"Increased Independence of Sanction Committee" Full-Scale Discussion on Amendment

Concerns Over Excessive Industry Influence Also Raised

[Asia Economy Reporter Kim Hyo-jin] A revised bill that strengthens and institutionalizes the participation of external organizations in the composition of the Financial Supervisory Service (FSS) Sanctions Committee for sanctioning financial companies has come onto the National Assembly's main discussion table, drawing attention.

Since the 21st National Assembly, while bills to significantly strengthen financial supervision functions and pressure financial companies have been continuously proposed, legislative attempts to check supervisory authority and represent the voices of financial companies are virtually limited to this case, attracting particular interest from the financial sector.

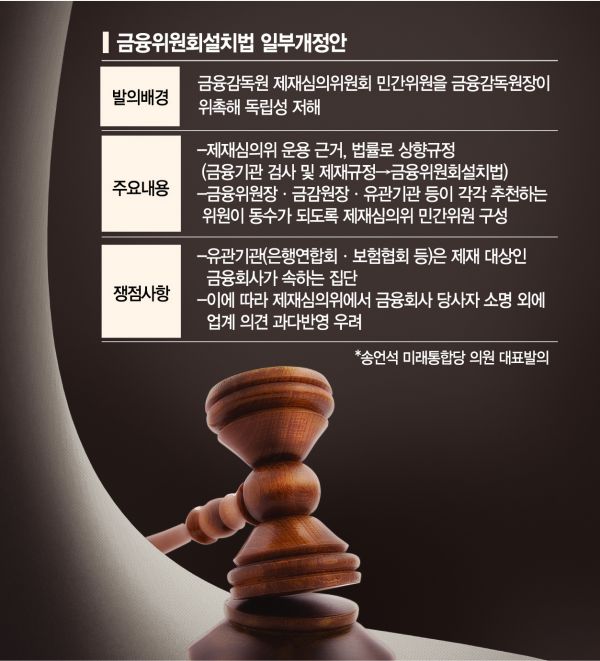

According to the financial and political circles on the 31st, the "Partial Amendment to the Act on the Establishment of the Financial Services Commission," which was jointly proposed by Song Eon-seok, a member of the Future United Party, in June, recently entered detailed discussions in a subcommittee after going through the full Political Affairs Committee meeting.

The core of the amendment is to compose the FSS Sanctions Committee (up to 24 members) civilian members through equal recommendations from the Financial Services Commission Chairman, the Financial Supervisory Service Governor, and related organizations such as the Korea Federation of Banks and the Korea Insurance Association, while abolishing three ex officio members: FSS executives, legal advisors, and the Financial Services Commission's agenda-related directors. To this end, the amendment also includes upgrading the legal basis for the Sanctions Committee from the current Financial Services Commission notice, "Regulations on Inspection and Sanctions of Financial Institutions," to the Financial Services Commission Establishment Act.

Rep. Song explained the background of the amendment, saying, "Currently, nearly 20 civilian members are appointed by the FSS Governor, which has been criticized for undermining the independence of the sanctions committee," and "the aim is to enhance the independence of the composition and operation of the sanctions committee."

The National Assembly Legislative Research Office stated in its review report that "from the perspective of securing expertise, objectivity, and fairness, it is reasonable to include members recommended by external financial-related organizations or groups to ensure that diverse views are balanced and expressed," indicating the appropriateness of the bill's intent.

In future discussions, concerns are expected to arise that the amendment might lead to overly reflecting the voices of financial companies, beyond enhancing the independence of the sanctions committee. This is because the external organizations stipulated in the amendment include groups to which the sanctioned financial companies belong, potentially causing controversy over bias.

The Legislative Research Office also pointed out, "There is a risk that industry opinions might be excessively reflected beyond the parties' (financial companies') explanations." A Political Affairs Committee official said, "Whether devices or compromises that can dispel such concerns during detailed discussions can be derived will be key to the passage of the amendment."

Ruling Party-led 'Financial Shackles Laws' Proposed One After Another

Expected Flexibility Amid Government's 'Consumer Protection' Policy

Currently, various types of financial company regulation bills, so-called 'Financial Shackles Laws,' mainly proposed by the ruling Democratic Party, are accumulating in the National Assembly.

These include amendments to the Financial Company Governance Act that mandate internal control responsibilities for financial company CEOs and impose fines triple the amount of consumer damages, amendments to the Financial Consumer Protection Act requiring compensation up to three times the damage amount to consumers upon detection of illegal acts, and the so-called "Samsung Life Act (Insurance Business Act amendment)" that requires insurance companies to calculate the value of held stocks based on market price rather than acquisition cost.

There is also a proposal to secure one-sided binding force in the Financial Consumer Protection Act amendment, which requires financial companies to unconditionally accept FSS dispute mediation proposals for cases below a certain scale if consumers (complainants) accept them. If introduced, this is expected to apply to about 80% of all dispute mediation cases, those involving amounts under 20 million KRW. For these cases, financial companies would lose their right to litigation.

A financial sector official said, "At first glance, many cases seem somewhat excessive, but considering the composition of the 21st National Assembly and the government and ruling party's strong consumer protection stance, it does not look trivial." A commercial bank official lamented, "We are closely monitoring the discussion status of these bills and hope that the financial sector's position will be sufficiently reflected during the discussion process, regardless of whether the bills are passed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.