Samsung Life Insurance Holds Over 50,000 Shares of Samsung Electronics

Valuation Basis Changed from Cost to Market Price

Must Sell Excess Over 3% of Total Assets

[Asia Economy Reporters Oh Hyung-gil and Park Cheol-eung] As the 'Fair Economy 3 Acts (Fair Trade Act, Commercial Act, Financial Group Supervision Act)' have emerged as major issues in the political arena, the business community has fallen into 'confusion.' In particular, Samsung Group is on high alert over the passage of the amendment to the Insurance Business Act, commonly known as the 'Samsung Life Insurance Act.'

If the bill passes, it is feared that the shock to the capital market will be considerable as Samsung Electronics shares worth at least 20 trillion won flood the market. Samsung Group is now urgently faced with the task of devising measures on how to acquire Samsung Electronics shares held by Samsung Life Insurance.

According to the National Assembly and the financial industry on the 15th, a subtle shift in sentiment has recently been detected even among opposition parties regarding the Fair Economy 3 Acts, which were proposed mainly by the ruling party.

Seong Il-jong, the senior member of the People Power Party on the National Assembly's Political Affairs Committee, told Asia Economy in a phone interview that regarding the amendment to the Fair Trade Act, "Rather than opposing it by reflecting the business community's position, we will review it from an efficiency perspective."

The Financial Group Supervision Act may also be reviewed from the fundamental standpoint of economic democratization. A People Power Party official said, "The Fair Economy 3 Acts should be viewed as corporate regulatory laws, and future discussions should proceed from that perspective."

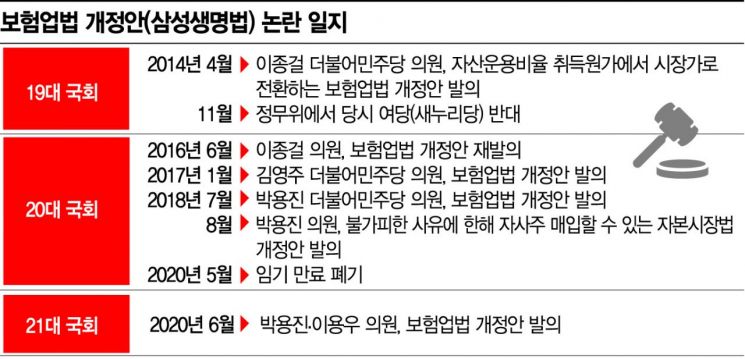

The market is closely watching the passage of the amendment to the Insurance Business Act, which would significantly affect Samsung Group's governance structure. The amendment to the Insurance Business Act, which started being discussed in the 19th National Assembly in 2014, has become the center of controversy again after six years. Earlier in June, Democratic Party members Park Yong-jin and Lee Yong-woo proposed a partial amendment to the Insurance Business Act, known as the Samsung Life Insurance Act.

Changes in Samsung's Governance Structure if the Insurance Business Act Amendment Passes

This amendment aims to change the evaluation standard for insurance companies' holdings of other companies' stocks under Article 106 of the Insurance Business Act from 'acquisition cost' to 'market value.'

Under the current law, insurance companies can own shares of major shareholders or affiliates up to 3% of total assets based on acquisition cost to prevent loss risks. Simply put, the amendment changes the 3% evaluation standard from acquisition cost to market value.

Samsung Life Insurance currently holds 508.16 million shares of Samsung Electronics (8.51% stake). Based on the acquisition cost at the time in 1980, the shares were valued at about 544 billion won, with a per-share price of around 1,000 won. Samsung Life Insurance's assets total 309 trillion won, so Samsung Electronics shares do not exceed '3%.'

However, based on Samsung Electronics' closing price of 60,400 won on the 14th, the value of Samsung Electronics shares held by Samsung Life Insurance amounts to 30.7 trillion won, far exceeding 3% of total assets. If the amendment passes, Samsung Life Insurance will have to sell the excess shares.

Samsung Group is now facing an urgent crisis. If Samsung Life Insurance disposes of its Samsung Electronics shares, changes will occur in Samsung Group's governance structure. Currently, Samsung Life Insurance is the largest shareholder of Samsung Electronics excluding the National Pension Service, and Samsung Group's governance structure follows the chain 'Owner family → Samsung C&T → Samsung Life Insurance → Samsung Electronics.'

Some speculate that Samsung C&T might sell its 43.4% stake in Samsung Biologics and acquire Samsung Electronics shares held by Samsung Life Insurance. However, since Samsung C&T is transitioning into a holding company, it must hold more than 20% of Samsung Electronics shares, making this practically impossible. Samsung Life Insurance also faces the challenge of finding new investment destinations to replace Samsung Electronics.

Samsung Life Insurance is keeping a low profile. A Samsung Life Insurance official said regarding the sale of Samsung Electronics shares, "Nothing has been decided yet," and added, "We are monitoring the National Assembly's discussion process."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.