Emerging Market Funds Show Clear Uptrend

4.6% Return in the Past Month

Local Retail Investors Increasing Buying Pressure

[Asia Economy Reporter Minji Lee] Amid sluggish returns of emerging market funds due to the impact of the novel coronavirus infection (COVID-19), Vietnam funds have attracted attention by maintaining a noticeable upward trend.

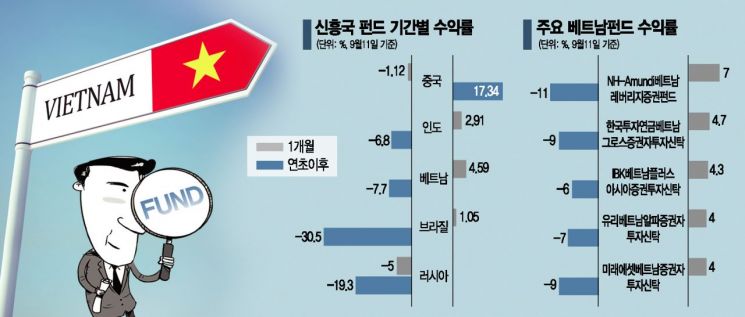

According to financial information company FnGuide on the 14th, among overseas equity funds related to emerging markets set up domestically as of the 11th, the fund with the highest return over the past month was Vietnam, recording 4.6%. In comparison, other emerging markets posted returns of India (2.91%), Brazil (1.05%), China (-1.12%), and Russia (-5%).

On an annual basis, emerging market stock markets are showing a clear downward trend. Except for China (17%), India (-6.8%), Vietnam (-7%), Brazil (-30%), and Russia (-19%) have not yet recovered to last year's levels. Although the weakening of the dollar has positively affected emerging market stock markets, investor anxiety about the economic recovery of emerging markets has expanded since the spread of COVID-19, resulting in slow foreign inflows.

The absence of leading sectors with notable investment inflows in global stock markets has also had an impact. In the case of China, Korea's KOSPI, and Taiwan's TAIEX, COVID-19 containment achievements and attention to technologies related to IT, healthcare, electric vehicles, and renewable energy appear to have positively influenced investor sentiment. The KOSPI and TAIEX have risen 9% and 5%, respectively, since the beginning of the year.

The recent remarkable growth of Vietnam funds is due to a significant rise in the stock market driven by increased buying by individual investors within Vietnam. From early last month to the 11th, the VN Index of the Ho Chi Minh Stock Exchange (HOSE) rose from 814.65 to 888.97, an increase of 11.35%. The VN Index, which had fallen from 900 points in June to the 770 level due to the resurgence of COVID-19, is showing an upward trend again, supported by individual liquidity.

The Vietnamese government stimulated individual investors' buying momentum. The government announced that the temporary transaction fee reduction, initially applied until the end of August as part of stock market revitalization measures, will be extended until June next year. It also stated that it is considering allowing same-day trading and short selling, increasing individual investors' willingness to participate in the stock market. So-yeon Lee, a researcher at Korea Investment & Securities, explained, "This is the result of extended risk asset preference due to abundant liquidity supply," adding, "With the extension of the transaction fee reduction, the VN Index broke through the short-term resistance level of 850 points."

Among Vietnam funds set up domestically, the NH-Amundi Vietnam Leverage Securities Fund posted the highest return over the past month, with a recent one-month return of 7%. This fund invests in exchange-traded funds (ETFs) and futures tracking the Vietnam VN30 Index, employing a strategy that follows 1.5 times the daily fluctuation rate of the VN30 Index. Other funds such as Kiwoom Vietnam Tomorrow Securities Fund (6.10%), KB Vietnam Focus Securities Fund (5.9%), Samsung Vietnam Securities Fund (5.2%), and Korea Investment Pension Vietnam Growth Securities Investment Trust (4.7%) also recorded positive returns.

However, it is expected to take more time for the VN Index to recover to the levels seen from mid-December 2017 to the first quarter of 2018, when the Vietnam fund investment boom occurred. At that time, coinciding with the expiration of tax-exempt overseas equity fund benefits, a frenzy of Vietnam fund subscriptions swept investors. For example, the "Korea Investment Vietnam Growth" product attracted funds amounting to 300 billion KRW during the tax-exempt period. During the investment surge period (mid-December 2017 to the first quarter of 2018), the VN Index averaged 1055 points, with a rise rate approaching 23%.

For the Vietnam Index to rise further, positive factors such as inclusion in the MSCI Emerging Markets Index are needed. Legislative procedures related to the implementation of amendments to the Securities Act and the Corporate Act are being prepared to ease shareholding restrictions, which act as obstacles to foreign capital inflows, but these expectations remain only hopeful. Matthew Smith, a researcher at Yuanta Securities, said, "The key issue for index inclusion is the foreign ownership limit, which seems to require more time," adding, "Still, Vietnam is one of the few countries expected to see GDP growth this year, and its recovery speed next year is expected to be above average."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)