Economic Sector's Greatest Concern Over Proposed Commercial Act Amendment on Separate Election of Audit Committee Members... No Such Case in the US, Europe, or Japan

Academia: "Creation of a Deceptive Director Appointment System May Violate Property Rights and Be Unconstitutional"

Strengthening Regulations on Preferential Business Transactions Also a Key Issue... Fears of Even Legitimate Internalization Being Hindered

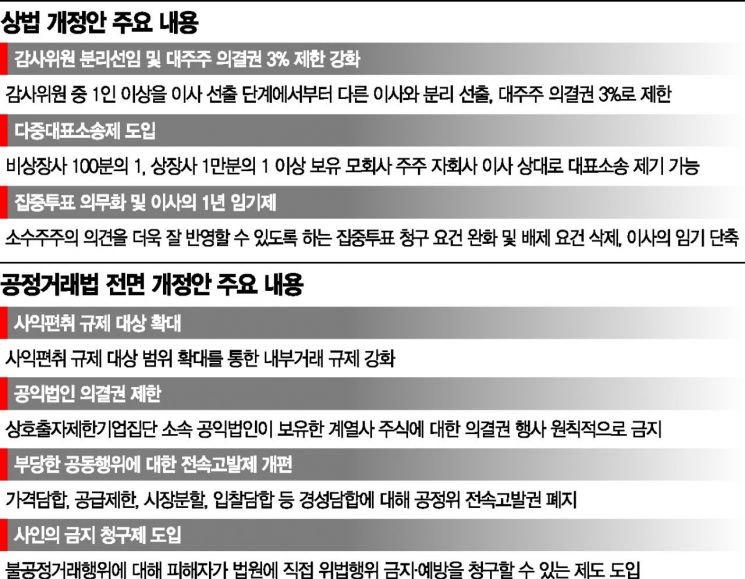

[Asia Economy Reporter Kim Hyewon] With the opening of the 21st National Assembly, the business community is expressing daily grievances over the so-called 'Fair Economy 3 Laws,' including the amendments to the Commercial Act and the Fair Trade Act pushed by the ruling party. Since the passage of these bills is highly likely in this session, there is a strong appeal to reflect the voices of the industrial field, which fears adverse effects, as much as possible. In this context, the '5th Industrial Development Forum' held on the 10th by 26 economic and industry-specific organizations centered on the Korea Automobile Industry Association urgently set the theme as 'Regulatory Policies Related to Governance and Internalization and Corporate Performance,' meticulously pointing out the side effects of the amendments to the Commercial Act and the Fair Trade Act.

Among the amendments to the Commercial Act, the clause that major conglomerates are most concerned about is the system of separately electing audit committee members. While the appointment of directors should be made through shareholders' voting rights at the general meeting to reflect shareholders' voting rights as much as possible, the amendment requires audit committee members to be elected separately at the election stage. Academia views this as creating a loophole for director appointments through the separate election of audit committee members and sees a high possibility of unconstitutionality due to infringement of fundamental rights.

At the forum, Song Won-geun, visiting professor at Yonsei University and the first presenter, pointed out, "Limiting the major shareholder's voting rights to 3% will result in the will of the total issued shares not being reflected, which undermines the foundation of joint-stock companies," and added, "It seriously infringes on constitutionally guaranteed property rights and violates the principle of shareholder equality (one share, one vote), which must be upheld."

Supreme Court precedents also hold that in joint-stock companies, which are based on the principle of separation of ownership and management, making it impossible or significantly difficult for shareholders to exercise their voting rights is not permissible as it undermines the essential function of the joint-stock company system.

There is also a serious issue that separately elected audit committee members participating in board decisions and causing company losses would bear responsibility only proportional to their shareholding, severely undermining the basic principle of joint-stock companies (principle of self-responsibility). There is a significant concern that competitors or speculative capital could split shares to increase holdings, appoint a specific person as an audit committee member, and then use the position to extract confidential company information.

Jung Manki, chairman of the Korea Automobile Industry Association, likened the situation to "us not being able to attend enemy operation meetings while the enemy enters our military operation meetings and steals secrets." For these reasons, no country including the United States, Europe, or Japan restricts the voting rights of specific shareholders when appointing directors.

Kwon Jaeyeol, dean of Kyung Hee University Law School, also pointed out in his presentation, "The system of separately electing audit committee members was devised to restrict shareholders' rights to appoint directors and infringes on shareholders' property rights," adding, "If used as a tool for activist institutional investors, it could hinder long-term growth." On the other hand, Park Sangin, professor at Seoul National University Graduate School of Public Administration, evaluated, "This bill falls short of former President Moon Jae-in's pledge to elect all audit committee members separately," and said, "It does not properly consider the domestic situation where resolving conflicts of interest between minority shareholders and major shareholder-managers is necessary."

Regarding the amendment to the Fair Trade Act, the main issue has emerged as the strengthening of regulations against unfair internal transactions (private profit appropriation). The business community fears that tightening internal transaction regulations will result in the contraction of legitimate internalization. The export restrictions imposed by Japan have been cited as an extreme example. Last year, in response to Japan's retaliatory export restrictions, domestic semiconductor companies overcame the crisis by vertically integrating to produce materials directly, but the government is now blocking such inevitable internalization.

There are also claims that the bill denies the market economy system where internal transactions are inevitable. For example, when an automobile company finds it difficult to procure competitively priced steel sheets on time due to price or information shortages from Japanese suppliers, it replaces market purchases with internalization to enhance corporate competitiveness. In other words, the business community argues that essential internalization for strengthening industry and corporate competitiveness should be distinguished from internalization pursued for the benefit of specific individuals.

Jo Byungseon, president of the Korea Institute for Industrial Economics & Trade, stated, "Most transactions between affiliates are normal transactions aimed at pursuing efficiency through vertical integration, ensuring transaction safety, and maintaining the quality of goods and services, yet they are uniformly regulated as private profit appropriation, which is unreasonable," and suggested, "Transactions between affiliates under holding companies should be excluded from strengthened regulations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.