th, domestic mobile OTT users subscribe to an average of 1.3 services. According to data released by market research firm Nielsen KoreanClick, as of November last year, the proportion of overlapping users who subscribe to other services among major mobile OTT users was estimated at 79.1% for Watcha. This means 8 out of 10 people subscribed to this service also watch other OTTs. Among TVING subscribers, the overlapping user ratio was 67.5%, Wavve 42.3%, and Netflix 39.8%.

This trend is much more pronounced in the global market. According to market research firm Statista, 66% of US Netflix subscribers also subscribe to Amazon Prime. Users who watch Disney Plus and Hulu together also exceeded 50% respectively.

About 80-90% of HBO Max, Apple TV+, Hulu, Disney Plus, and Amazon Prime subscribers also subscribe to Netflix. The average number of OTTs subscribed per household in the US is estimated at 2.8. In Canada, the proportion of subscribers who subscribe to three or more OTTs increased from 12% before the COVID-19 pandemic to 19% in the first half of this year, according to survey results.

A content industry official said, "In the US, watching cable or satellite TV requires paying about $100 (approximately 120,000 KRW) per month, whereas OTT services cost about $10 (approximately 12,000 KRW) per month per service, so the burden of multiple subscriptions is low," adding, "Each content lineup is solid, so the rate of choosing two or more services according to interests is high."

He added, "Domestic OTTs also find it difficult to satisfy various content preferences such as dramas, entertainment, and movies with just one service," and "The trend of subscribing to multiple OTTs to fill these content selection gaps may continue."

Content and Service Differentiation Strategies by Providers

Reducing Price Burden through Multiple Device Access

Complementary Rather Than Winner-Takes-All

In the online platform business, the 'winner-takes-all' structure of market-leading operators has been solidified, and platforms that fail to do so are perceived to be ousted or fade away, according to the 'two-sided market theory.' However, the recent domestic and international OTT market situation is moving in a direction that does not align with this. If platforms operate by targeting characteristics such as genre or age, it becomes possible to be chosen as a multi-subscription target by users. Almost all OTTs provide multi-device access functions, so if 2 to 4 people share the fee, the price burden can also be reduced.

Reed Hastings, CEO of Netflix, also said at a recent meeting with domestic reporters, "If each company has content with different appeal and price competitiveness, consumers will use multiple streaming services," adding, "(The OTT market) still has opportunities for many companies to continue growing."

Earlier, the Korea Fair Trade Commission classified the domestic mobile OTT market into 'subscription video on demand (SVOD) only' and 'mixed SVOD' based on content types and VOD fee charging methods.

SVOD only refers to services like Netflix and Watcha, which rely solely on monthly subscription fees as their revenue model. Mixed SVOD offers monthly subscription fees along with pay-per-content payment methods and live broadcast services, including Wavve, Season, TVING, and U+ Mobile TV.

Among major domestic mobile OTT users, about 1.4 million are estimated to subscribe to both types. The Fair Trade Commission noted, "At this point, each OTT service is more likely to function as a complement rather than a substitute for each other."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)