Non-Financial Values Such as Environment and Society

Indicators for Judging Long-Term Growth Companies

Total of 6 Related Funds Launched This Year

Returns Reach Up to 44.95%

[Asia Economy Reporter Minji Lee] As investors increasingly value non-financial performance indicators such as ESG (Environmental, Social, and Governance), the asset management industry is actively launching ESG funds. ESG investing refers to making investment decisions by assessing a company's value based on factors beyond traditional financial information, including climate, health, and cost-saving technologies.

Growing Interest in Sustainable Investment Since COVID-19

According to NH-Amundi Asset Management on the 1st, they plan to launch the 'Century Company Green Korea' ESG fund early this month. This fund invests in companies with excellent environmental, social, and governance-related indicators. It is known to have selected stocks based on the MSCI ESG index, composing a portfolio by combining domestic companies included in the index and those that received high scores in NH-Amundi Asset Management's proprietary ESG score evaluation.

An NH-Amundi Asset Management official explained, "The name implies including companies that can grow sustainably for 100 years," adding, "As demand for socially responsible investment increases, we aim to develop this into the second 'Winning Korea' fund."

In July, Schroder Asset Management became the first foreign asset manager to launch the 'Schroder Global Sustainable Growth Equity Fund.' The fund is characterized by constructing an investment portfolio based on ESG factors to predict actual profit growth of companies. It aims to achieve a steady annual return of 5-6% or more.

ESG investing is gaining attention not only domestically but globally. Since the outbreak of COVID-19, global investors' interest in sustainable investment has expanded further. Kwangyoung Oh, a researcher at Shin Young Securities, analyzed, "During the sharp decline in global asset prices caused by COVID-19, the perception of ESG as a safe haven expanded," adding, "Interest in environmental issues has significantly increased due to COVID-19, leading to notable capital inflows." According to global fund rating agency Morningstar, $71.1 billion (84 trillion KRW) flowed into ESG funds worldwide in the second quarter alone, far surpassing last year's investment scale of $21.4 billion (25 trillion KRW).

Major institutional investors' awareness of ESG is also changing. As it has been confirmed that ESG investments outperform general equity funds in the long term, companies are actively considering non-financial factors. However, an independent and objective evaluation system for ESG has yet to be established proportionally to market growth. According to EY Han Young, a survey of institutional investors showed that 80% agreed on the need for audits to increase trust in ESG indicators. Kwangyeol Lee, head of the audit division at EY Han Young, explained, "As institutional investors' expectations for ESG reliability rise, it is necessary to establish a foundation that can simultaneously enhance the transparency and reliability of non-financial information."

ESG Fund Net Asset Size Also 'Growing Rapidly'

Since the beginning of this year, six ESG-related funds have been launched domestically. Although the domestic fund market has seen a decline in new fund launches due to private equity fund scandals and the impact of COVID-19, ESG-related funds have been launched more actively this year compared to last year (six funds).

In Korea, interest in ESG has significantly increased due to the combined effects of COVID-19 and the government's Green New Deal policy. According to financial information provider FnGuide, 41 ESG-related funds have attracted 52.8 billion KRW in capital inflows since the beginning of the year. While 13.57 trillion KRW has been withdrawn from domestic equity funds since the start of the year, ESG-related funds have consistently attracted capital.

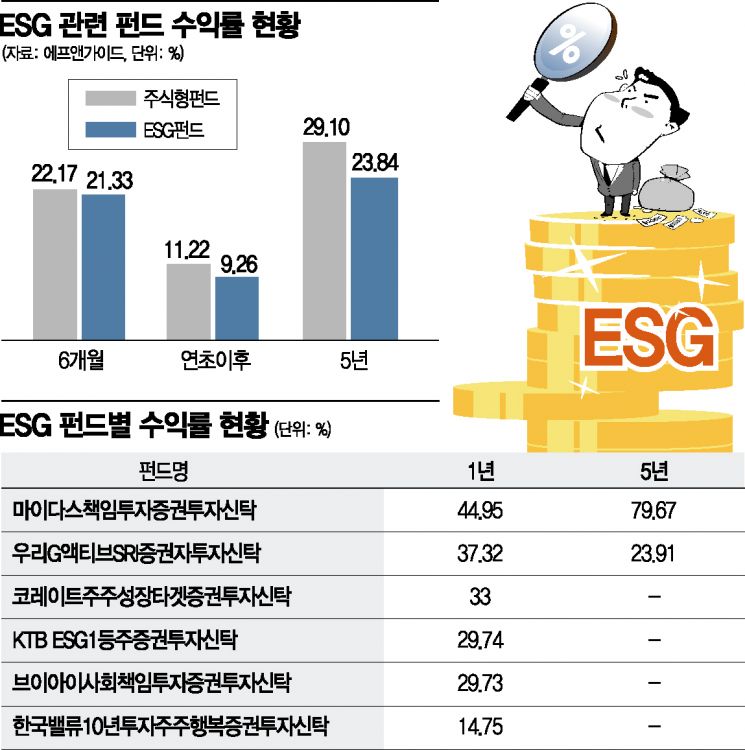

The average return of ESG funds recorded 11.2% since the beginning of the year, outperforming the domestic equity fund return of 9.26%. Compared to the benchmark KOSPI index return of 6.9%, it is about twice as high. Over six months after the COVID-19 impact, ESG funds recorded a 22.17% return, higher than the 21.33% return of domestic equity funds. Even over a five-year period, ESG funds have higher returns. Despite increased volatility in the domestic stock market, ESG funds have delivered superior returns compared to equity funds in both the short and long term.

Among funds, the Midas Responsible Investment Securities Trust posted the highest return of 44.95% over the past year. It also recorded nearly 80% returns over five years. This fund's portfolio focuses on blue-chip stocks such as Samsung Electronics (17%), LG Chem (4%), SK Hynix (3.7%), Naver (3.3%), Kakao (3%), Hana Financial Group (2%), and Nongshim (1.6%). During the same period, Woori G Active SRI Securities Investment Trust (37%) and Koreate Shareholder Growth Target Securities Investment Trust (33%) also maintained high returns.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.