Next Month's Designer Qualification Exam Scheduled as Planned

"Unable to Recruit for Second Half Public Hiring..."

Long-Term Hiring Difficulties Due to COVID-19 Resurgence Risk

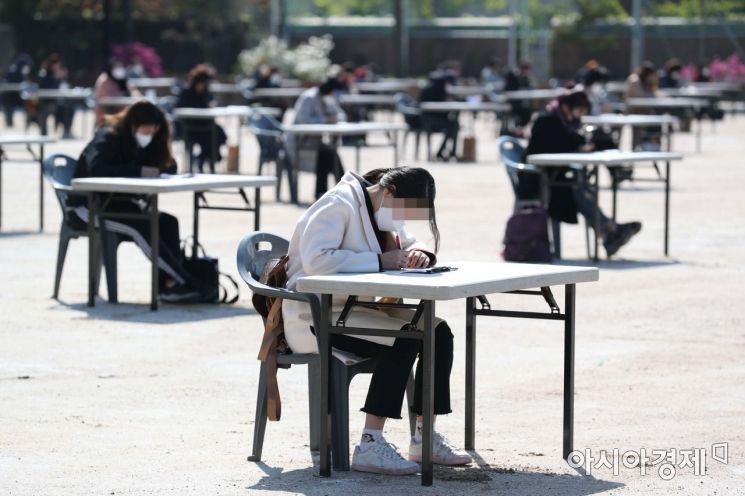

The insurance planner exam is being held on the 26th at the Myeongji College sports field in Seodaemun-gu, Seoul, to prevent the spread of the novel coronavirus infection (COVID-19). Photo by Mun Ho-nam munonam@

The insurance planner exam is being held on the 26th at the Myeongji College sports field in Seodaemun-gu, Seoul, to prevent the spread of the novel coronavirus infection (COVID-19). Photo by Mun Ho-nam munonam@

[Asia Economy Reporter Oh Hyung-gil] The insurance industry is anxiously concerned about a potential shortage of insurance agents due to the resurgence of the novel coronavirus infection (COVID-19). Although the current social distancing level 2 has been extended, allowing scheduled exams to proceed, if the situation worsens, securing new personnel will inevitably face difficulties.

According to the insurance industry on the 28th, the Life and Non-life Insurance Associations have confirmed their plan to proceed with the insurance agent qualification exams scheduled for next month as planned. The government decided not to raise the social distancing level from 2 to 3 and will maintain level 2 for the next week.

Both associations plan to limit the number of examinees per test site to 50 or fewer in accordance with the level 2 implementation guidelines. The Korea Insurance Research Institute also announced that the insurance agency exam will be held on the 19th of next month in six regions nationwide, including Seoul and Busan.

A representative from the Life Insurance Association stated, "With the government extending social distancing level 2 by one week, there is no change to the agent exam schedule. To prevent further spread of COVID-19 and ensure the safety of examinees, those suspected of having major symptoms such as fever, cough, or vomiting will not be allowed to take the exam, and masks must be worn inside the exam venues."

While the insurance industry has avoided the immediate threat of exam suspension, the atmosphere remains cautious. Suspension of exams directly affects the recruitment of agents, which in turn determines sales capabilities, so insurance companies are closely monitoring the situation.

If social distancing is raised to level 3, gatherings of more than 10 people will be prohibited, making it virtually impossible to hold the insurance agent qualification exams. This is expected to further impact the already weakened face-to-face sales activities.

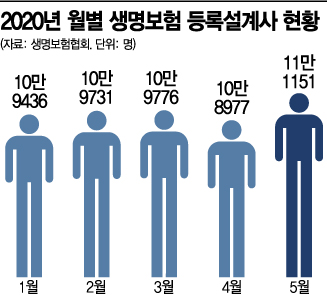

Earlier, during the initial COVID-19 outbreak in late February, qualification exams were suspended but resumed from late April. During this period, the number of registered agents with the Life Insurance Association decreased from 109,731 in February to 108,977 in April, then increased to 111,151 in May.

Recruitment through open hiring by insurance companies has also been slow to open. With the recent resurgence of over 300 new confirmed cases daily, the hiring process itself has become more complicated.

Most insurance companies, including Samsung Life, Samsung Fire & Marine, Hanwha Life, Kyobo Life, and Hyundai Marine & Fire, have not set schedules for open recruitment in the second half of the year. DB Insurance is the only company accepting open recruitment applications from next month 1st to October 6th, expecting to hire about 30 people, similar to last year’s scale.

Recently, Financial Services Commission Chairman Eun Sung-soo emphasized human investment in the financial industry and urged active recruitment, prompting insurance companies to deliberate on when to resume hiring.

A representative from a life insurance company said, "We cannot avoid hiring new employees in the second half, but we are cautious because we do not know what unforeseen issues might arise. We plan to decide on recruitment while monitoring the COVID-19 situation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)