Most IPO Stocks This Year Rose About 70% Compared to Offering Price

Two Stocks Surged Over 200%... IPO Funds Also Gaining Popularity

IPO Subscription Boom Expected to Continue Starting with BigHit

[Asia Economy Reporter Minwoo Lee] As the enthusiasm for public offering stock investments sparked by SK Biopharm continues, investment funds for public offering stocks are rapidly increasing. With a series of new initial public offerings (IPOs) following the listing of Kakao Games, the frenzy for public offering subscriptions is expected to persist for the time being.

According to the Korea Financial Investment Association on the 10th, as of the 8th, the balance of securities firms' Comprehensive Asset Management Accounts (CMA) reached 60.0586 trillion won. This is an increase of about 2 trillion won in just two trading days from 58.1313 trillion won recorded on the 4th, when the subscription deposits for Kakao Games were refunded. Since CMA balances represent funds that can flow into funds, equity-linked securities (ELS), or public offering subscriptions, the market's expectations for public offering stocks have grown stronger following the listing of Kakao Games.

The enthusiasm for Kakao Games remained high even until the day before its listing. Due to expectations of a stock price surge after listing, over-the-counter shares traded at prices exceeding three times the public offering price of 24,000 won. On the Korea Financial Investment Association's over-the-counter trading market 'K-OTC BB,' the average trading price of Kakao Games on the previous day was 80,000 won. The average transaction price, which was 65,225 won on the 26th of last month, surged approximately 22.6% after going through demand forecasting for institutional investors and public offering subscriptions for general investors. Other unlisted stock integrated trading platforms such as 'Securities Plus Unlisted' and 38 Communications also formed average trading prices above 78,000 won. This is about 25% higher than Kakao Games' 'Ttah-sang' price (the price after doubling the public offering price at the opening and hitting the upper limit), which was 62,400 won. Some investors even placed buy orders at 130,000 won, more than five times the public offering price.

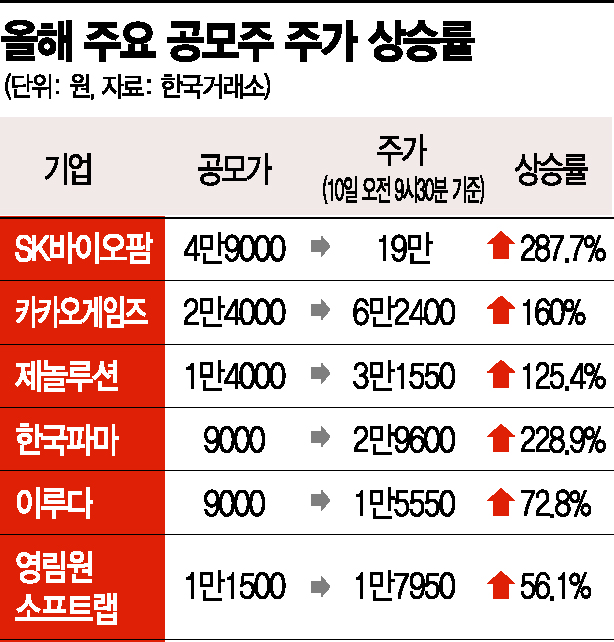

This investment enthusiasm stems from the belief that public offering stocks are a "guaranteed hit." According to the Korea Exchange, among 25 stocks listed on the KOSPI and KOSDAQ markets this year (excluding relistings and SPACs), 17 stocks (68%) rose above their public offering prices. Excluding five REITs (Real Estate Investment Trusts), which were inevitably affected by various regulations and the cooling of real estate investment enthusiasm, the proportion of stocks rising above their public offering prices jumps to 85% (17 out of 20). SK Biopharm recorded 190,000 won as of 9:30 a.m. that day, up 287.7% from its public offering price. Kakao Games, listed that day, recorded a 'Ttah-sang' with a 160% increase. Korea Pharma (228.9%), Genolution (125.4%), Iruda (72.8%), and Younglimwon Soft Lab (56.1%) also posted double-digit returns compared to their public offering prices.

As more investors directly enter the stock market, public offering stock funds performed well even in the sluggish fund market. According to financial information provider FnGuide, 1.7859 trillion won flowed into 113 public offering stock funds over the past three months. Compared to early last month, about 1 trillion won poured in within a month, pushing the total assets under management over 3 trillion won. This contrasts with the domestic equity fund market, which saw a net outflow of 5.5741 trillion won over three months.

With a series of public offering subscription schedules lined up, this enthusiasm is expected to continue for the time being. This month, Wonbang Tech (15th-16th), Quantametrics (21st-22nd), and Panasia (22nd-23rd) will consecutively conduct subscriptions. On the 5th-6th of next month, Big Hit Entertainment, the agency of the globally popular idol group BTS (Bangtan Sonyeondan), will accept public offering subscriptions from general investors. The public offering amount is expected to reach up to 962.6 billion won, surpassing SK Biopharm (959.3 billion won) and Kakao Games (384 billion won).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)