[The Crisis of Korean Display] Display Industry Facing Collapse, Escape or Export to China

Chinese Low-Cost LCDs Followed by OLEDs Flood Korean Market

Must Fight for Next-Generation Display Development and Market Securing

[Asia Economy Reporter Changhwan Lee] #. Mr. A, who works at one of Korea's leading display companies, is recently exploring job changes through a headhunter. A few years ago, Mr. A had great affection for the company that led the global display market. However, recently the company has been struggling due to poor performance, followed by workforce adjustments and worsening treatment, prompting him to actively seek better conditions. Mr. A said, "The overall atmosphere in the company has recently been down," adding, "Among young employees, there is a strong sentiment to change jobs if given the opportunity."

The domestic display industry in Korea is facing difficulties due to poor performance, and the aftershocks from Huawei are further worsening the situation.

Low-cost Chinese LCD and OLED panels are threatening Korean companies, and with the growing Huawei risk, the future is becoming more uncertain. While the Korean display market is shrinking, the Chinese market is rapidly expanding, and small and medium-sized display companies are betting their survival on exports to China.

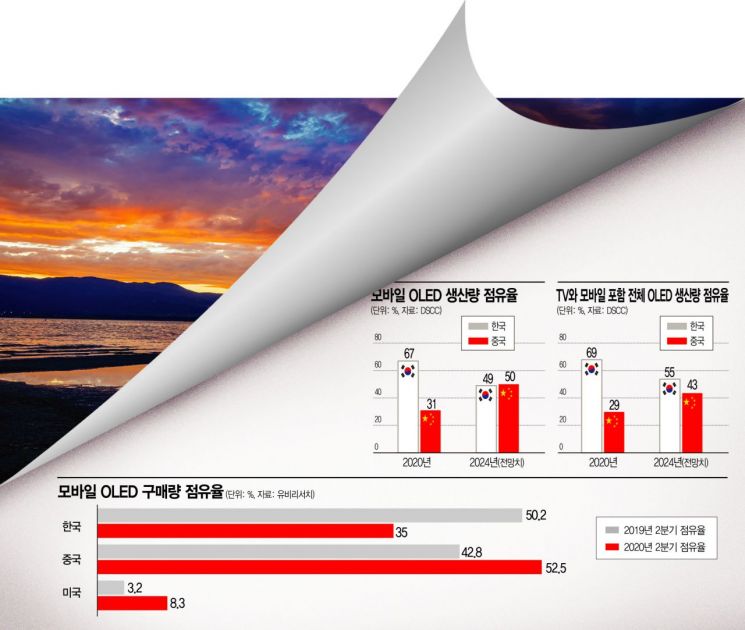

According to the display market research firm DSCC on the 16th, based on production volume, Korea holds a 67% share of the global mobile OLED market this year, while China holds 31%. However, by 2024, four years from now, China is expected to surpass Korea for the first time with 50%, compared to Korea's 49%.

Already, based on purchase volume, China exceeded Korea's share for the first time this year, and it is estimated that China will surpass Korea in production volume within a few years.

Until last year, Korean companies were the world's largest mobile OLED buyers, but starting this year, Chinese companies have become the largest buyers. According to market research firm UBI Research, Huawei accounted for the largest share of mobile OLED purchases in the second quarter at 53.4%, followed by Oppo with 8.9%.

A UBI Research official explained, "Until last year, Korean companies including Samsung Electronics were the largest OLED buyers, but starting this year, as Chinese smartphone companies' OLED usage has become the largest, the production increase of Chinese panel companies is expected to accelerate."

◆ From LCD to OLED, Chinese Products Flooding In... Korea's Display Industry Faces a Life-or-Death Crisis

OLED, a new product that Korea has developed over more than 10 years to replace the declining LCD, is expected to be surpassed by China within a few years. The next-generation OLED, flexible OLED, is also projected to see China's global market share rise from 29% last year to 50% in 2023.

Major Chinese display companies such as BOE, China Star (CSOT), and Tianma are rapidly increasing OLED investments backed by massive support from the Chinese government.

Recently, BOE announced plans to ship more than 40 million flexible OLED panels this year, more than double last year's volume. Facing the Chinese volume offensive, Samsung Electronics and LG Electronics have even used Chinese LCD panels instead of their affiliates' panels for mid- to low-end products.

An industry insider explained, "Chinese display panels are priced more than 30% cheaper than domestic panels of the same specifications," adding, "Set companies sometimes have no choice but to use Chinese panels to lower the final product price, as the prices are at dumping levels."

In response, Korean display companies are also increasing exports to China to find their own survival paths. LG Display plans to increase sales of its latest OLED panels in China through its Guangzhou plant.

Following China's large-scale display investments, exports from mid-sized and small display companies to China are also continuing. Invenia, a dry etching equipment company, recently signed a display equipment supply contract worth 65 billion KRW with China's HKC. This is a large contract amounting to 45% of last year's sales.

Youngwoo DSP signed OLED inspection equipment contracts worth 30.8 billion KRW and 6.5 billion KRW with CSOT and Tianma, respectively, in July. In addition, major display companies such as Viatron, Top Engineering, KC Tech, and Cham Engineering have signed large-scale equipment contracts with China.

As Chinese influence grows not only in LCD but also in OLED, there are calls for Korean companies to rethink their survival strategies.

Jeong Won-seok, a researcher at Hi Investment & Securities, said, "The expansion of market share by Chinese display companies, supported by massive government backing, poses another threat to domestic companies," adding, "To prevent losing the OLED market to China in the future, strategic changes and overwhelming technological differentiation by Korean display companies are becoming increasingly important."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)