Rapid Sales Growth After COVID-19

20 Years of Debt-Free Policy, Industry-Leading 'Financial Stability'

As confirmed cases of the novel coronavirus infection (COVID-19) surge, more companies are adopting remote work. Samsung Electronics is implementing remote work for all employees company-wide, excluding the semiconductor division, for the first time since the COVID-19 outbreak. LG Electronics has also decided to expand remote work to more than 30% of its entire workforce. Many companies had previously refrained from adopting remote work due to concerns over decreased efficiency. However, as more companies have experienced remote work amid the COVID-19 crisis, the likelihood of remote work becoming a new standard work style has increased. It is expected that more companies will establish environments that enable remote work in preparation for unforeseen circumstances. To create a remote work environment, enterprise collaboration platforms supporting group messengers, video conferencing systems, remote PC control, and cloud services are necessary. Recently, stocks of solution providers supporting remote work have surged in the domestic stock market. Asia Economy reviews the management status of companies such as RSUPPORT, ECS, and Fasoo to gauge the potential for increased corporate value.

[Asia Economy Reporter Lim Jeong-su] KOSDAQ system integration (SI) company ECS Telecom (ECS) has taken off amid the expansion of non-face-to-face work among enterprises. While expanding new businesses such as video conferencing systems, its performance has sharply improved since COVID-19. Its stable financial structure, including maintaining a long-term debt-free policy, is also attracting attention.

◇Quarterly sales up over 50%... steep revenue growth= ECS was established in 1999 by CEO Hyun Hae-nam, a former Daewoo Telecom executive, following the dissolution of the Daewoo Group. Initially, it expanded its scope by leveraging the existing sales network from the Daewoo Group era to operate SI and contact center (call center) businesses. Demonstrating stable performance, it entered the KOSDAQ market in December 2007.

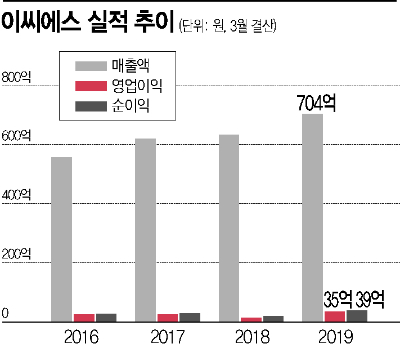

Recently, ECS has been expanding its business segment in non-face-to-face solutions such as video conferencing and unified communications, based on a stable customer base in the existing SI sector. This business expansion has directly translated into increased sales. For the fiscal year ending in March, ECS surpassed 70 billion KRW in sales for the first time since its establishment during the period from April 2019 to March 2020.

In the first quarter of this year (April to June), sales recorded 15.8 billion KRW, an increase of more than 50% compared to the same period last year. This was a result of increased orders for non-face-to-face solutions due to COVID-19. According to ECS, while contact center sales previously accounted for the overwhelming majority, sales related to digital workplace solutions such as video conferencing have recently grown rapidly. Global research firm MarketsandMarkets forecasts the digital workplace market to grow from 13.4 billion USD in 2018 to 35.7 billion USD by 2023, at a compound annual growth rate of 21.7%.

Profitability is also improving. ECS posted an operating profit of 3.5 billion KRW last year, more than doubling compared to the previous year. In the first quarter of this year, it recorded a profit of 800 million KRW, returning to the black.

A securities analyst commented, "SI companies generally have low profitability due to intense price competition and high selling and administrative expenses," adding, "However, ECS maintains a stable operating profit margin of around 5% based on its high technological capability and long-standing experience in the non-face-to-face sector."

◇20 years of debt-free policy... outstanding financial stability= A stable financial structure is also cited as a factor enhancing corporate value. ECS has maintained a debt-free policy with cash assets exceeding borrowings for over 20 years since its establishment.

As of the end of June this year, borrowings amounted to only 1.5 billion KRW. There are no borrowings through general loans or bond issuance. All borrowings are trade finance (Usance) and lease liabilities arising from business operations. Cash assets stand at 38.6 billion KRW, leaving more than 35 billion KRW in cash assets even after repaying all borrowings.

A related industry official explained, "SI projects are often conducted through bidding unless they are negotiated contracts, and clients frequently evaluate financial stability as part of the scoring criteria," adding, "To ensure stable operations, a certain level of financial stability must be secured."

However, there are criticisms that corporate control through shareholding is somewhat weak. The current CEO holds only 21.96% of shares. Even combined with shares held by executives, the total is 26.35%. This is due to dilution of the owner's shareholding through several rounds of capital increases.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)