Junggyeonryeon, '2020 First Half Mid-sized Companies Overseas Subsidiaries Sales Performance and Financial Difficulties Survey' Results

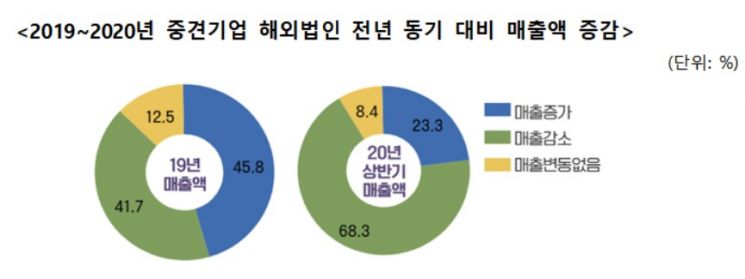

[Asia Economy Reporter Kim Cheol-hyun] It has been confirmed that two out of three mid-sized companies experienced a decline in the performance of their overseas subsidiaries in the first half of this year. On the 6th, the Korea Federation of Mid-sized Enterprises (hereinafter referred to as Mid-sized Federation) conducted the '2020 First Half Mid-sized Companies Overseas Subsidiary Sales Performance and Financial Difficulties Survey' targeting mid-sized companies with overseas subsidiaries, revealing that 68.3% of mid-sized companies reported a decrease in overseas subsidiary sales in the first half compared to the same period last year.

The average decrease was as much as 12.0%. Only 23.3% of mid-sized companies responded that their overseas subsidiary sales increased in the first half. This contrasts with 45.8% of mid-sized companies who responded that their overseas subsidiary sales increased last year compared to 2018. This survey was conducted over two weeks from July 30 to August 14, targeting 120 mid-sized companies with overseas subsidiaries.

The survey results confirmed that as the spread of the novel coronavirus infection (COVID-19) continues, mid-sized companies are also facing difficulties in raising funds. 24.0% of mid-sized companies cited the overall deterioration of cash flow as the biggest challenge, and various financial difficulties that increase management burdens were identified, including difficulties in obtaining local bank loans (12.0%), pressure to repay funds (10.0%), foreign exchange losses due to exchange rate fluctuations (10.0%), and inability to secure additional loans (8.0%).

Accordingly, 45.5% of mid-sized companies with overseas subsidiaries said that financial support recognizing overseas subsidiary assets as collateral could be a useful solution to alleviate financial difficulties. In particular, among manufacturing mid-sized companies, 20.9% responded that they would positively consider, and 22.4% said they would be willing to use loan products launched by domestic banks that recognize overseas subsidiary assets as collateral. 60.0% of non-manufacturing mid-sized companies said they would positively consider using such loan products. A Mid-sized Federation official stated, "It is difficult for foreign companies to borrow from local banks, and many mid-sized companies cannot receive additional loans domestically due to lack of collateral," adding, "As COVID-19 continues to spread, it has become even more difficult for companies not invested in the host country to obtain new loans from local banks."

Ban Won-ik, the full-time vice chairman of the Mid-sized Federation, emphasized, "In the current situation where quarantine to overcome the COVID-19 crisis is also economic activity, preparing for the post-COVID era and establishing a new growth foundation is another form of essential quarantine," and added, "To prevent the vicious cycle of deteriorating performance and financial difficulties of mid-sized companies, which has been clearly confirmed by concrete figures, bold implementation of broad support policies, including expanding financial support for overseas subsidiaries and backing corporate self-help efforts, is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.