Life Insurers' Retention Rate Over 2 Years Drops 3.7%P

Mid-Term Cancellations Rise Due to COVID-19 Spread and Financial Hardship

Poor Management Amid Agents' Avoidance of Face-to-Face Sales

[Asia Economy Reporter Oh Hyung-gil] The aftermath of the novel coronavirus infection (COVID-19) crisis is causing gaps in insurance contract management.

Not only are more policyholders opting for early termination rather than maintaining their insurance, but the inability to actively manage customers is also seen as a contributing factor.

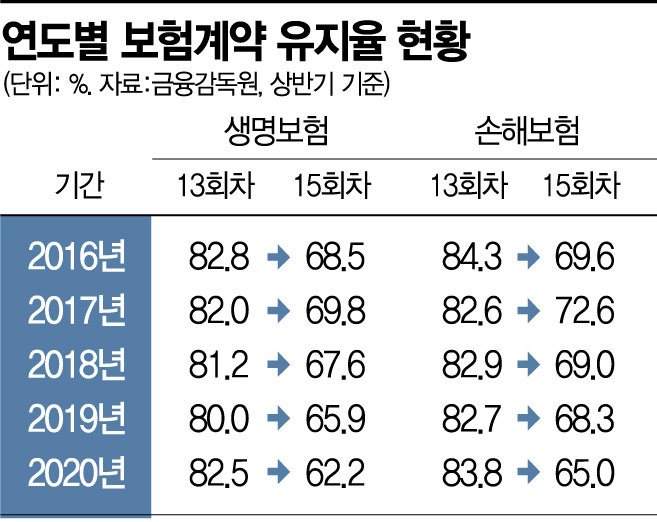

According to the Financial Supervisory Service on the 9th, the insurance contract retention rate in the first half of this year recorded the lowest level in the past five years, indicating the worst contract soundness.

The 25th installment retention rate, which refers to the percentage of contracts maintained for more than two years after insurance enrollment, fell by 3.7 percentage points year-on-year to an average of 62.2% for life insurance. It has been declining every year since recording 69.8% in the first half of 2017.

The lowest was Chubb Life Insurance at 43.3%. Fubon Hyundai Life also recorded 49.5%. This means that half of the customers of these insurers cancel their insurance within two years of enrollment.

KB Life (55.2%), Orange Life (56.9%), DB Life (57.6%), and DGB Life (58.1%) also showed low 25th installment retention rates. Kyobo Lifeplanet Life had the highest 25th installment retention rate at 79.6%.

The 'Big 3' life insurers?Samsung Life, Hanwha Life, and Kyobo Life?recorded 59.0%, 59.3%, and 61.2%, respectively, all below the average.

For non-life insurance, the average 25th installment retention rate was 65.0%, down 3.3 percentage points compared to the same period last year. Among insurers, AIG General Insurance (56.6%), Samsung Fire & Marine Insurance (58.2%), and Heungkuk Fire & Marine Insurance (56.9%) showed poor performance, while The-K Non-Life Insurance reached 81.9%.

Insurance contract retention rates naturally decline over time due to policyholders' economic circumstances. However, the sharp decline this year is analyzed to be closely related to the recent economic situation.

The surrender refund amount received from early termination of life insurance in the first half of the year was 14.1785 trillion KRW, a 7.4% increase from 13.198 trillion KRW in the same period last year. This reflects the inability to maintain insurance due to financial hardship and premium payment burdens.

Switching Prevails Amid Recruitment Commission Competition

The side effects of excessive recruitment commission competition persist. The 13th installment retention rate, which is the rate of maintaining contracts for more than one year after life and non-life insurance enrollment, was 82.5% and 83.8%, respectively, showing slight improvement from the previous year.

Contracts past the 13th installment do not require agents to return commissions even if the contract is terminated early, leading agents to neglect insurance maintenance.

This also indicates the practice of 'switching sales,' where old insurance policies are canceled and new products with higher commissions are sold. As of the end of June, the initial premium for life insurers was 3.4623 trillion KRW, an increase of 400 billion KRW from 3.0479 trillion KRW in the same period last year. The new contract rate in the first half also rose from 6.35% last year to 6.55%.

An industry insider said, "Many cases of insurance remodeling occur through recent insurance coverage analysis services, so it cannot be viewed solely as switching," adding, "Due to COVID-19, face-to-face sales have been restricted, making it impossible for agents to meet customers, and contract management inevitably becomes more negligent."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman Who Jumps Holding a Stolen Dior Bag... The Mind-Shaking, Bizarre Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)