Hana Financial Group Analyzes Financial Asset Status of Geumtoejoek

Geumtoejoek Actively Invested in Stocks and Funds in Their 30s and 40s

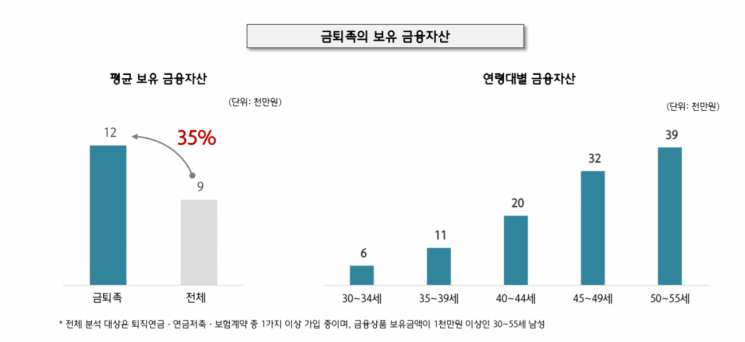

[Asia Economy Reporter Kim Min-young] The average financial assets of the so-called ‘Geumtoe-jok’?those who can enjoy a comfortable retirement even after retirement?were found to be 120 million KRW. The size of financial assets increased with age.

Geumtoe-jok stand out from their 40s, with large pension assets and active fund investments. However, those with real estate tended to have a lower proportion of stock investments.

According to the report "100 Years of Happiness, Living as Geumtoe-jok" released on the 9th by Hana Financial Group’s 100-Year Happiness Research Center, the average financial assets of Geumtoe-jok were 120 million KRW, 35% higher than the overall survey target (90 million KRW).

By age group, the average financial assets were ▲60 million KRW for ages 30-34 ▲110 million KRW for ages 35-39 ▲200 million KRW for ages 40-44 ▲320 million KRW for ages 45-49 ▲390 million KRW for ages 50-55. The size of financial assets increased with age.

Geumtoe-jok become prominent starting in their 40s. The financial assets of Geumtoe-jok in their early 40s were over 100 million KRW more than the overall average. This gap is more than twice the 50 million KRW difference seen in the late 30s.

Differences also appear in the composition of financial products. Geumtoe-jok allocate more than 60% of their total financial assets to funds, pensions, and trusts across all age groups. This is 7 to 15 percentage points higher than the overall average.

The proportion of stock investments peaked at ages 40-44, and fund investment size peaked at ages 45-49. Geumtoe-jok aged 40-44 allocated 15% of their financial assets to stocks through general funds, retirement pensions, and pension savings. This is 9 percentage points higher than the 6% of the same age group overall and is the highest level across all age groups.

The average fund investment was 59 million KRW, peaking at ages 45-49. Fund balances in the 50s were also 58 million KRW, indicating that active fund investment in the 40s continued into the 50s.

If real estate (housing pension) is included, the scope of Geumtoe-jok expands. Securing 650,000 KRW monthly from real estate starting at age 60 (based on a housing pension for a property valued at 310 million KRW at the end of 2019) reduces the financial assets held by Geumtoe-jok aged 50-55 from 390 million KRW to 220 million KRW immediately.

Real estate cash flow also lowered the proportion of stock investments. Considering real estate cash flow, the stock investment ratio for ages 40-44 dropped from 15% to 8%, showing that real estate cash flow lowered the threshold for becoming Geumtoe-jok.

There were also significant changes depending on current income levels. For ages 50-55, the average financial assets of Geumtoe-jok were ▲150 million KRW (monthly income under 3 million KRW) ▲310 million KRW (3 million to 5 million KRW) ▲510 million KRW (5 million to 8 million KRW) ▲1.06 billion KRW (over 8 million KRW), showing a wide range.

The center analyzed that as income increases, consumption expenditure also rises, but the national pension remains at a certain level or below, so the cash flow that must be prepared directly increases.

Center Director Jo Yong-jun emphasized, “Geumtoe-jok have large pension assets and active fund investments. Ideally, the foundation to become Geumtoe-jok should be established by the early 40s, and to achieve this, protecting pension assets and executing financial investments are the most basic and reliable methods.”

Meanwhile, this survey was conducted by the Happiness Research Center in collaboration with Hana Bank’s AI Big Data Center, targeting men aged 30-55 to find actual cases of Geumtoe-jok. They extracted ideal cases that could maintain current consumption expenditure from age 60 to expected life expectancy according to income level and age group, and examined their characteristics.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.