Hong Nam-ki "Real Estate Supply Measures Clearly Showing Results"

"Promise to Pursue Consistent Real Estate Policy"

Bank of Korea Evaluates Housing Prices Are Stabilizing in Monetary and Credit Policy Report

Leaves Room for Possibility of Funds Flowing into Housing Market

[Asia Economy Reporter Kim Eunbyeol] The government and the Bank of Korea have both recently assessed that the upward trend in housing prices is slowing down. They view this as a result of the high-intensity real estate policies, and the government has firmly expressed its commitment to pursuing consistent real estate policies. However, the Bank of Korea added that due to uncertainties from the novel coronavirus disease (COVID-19) and increased money supply, there is still a possibility that funds could flow into the housing market in the future, so close monitoring is necessary.

On the 10th, Deputy Prime Minister and Minister of Strategy and Finance Hong Nam-ki stated on his Facebook account, "About a month after the August 4 supply measures, clear results are emerging," and self-assessed that "compared to the situation before August, when there was a one-sided surge, this is a meaningful change."

He also expressed regret over some media reports that his remarks during the 6th Real Estate Market Inspection Meeting on the 8th presented only statistics favorable to the government. At that time, Hong explained that prices of certain apartments had dropped by 300 to 400 million KRW, but there was controversy that he selectively mentioned favorable statistics, as these were transactions through urgent sales and could not be seen as representative of the whole market.

Hong clarified that he did not mention only favorable statistics by citing five indicators as examples.

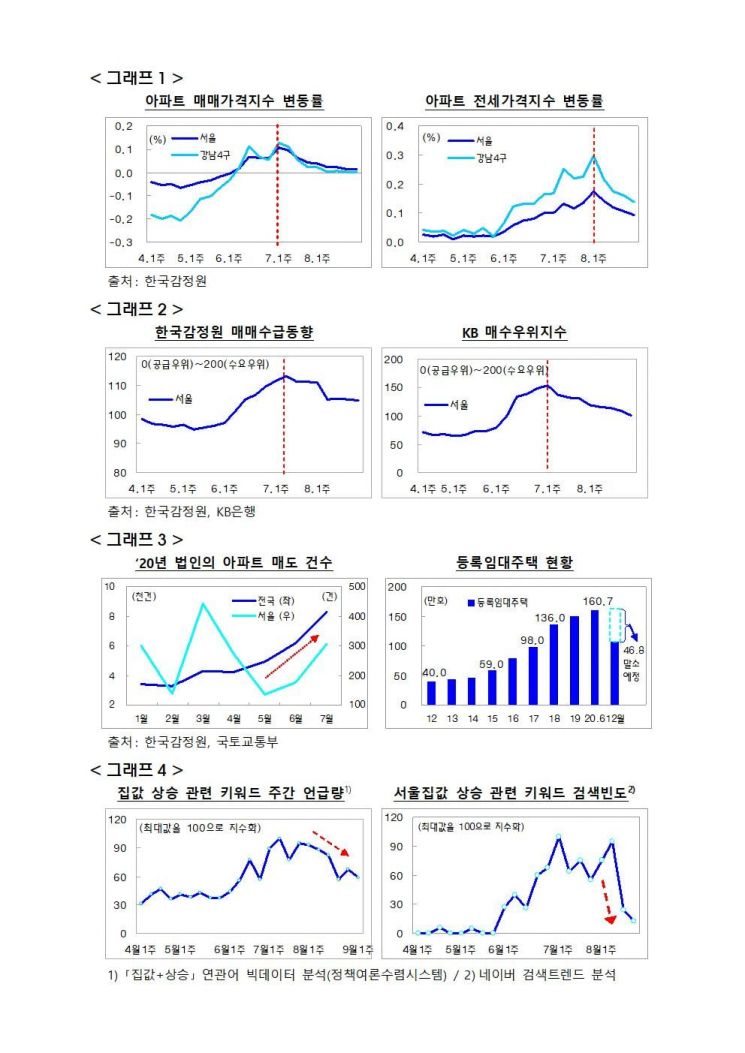

The first is the price index. Hong stated that in the fifth week of August, apartment sale prices in Seoul remained flat for two consecutive weeks at 0.01%, and in the four Gangnam districts, the upward trend stopped for four consecutive weeks. He added that the rise in jeonse (long-term lease) prices also showed a slowing trend.

Upon reviewing actual transaction statistics, he noted that while there were cases of price increases, there were also transactions showing price declines in many areas. Hong explained, "Therefore, the overall sales price index is showing a stable trend," and that "the examples presented in the opening remarks were to inform the public and the market that there are actual transaction cases where prices have fallen."

He also revealed that the sales sentiment indices from the Korea Real Estate Board and KB Real Estate have approached the balance point of 100 in August (Seoul and metropolitan area). Additionally, the volume of transactions has increased recently, with more apartments held by corporations being put on the market, and registered rental housing, which had increased significantly until recently, will see 468,000 units automatically deregistered by the end of the year, many of which are expected to be supplied to the market.

He emphasized that big data analysis, such as portal site search keywords, also suggests that the general public and market participants' expectations for housing price increases are gradually weakening.

Hong stressed, "The government promises to continue pursuing consistent real estate policies so that these changes can become more firmly established in the future."

Meanwhile, the Bank of Korea also evaluated on the same day that the recent housing market situation shows a slowdown in the rise of housing prices. In its Monetary and Credit Policy Report, the Bank stated, "Housing prices had expanded their rise in both the metropolitan and non-metropolitan areas since June due to high price increase expectations, but in August, the upward trend somewhat diminished due to the government's housing market stabilization measures."

The Bank of Korea also noted, "Government housing-related measures and uncertainties in the economy due to the resurgence of COVID-19 are factors that will ease expectations of housing price increases and the flow of funds into the housing market." However, it pointed out that the previous increase in housing transactions, rise in jeonse prices, and the expansion of supply and move-in volumes in the second half of this year could act as factors increasing demand. Furthermore, the Bank stated, "Since it is difficult to rule out the possibility of continued inflows of funds into the housing market, it is necessary to closely monitor related trends."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)