Individual Buying Pressure in Companies Holding Shares Including Korea Financial Group and Yes24

[Asia Economy Reporter Song Hwajeong] After Kakao Games recorded a "ttasangsang" (opening at twice the IPO price on the first day of listing followed by two consecutive days of hitting the upper price limit), it has shown a continuous downtrend, prompting individual investors to shift their attention early to Kakao Bank, Kakao's next IPO candidate.

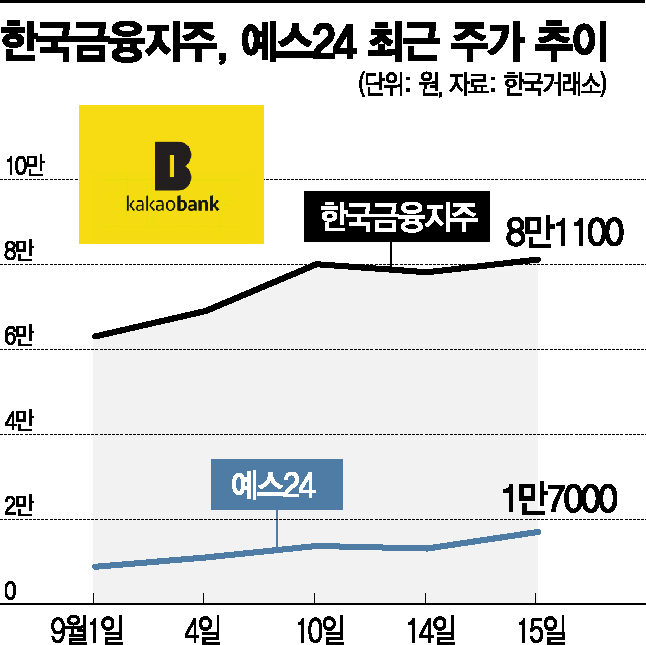

According to the Korea Exchange on the 16th, individuals purchased 26.4 billion KRW worth of Korea Financial Group shares, making it the second-largest net purchase after Samsung Electronics Preferred shares. Individuals also net bought 421.7 million KRW worth of Yes24 shares. Thanks to the buying pressure from individuals, Korea Financial Group rose 3.84% the previous day, hitting a 52-week high of 89,100 KRW during the session. Yes24, after hitting the upper price limit the previous day, also recorded a 52-week high of 18,750 KRW shortly after the market opened.

The strong individual buying interest in Korea Financial Group and Yes24 is interpreted as being driven by expectations for Kakao Bank's listing. Korea Financial Group holds 4.93% of Kakao Bank's shares, while Yes24 holds 1.97%. Including the stake held by Korea Investment Value Asset Management, a subsidiary of Korea Financial Group, which owns 28.6%, Korea Financial Group's total stake reaches 33.5%.

Jung Junseop, a researcher at NH Investment & Securities, said, "Korea Financial Group is expected to recognize equity method disposal gains corresponding to the decrease in its stake due to new share issuance at market price during Kakao Bank's IPO." He added, "The shares Korea Financial Group holds in Kakao Bank will positively impact the company's corporate value in some form."

Kim Eungap, a researcher at IBK Investment & Securities, explained, "Assuming Kakao Bank's market capitalization at 12 trillion KRW upon listing, Korea Financial Group's valuation gain is estimated at about 3.4 trillion KRW, which corresponds to approximately 70% of Korea Financial Group's current market capitalization." He added, "Although there is uncertainty regarding Kakao Bank's market value and the investment stake may not convert into trading profits, the increase in stake value is so significant that even pre-listing expectations can bring changes to valuation."

After Kakao Games' listing, individual investors who had been buying Kakao Games shifted their investment direction toward Kakao Bank, considered the next listing candidate among Kakao subsidiaries, as Kakao Games stopped at two consecutive days of upper price limits and then showed a downward trend. Although Kakao Games' listing is expected to take place as early as next year, investors have already started preparing by purchasing related stocks. During Kakao Games' general subscription, the competition rate was record-breaking, and even investing 100 million KRW only allocated 5 shares, prompting investors to quickly turn their attention to related stock investments this time. Kakao Bank's over-the-counter market price soared to 125,000 KRW, pushing its market capitalization beyond 46 trillion KRW, which exceeds the combined market capitalization of the four major financial holding companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.