Tightening Global Internal Combustion Engine Vehicle Regulations

Electric Vehicle Sales Expected to Surpass Internal Combustion Engine Vehicles in Late 2030s

[Asia Economy Reporter Ki-min Lee] To expand the competitiveness of electric vehicles, it is necessary to induce private sector investment in charging infrastructure and actively engage in overseas resource development to secure battery raw materials, according to opinions expressed.

The Federation of Korean Industries (FKI) presented measures to enhance electric vehicle competitiveness in its report titled "Global Trends and Implications of the Electric Vehicle Market" on the 17th. The FKI suggested in the report ▲expansion of customized charging infrastructure for consumers ▲strengthening overseas resource development to stabilize battery raw material supply ▲establishment of a diverse electric vehicle lineup ▲and strengthening electric vehicle support in response to COVID-19.

◆Global Internal Combustion Engine Vehicle Regulations Tighten... Electric Vehicle Sales Expected to Surpass Internal Combustion Engine Vehicles by the Late 2030s

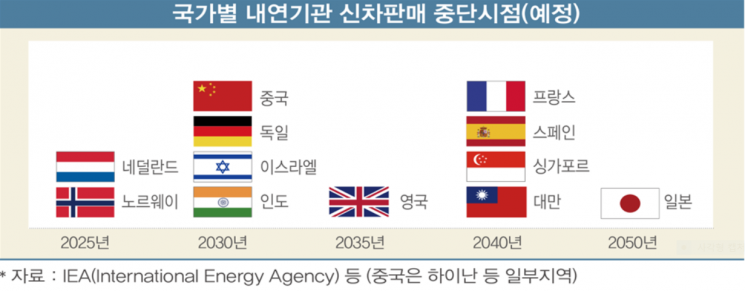

To reduce carbon dioxide emissions from automobiles, governments worldwide are tightening regulations on internal combustion engine vehicles while increasing demand for electric vehicles. According to the International Energy Agency (IEA) and others, the Netherlands and Norway will stop selling new internal combustion engine vehicles by 2025. Global electric vehicle sales are expected to surpass internal combustion engine vehicles by the late 2030s.

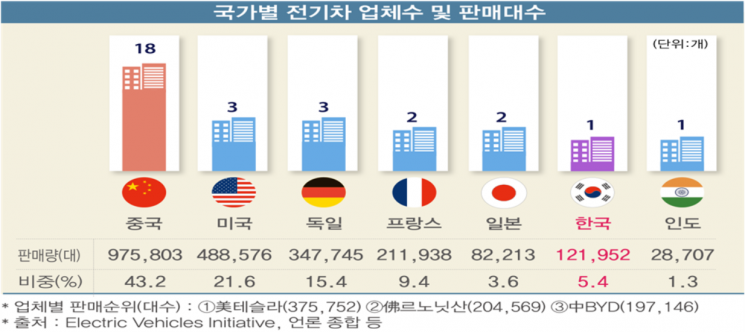

However, as of last year, only one Korean company is among the top 30 global electric vehicle manufacturers. Among the top 30 companies, 18 are Chinese, 3 each from the United States and Germany, and 2 each from France and Japan.

Global market share is also not high. Last year, Korean companies sold 121,952 units, recording a 5.4% market share. By company, electric vehicle sales were led by U.S. Tesla with 375,752 units, followed by France’s Renault-Nissan with 204,569 units, and China’s BYD with 197,146 units. Domestic electric vehicle sales in Korea accounted for only 1.6% of global sales.

◆Four Key Factors to Expand Electric Vehicle Competitiveness: ① Expansion of Domestic Charging Infrastructure ② Securing Battery Raw Materials ③ Diversification of Vehicle Models ④ Expansion of Government Support

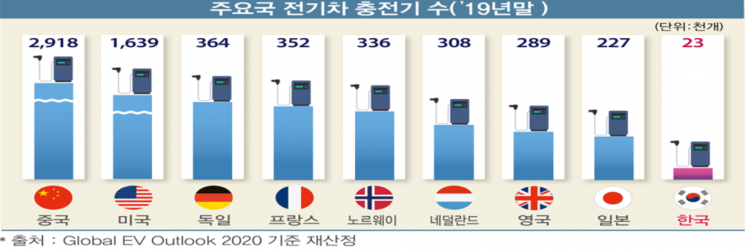

First, the FKI proposed expanding customized charging infrastructure to strengthen the competitiveness of the Korean electric vehicle market. In particular, it is necessary to induce private sector investment in charging infrastructure in places with high charging demand such as gas stations, parking lots, apartment complexes, and workplaces. As of the end of last year, the number of chargers in Korea was 23,000, which is only 0.8% of China’s, 1.4% of the U.S.’s, and 10.1% of Japan’s.

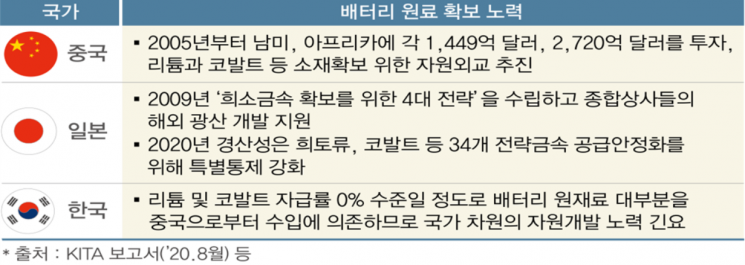

Additionally, since Korea’s self-sufficiency rate for key raw materials of electric vehicle batteries such as cobalt and lithium is 0%, it was advised to participate in overseas resource development. In the case of China and Japan, governments and general trading companies have invested in overseas resource development to secure raw materials.

It was also noted that a diverse electric vehicle lineup is necessary to expand market share. Although Hyundai Motor Company is expected to develop nine new models in 2021, overseas companies such as Ford and BMW plan to release more than 20 electric vehicle models to attract customer choice.

Furthermore, it was pointed out that government support for electric vehicles should be strengthened in response to the COVID-19 pandemic. Since the spread of COVID-19, major countries such as Germany, France, and the United Kingdom have significantly increased subsidies for electric vehicle purchases as part of their measures.

Kim Bong-man, Director of International Cooperation at the FKI, said, “As major countries recently expand policies to phase out internal combustion engines due to strengthened environmental regulations, the global electric vehicle market is rapidly growing. For our companies to be competitive in the global market, government-level efforts for resource development of key electric vehicle raw materials are necessary, and at the corporate level, a diverse lineup of electric vehicle models comparable to global companies must be established.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.