Institutional Demand Forecast Competition Rate Surpasses 1000 to 1...

Unprecedented Case Among Large-Cap Stocks with Over 300 Billion Won Public Offering

"At Least 10 Trillion Won Expected... Long-Term Success Possible"

[Asia Economy Reporter Minwoo Lee] Kakao Games, which has officially entered its initial public offering (IPO) schedule, is expected to attract tens of trillions of won in large-scale funds. As a large-cap stock with a public offering amount exceeding 300 billion won, the demand forecast competition rate among institutional investors has unusually surpassed 1000 to 1, signaling a strong market reception.

According to the financial investment industry on the 28th, the demand forecast competition rate for Kakao Games among institutional investors, conducted from the 26th to 27th, exceeded 1000 to 1. Approximately 1,100 domestic and international institutional investors, including pension funds, banks, insurance companies, and asset management firms, expressed their intention to participate. This far surpassed the demand forecast competition rate of 836 to 1 for SK Biopharm, which sparked a subscription frenzy in June. This year, only Iruda, Korea Pharma, and TSI have recorded demand forecast competition rates above 1000 to 1, but their public offering amounts were around 13.5 to 18.5 billion won. In comparison, Kakao Games’ public offering amount is expected to reach up to 384 billion won. It is considered exceptional for a large-cap stock with a public offering amount exceeding 300 billion won to achieve a demand forecast competition rate of 1000 to 1.

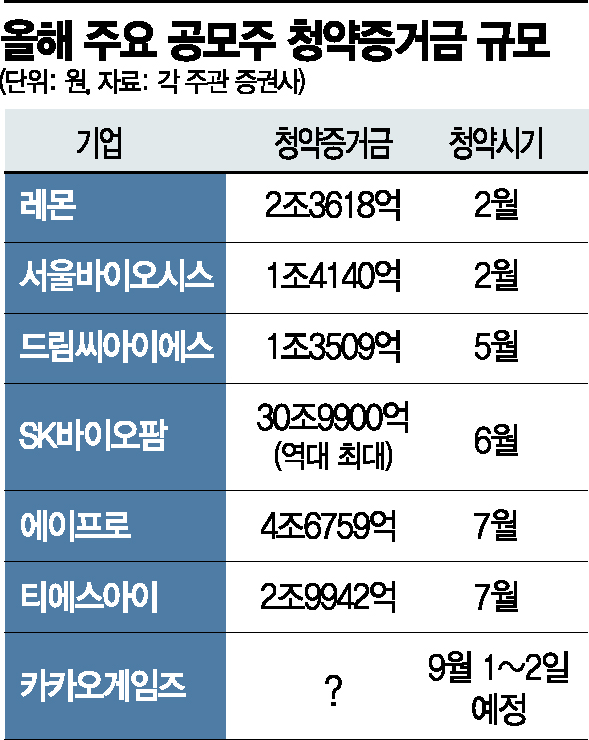

Fueled by this popularity, the securities industry anticipates that the subscription deposits for Kakao Games could reach record-breaking levels. The previous highest subscription deposit was 30.99 trillion won for SK Biopharm. SK Biopharm was the first on the KOSPI to achieve a 'ttasang' (where the opening price is double the public offering price followed by a daily upper limit price) and maintained the upper limit price for two consecutive days. The subscription competition rate for general investors was 323 to 1. Even if Kakao Games’ subscription competition rate reaches only 300 to 1, investors would need to deposit at least 3.6 million won to receive one share. Given that companies slightly smaller than Kakao Games, such as Lemon (2.3618 trillion won) and Apro (4.6759 trillion won), attracted subscription deposits worth several trillion won, the investment enthusiasm is expected to be even hotter.

Nam Dong-jun, CEO of Tekton Investment Advisory, said, "Since Kakao Games’ expected public offering price band is 20,000 to 24,000 won, which is significantly lower than the over 63,000 won price of its over-the-counter stock, investors are entering with high expectations." He added, "Considering this atmosphere and the company’s scale, it seems likely that subscription deposits will easily exceed 10 trillion won."

Although an unprecedented amount of funds is expected to pour in, there are concerns that this could be merely a temporary speculative investment. A financial investment industry official pointed out, "Recent IPO investments tend to be short-term in nature, where investors sell shares on the listing day or shortly thereafter to gain profits, rather than conducting thorough research on the company and investing for the long term." He added, "Although somewhat uncomfortable, it is also true that many approach it more as an IPO event rather than a genuine investment."

As this is Kakao’s first subsidiary to go public, there is also analysis that it will deliver long-term results. Kakao Games is pursuing a strategy to bring various games closer to daily life by using the 'national messenger' KakaoTalk as its platform. Leveraging the Kakao platform, which has shown unprecedented influence amid the spread of non-face-to-face culture due to COVID-19, Kakao Games, equipped with capabilities in both in-house game development and publishing games from other developers, is expected to continue its successful run.

This is already being proven by its performance. In the first half of this year, it recorded sales of 203 billion won and operating profit of 28.7 billion won, representing increases of 8.2% and 63.7% respectively compared to the same period last year. Its compound annual growth rate (CAGR) over three years since 2017 is 57%. The recently released Guardian Tales is performing well, and new titles such as the PC online MMORPG 'Elyon' (scheduled for release this year) and the mobile MMORPG 'Odin' (scheduled for release next year) are lined up. Namgung Hoon, CEO of Kakao Games, emphasized, "Kakao Games is the only domestic game company that owns a platform encompassing both mobile and PC online. We have proven publishing capabilities with titles like PUBG and Guardian Tales, as well as in-house development capabilities. Based on this, we will actively target overseas markets and strive to become a leading global game company from Korea."

Kakao Games will announce its final public offering price on the 31st after compiling the demand forecast results, conduct subscriptions for general investors on the 1st and 2nd of next month, and list on the KOSDAQ market on the 10th. The lead underwriters are Korea Investment & Securities and Samsung Securities.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)