From the 23rd of this month, implemented under revised standards at 12 banks

Additional 2.5 trillion KRW support for SME special credit loans

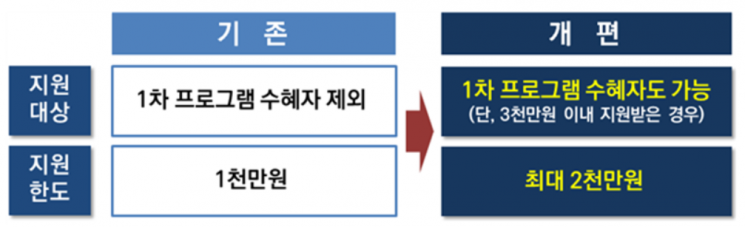

[Asia Economy Reporter Kim Hyo-jin] Financial authorities have raised the loan limit for the second financial support program designed for small business owners affected by the novel coronavirus infection (COVID-19) to 20 million KRW. Additionally, small business owners who received support through the first program can also receive support through the second program.

On the 15th, the Financial Services Commission announced this plan at the Financial Risk Response Team meeting chaired by Vice Chairman Son Byung-doo.

Accordingly, the loan limit for the second small business loan handled by commercial banks has increased from the current 10 million KRW to 20 million KRW. Small business owners who have already received the second loan can receive an additional 10 million KRW if needed.

Even if support was received through the first program such as the Industrial Bank of Korea’s ultra-low interest loans, commercial banks’ interest subsidy loans, or the Small Enterprise and Market Service’s business stabilization funds, new second loans can be obtained.

The financial authorities have restricted overlapping support to "those who have received support within 30 million KRW among existing recipients" so that small business owners in relatively worse conditions can be prioritized for supply. Since 91.7% of the total fall under this category, most are expected to be able to receive overlapping support.

The second small business loans are handled by 12 banks including KB Kookmin, NH Nonghyup, IBK Industrial Bank, Shinhan, Woori, Hana, Gyeongnam, Gwangju, Daegu, Busan, Jeonbuk, and Jeju banks. These banks plan to handle loans based on the revised criteria starting from the 23rd after adjusting their internal computer systems.

A total of 10 trillion KRW has been allocated for the second small business loans, but so far only about 600 billion KRW has been executed based on the five major commercial banks and Industrial and Daegu banks, drawing criticism for being less effective than the first round. This is analyzed to be due to the loan limit being lowered from a maximum of 70 million KRW to 10 million KRW and the inability to receive overlapping support.

Along with this, financial authorities have decided to provide an additional 2.5 trillion KRW in special credit loans for small and medium-sized enterprises affected by COVID-19. The primary collateralized bond obligation (P-CBO) limits, currently 70 billion KRW for mid-sized companies and 100 billion KRW for large companies, will be expanded to 105 billion KRW for mid-sized companies and 150 billion KRW for large companies.

'Policy-type New Deal Fund Task Force' to Operate During the Week

Meanwhile, regarding the policy-type New Deal fund among the New Deal funds promoted by the government, financial authorities have decided to operate the 'Policy-type New Deal Fund Task Force' centered on KDB Industrial Bank and Korea Growth Investment Corporation starting this week.

Through this, they plan to meticulously prepare implementation plans such as detailed fund structure design and incentives for private investors, and to guide the financial sector on detailed plans by procedure within this month.

Financial authorities also plan to prepare a 'New Deal Investment Guideline' selecting items in the digital and green sectors by the end of this month through consultations with related ministries such as the Ministry of Trade, Industry and Energy and the Ministry of Science and ICT, judging that the success of the New Deal fund depends on discovering concrete projects.

Furthermore, since New Deal sector projects have been confirmed through next year’s budget, financial authorities plan to hold investment briefings by theme centered on related ministries as soon as possible.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.