[Asia Economy Reporter Park So-yeon] Safety concerns are being raised as fires have repeatedly occurred in electric vehicles equipped with products from CATL, China's top battery manufacturer.

The domestic battery industry believes that Korea still leads China in next-generation battery technology and is focusing on further widening the gap.

According to industry sources and local media on the 29th, fires broke out consecutively on the 12th and 23rd in the 'Aion S' model by Chinese automaker Guangzhou Automobile Group Co., Ltd. (GAC). There was also a fire in this vehicle on May 18.

GAC has not officially announced the cause of the fires so far, but it is known that the ignition point of the most recent fire was the battery.

GAC ranked fourth in electric vehicle sales in China from January to July this year, and the Aion S is equipped with batteries from CATL, considered a major competitor to Korea's top three domestic battery companies.

The product supplied by CATL for the Aion S is the NCM811 battery, which is also supplied to BMW iX3 and Geely Automobile, among others.

NCM811 refers to a battery with a cathode active material ratio of nickel, cobalt, and manganese at 80%, 10%, and 10%, respectively.

Generally, a higher nickel content allows for longer driving distances but reduces safety, and the industry estimates that CATL has not been able to technically overcome this issue.

An industry insider explained, "CATL is known to have a factory yield rate of 45-55%, indicating a high defect rate," adding, "Safety issues may have arisen from attempts to increase nickel content."

In particular, CATL's main product is LFP (Lithium Iron Phosphate), which has lower energy density but guaranteed safety, leading to criticism that its NCM technology is still at a low level.

On the other hand, domestic battery companies have resolved these safety issues and have already commercialized NCM811 since 2018.

LG Chem began mass-producing and supplying NCM811 for electric buses in 2018, and some Tesla Model 3 vehicles sold in China also use NCM811.

LG Chem's NCM811 will also be used in the 'Lucid Air' by American automaker Lucid Motors, launching this September, and recently announced plans to mass-produce NCMA (Nickel-Cobalt-Manganese-Aluminum) batteries, which reduce cobalt content and add aluminum, in 2022.

SK Innovation produces NCM811 batteries at its plants in Seosan, Korea; Changzhou, China; and Kom?rom, Hungary. It supplies NCM811 batteries for the Hyundai Kona Electric produced in the Czech Republic and the Arcfox 'Mark 5' by Beijing Automotive Group in China.

Additionally, SK Innovation plans to equip the 2023 Ford 'F-150' electric pickup truck in the U.S. with NCM batteries containing over 90% nickel content, known as NCM 9½½.

Samsung SDI will apply NCA (Nickel-Cobalt-Aluminum) technology with nickel content exceeding 88% in its 5th generation electric vehicle batteries to be released next year.

Samsung SDI's high-nickel NCA batteries will be installed in BMW's next-generation electric vehicles, and the two companies have signed a supply contract worth approximately 4 trillion KRW related to this.

CATL, not to be outdone, has aggressively recruited domestic battery researchers to secure technology and first commercialized NCM811 in 2019, about a year later than domestic companies.

In early May, CATL stated, "The sales proportion of NCM811 currently accounts for around 20%," and "We will continue to expand NCM811 sales."

However, with two fires already occurring this month in electric vehicles equipped with CATL batteries, the industry has reaffirmed the technological gap between Korea and China.

A domestic battery industry official said, "The current technology gap between Korea and China in batteries is about 2 to 3 years," adding, "No matter how many personnel are poached, it is impossible to catch up in a short time."

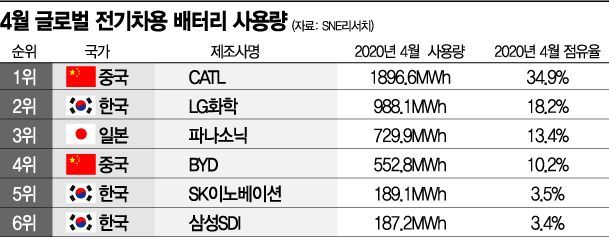

According to market research firm SNE Research, in the first half of this year, LG Chem ranked first in global battery market share (24.6%), CATL second (23.5%), and Panasonic third (20.4%).

Samsung SDI ranked fourth with 6.0%, and SK Innovation sixth with 3.9%. Among the top 10 companies, only China's CALB and Korea's top three battery companies showed growth compared to last year.

The share of high-nickel and NCMA batteries in the global battery market is expected to increase from about 4% in 2020 to 35% by 2030.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.