Hanwha Asset Management ARIRANG US S&P500(H) ETF

Free Trading Available in Personal Pension Savings and Retirement Pension Accounts

[Asia Economy Reporter Eunmo Koo] Global electric vehicle company Tesla is set to be included in the U.S. Standard & Poor's (S&P) 500 index in mid-month, drawing attention to related exchange-traded funds (ETFs) as investment vehicles for Tesla.

Hanwha Asset Management announced on the 3rd that investment in the S&P 500 index is possible through the Arirang (ARIRANG) U.S. S&P 500 (H) ETF. Listed on the Korea Exchange in May 2017, the ARIRANG U.S. S&P 500 (H) was the first physical investment-type ETF related to the S&P 500 among domestic ETFs and currently records a net asset size close to 30 billion KRW. Notably, it is the only domestic S&P 500 physical ETF currently operated with currency hedging, which differentiates it by allowing stable tracking of the S&P 500 index’s inherent returns during periods of high volatility in the KRW-USD exchange rate.

The S&P 500 index is drawing attention as an investment vehicle for Tesla, which is scheduled to be included in mid-month. On the 20th of last month, Tesla’s stock price surpassed $2,000, setting a record high. Tesla’s stock price has risen approximately ninefold over the past year and more than fourfold this year alone. This price increase was supported by fundamental positives such as battery technology and sales expansion, along with expectations of a stock split and the possibility of inclusion in the S&P 500 index.

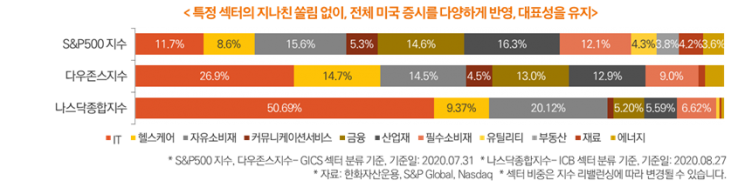

The S&P 500 index, composed of 500 leading U.S. companies, is classified as one of the three major indices of the New York Stock Exchange alongside the Dow Jones Industrial Average and the Nasdaq Composite Index, with estimated assets tracking it totaling about $4.6 trillion.

Yoon Ki-hyun, Manager of the Solution Marketing Team at Hanwha Asset Management, explained, “Investing in the S&P 500 automatically diversifies investment across 500 leading U.S. companies,” adding, “The advantages of ETFs include lower fees (30 basis points; 1 bp = 0.01 percentage points) compared to typical overseas funds and easy real-time trading, enabling flexible market responses.”

He also stated, “As a physical ETF, it can be freely traded within personal pension savings and retirement pension accounts. Once Tesla’s inclusion in the S&P 500 index is confirmed, it will encompass the world’s largest automobile company by market capitalization, which will further strengthen the index’s growth effect and representativeness in the future.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.