Bank of Korea '2020 Q2 Loan Balances by Industry for Deposit-Taking Institutions'

Both Loan Balances and Increases Reach All-Time Highs

[Asia Economy Reporter Kim Eun-byeol] It has been revealed that self-employed individuals and companies endured the second quarter with debt amid the spread of the novel coronavirus infection (COVID-19).

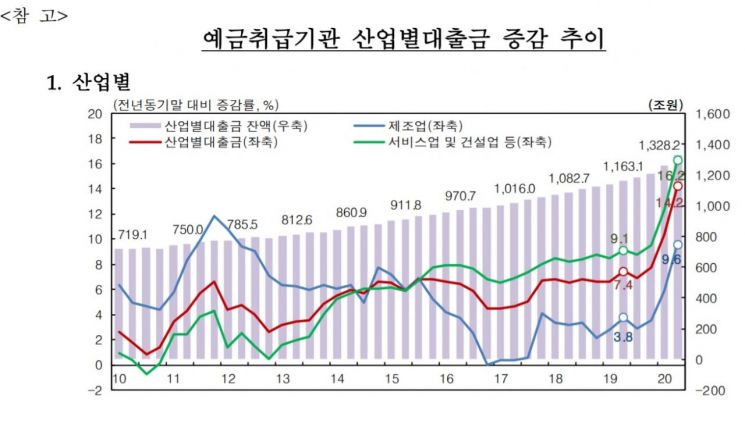

According to the "2020 Q2 Depository Institutions' Industry-Specific Loan Statistics" released by the Bank of Korea on the 2nd, the outstanding loan balance by industry of depository institutions reached 1,328.2 trillion KRW, an increase of 6.91 trillion KRW compared to the end of the previous quarter.

The increase expanded by more than 1 trillion KRW compared to the previous quarter (5.14 trillion KRW), marking the highest level since the statistics compilation began in Q1 2008. The outstanding loan balance also reached an all-time high, rising 14.2% year-on-year.

By industry, loans to the service sector increased by 4.72 trillion KRW in Q2, significantly higher than the 3.4 trillion KRW increase in the previous quarter. Due to the impact of COVID-19, companies in the service sector experiencing deteriorated business conditions continued efforts to secure funds, and financial support increased, leading to an expanded loan increase.

Loans for wholesale and retail trade, accommodation, and food services rose from 1.22 trillion KRW to 1.88 trillion KRW, and real estate loans increased from 650 billion KRW to 1.06 trillion KRW. Loans for transportation and warehousing also expanded from 200 billion KRW to 320 billion KRW. By purpose, working capital loans (+3.6 trillion KRW) increased significantly compared to Q1 (2.25 trillion KRW), while facility investment loans (+1.12 trillion KRW) saw a slight decrease in growth.

In manufacturing, loans increased by 1.72 trillion KRW in Q2, expanding compared to the previous quarter (+1.48 trillion KRW). By industry, loans to metal processing products and machinery equipment industries increased by 460 billion KRW, more than doubling from the previous quarter, and loans to the automobile and trailer industry also expanded to 280 billion KRW, up from 150 billion KRW in Q1. While the increase in working capital loans slightly decreased, facility investment loans expanded from 150 billion KRW in Q1 to 450 billion KRW.

By lending institution, loans increased by 4.5 trillion KRW at deposit banks and by 2.41 trillion KRW at non-bank depository institutions.

Song Jae-chang, head of the Financial Statistics Team at the Bank of Korea's Economic Statistics Bureau, explained, "Due to the sluggish business conditions caused by COVID-19, it is estimated that demand for working capital loans has increased. Additionally, the government's and financial institutions' increased COVID-19 financial support is also a background for the loan increase." He added, "In Q3, it is difficult to predict now as the loan scale may change depending on how the policy authorities' support measures take effect and the business conditions of each industry in Q3."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.