H2O Multi Bond and Others Show Signs of Distress

Kiwoom Global Alternative 360 Billion Won

VI Fund Also Over 100 Billion Won

Rapid Asset Value Changes Due to Economic Conditions

Limitations Noted in Overseas Asset Due Diligence

[Asia Economy Reporter Minji Lee] This year, a series of redemption suspensions have occurred in funds investing in overseas assets. This time, redemption suspensions have occurred in overseas private equity fund of funds (FoF) and public-private funds, resulting in the freezing of investment funds amounting to 500 billion KRW. It is interpreted that the redemption suspension incidents occurred due to the sharp decline in asset values caused by the rapid changes in domestic and international economic conditions amid the COVID-19 pandemic.

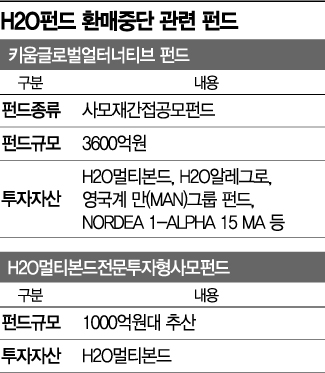

According to the financial investment industry on the 8th, recently Kiwoom Asset Management notified distributors of the redemption suspension of the 'Kiwoom Global Alternative Fund,' a private fund of funds with net assets of 360 billion KRW. This was because signs of distress were detected in 'H2O Multi Bond' and 'H2O Allegro,' the flagship funds of a global bond fund specialist included in the fund's assets. VI Asset Management also decided to suspend redemptions for the 'H2O Multi Bond Specialized Private Fund,' which holds the same assets, earlier this month. This fund was established less than a year ago and is estimated to be around 100 billion KRW in size.

This incident surfaced after three funds, including the two mentioned above and 'H2O Multi Strategy,' were notified by the French financial regulator (AMF) at the end of last month to suspend redemptions for one month. This was due to the high proportion of illiquid private bonds in the funds, increasing the risk of distress. H2O Management plans to separate the problematic private bonds and resume redemptions.

Risk of Rapid Asset Value Changes Due to COVID-19

Limitations of Domestic Managers' Due Diligence on Overseas Assets

While the low interest rate environment continues, the popularity of overseas assets, which can provide relatively stable and high returns, is increasing, but so are the warning signs of distress. A common issue among funds that have recently suspended or delayed redemptions is the rapid fluctuation in asset values due to COVID-19. A financial investment industry official explained, "In the case of illiquid alternative assets, variables due to external environments are significant. When liquidity is abundant, profitability is good, but as the market situation rapidly deteriorated due to COVID-19, if delinquency rates rise or sales drop sharply, there can be significant problems in asset securitization."

Another issue pointed out is the limitation in due diligence on overseas assets by public funds that invest indirectly in private funds. The risk of private funds can be transmitted at any time, but it is difficult for domestic managers to verify the assets held by overseas managers one by one. This means that unless notified locally or during regular due diligence, responses to signs of distress may be relatively slow. Another industry official said, "Public fund managers launch public funds in a fund of funds structure after multiple due diligence and verification processes, but it is inevitable that rapid responses to asset fluctuations are not smooth."

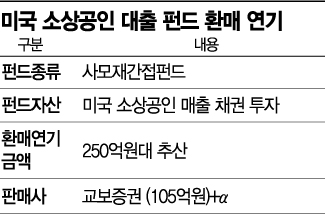

The Kyobo Securities fund, which invests indirectly in a private fund holding U.S. small business accounts receivable and has experienced redemption delays since March, also reflected negative impacts from COVID-19. As U.S. small businesses suffered, 98% of the assets were classified as distressed. Kyobo Securities, which invested in the U.S. small business loan finance company WBL through the Hong Kong-based Tandem Invest, stated, "Since the shutdown situation began in March, the external environment has changed significantly," adding, "We will respond with litigation regarding the local manager's failure to actively manage despite detecting signs of distress."

Industry insiders expect that since the funds listed for redemption suspension were affected by market conditions, redemptions may resume once asset values recover. A Financial Supervisory Service official said, "The funds involved in this issue are not fraudulent from the start like Optimus or Lime, nor do they have intentions to disrupt market order. Although more investigation is needed, given the unfavorable global market conditions, this is seen as a temporary phenomenon."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.