Increased by 18.1% Compared to the Previous Year

Must File a Lawsuit to Resolve Even After Return Request

[Asia Economy Reporter Jo Gang-wook] The so-called 'Mistaken Remittance Act,' which helps recover money sent by mistake due to incorrect account numbers or amounts, is being discussed again in the 21st National Assembly. As non-face-to-face financial transactions such as internet banking and mobile banking rapidly increase every year, mistaken remittances caused by incorrect input or recording of recipient financial institutions and recipient account numbers are also on the rise.

Opposition Proposes 'Prior Recovery, Later Cost Settlement'

According to financial circles on the 14th, Seong Il-jong, a member of the People Power Party, officially proposed an amendment to the 'Depositor Protection Act' on the 10th to address damages caused by mistaken remittances, a side effect of non-face-to-face financial transactions. Currently, when a mistaken remittance occurs, the sender can request a refund through the financial company, but the problem is that refunds are not being smoothly processed. In such cases, the sender can only recover the money through costly and time-consuming litigation, resulting in significant costs for society as a whole.

Legal Basis Established to Induce Voluntary Return

The amendment to the Depositor Protection Act, proposed by Representative Seong, adds 'mistaken remittance damage relief work' to the scope of duties of the Korea Deposit Insurance Corporation (KDIC). It stipulates that when a mistaken remittance occurs, the unjust enrichment obtained by the recipient can be recovered, and the costs incurred for damage relief can be settled afterward. The KDIC, equipped with deposit-related infrastructure and expertise, can purchase claims for the return of unjust enrichment related to mistaken remittances and request voluntary returns through recipient contact information obtained from financial companies and central administrative agencies. In particular, it establishes a legal basis to receive the recipient's actual mobile phone number from telecommunications service providers to encourage voluntary returns rather than litigation.

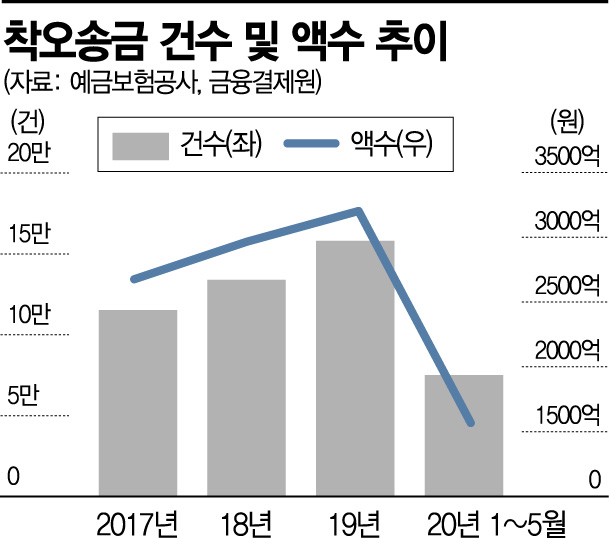

The number and scale of mistaken remittances are steadily increasing. According to the KDIC and the Korea Financial Telecommunications & Clearings Institute, the number of mistaken remittance transactions last year rose by 18.1% year-on-year to 158,138 cases, and the mistaken remittance amount also increased by 8% during the same period to 320.3 billion KRW, marking an all-time high. From January to May this year, the number of mistaken remittance transactions reached 75,083 cases, and the mistaken remittance amount was 156.7 billion KRW. These figures represent increases of 19.4% and 23.5%, respectively, compared to the same period last year. However, on average, only about half of the money is recovered. The return rate of mistaken remittance amounts has remained around 49.0% in 2015, 45.2% in 2016, 53.3% in 2017, 49.8% in 2018, and 51.9% in 2019.

The Mistaken Remittance Act was also discussed in the 20th National Assembly. However, opposition voices arose on the grounds that 'it could cause moral hazard if the state solves even individuals' mistakes,' and the bill was not submitted to the National Assembly's Legislation and Judiciary Committee.

Ruling Party Also Proposes Bills... Growing Expectations

However, the situation is different this time. Earlier in June, Yang Kyung-sook of the Democratic Party of Korea, and in July, independent lawmaker Yang Jeong-sook and Kim Byung-wook of the Democratic Party of Korea, each introduced similar bills as lead sponsors. Notably, the bills no longer include provisions for funding from state or financial company-provided funds, removing the biggest obstacle.

From 2017 to 2019, the official number of refund claims reached 407,375 cases, but more than half, 53.6%, were ultimately not recovered. Last year, the number of mistaken remittance refund claims was 106,262 cases, and the claimed amount was 239.2 billion KRW, but the number of unrecovered cases was 58,105, with an amount of 120 billion KRW.

A financial industry official said, "Currently, if the other party does not return the mistakenly sent money after a mistaken remittance incident, there is no option other than civil litigation," adding, "The litigation cost to recover a mistakenly sent 1 million KRW is about 600,000 KRW, and considering subsequent procedures such as compulsory execution, the cost increases further. Therefore, unless the amount is large, such as tens of millions or hundreds of millions of KRW, it is difficult to take action easily, and many senders give up on litigation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)