Final Decision by the Board on the 27th

Historic First '100% Compensation' Milestone

Criticism of 'Blaming Only Financial Companies'

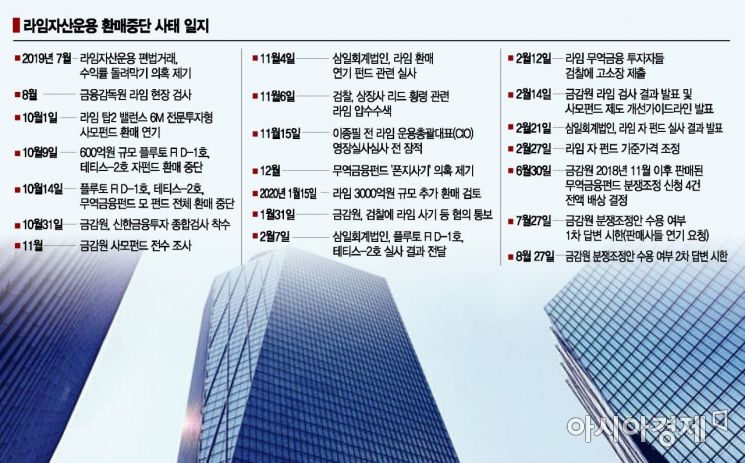

[Asia Economy Reporter Kim Hyo-jin] Lime Trade Finance Fund (Pluto TF-1) distributors are reported to have held a board meeting on the 27th and decided to accept the Financial Supervisory Service's (FSS) dispute mediation proposal of '100% compensation of invested principal.' Returning 100% of the principal to investors is the first case in the history of financial investment product dispute mediation.

This decision is expected to have significant repercussions as it could apply not only to other Lime funds whose redemptions have been suspended but also to other fund cases including Optimus Asset Management. Some critics argue that following the derivative-linked fund (DLF) scandal and the Lime incident, the financial authorities have avoided responsibility and shifted all blame onto financial institutions.

According to financial circles on the 26th, Hana Bank and Woori Bank, distributors of the Lime Trade Finance Fund, despite the burden of setting a precedent for full principal compensation, have reportedly settled on accepting the FSS mediation proposal. These banks have reportedly focused especially on persuading some board members who strongly opposed the acceptance of the proposal over the past month to consolidate the board's overall opinion.

Mirae Asset Daewoo, which has the smallest sales amount among the four distributors, is also said to have finalized acceptance. Shinhan Financial Investment is currently in the final stages of persuading its board members, leaning towards acceptance. Shinhan Financial Investment is emphasizing acceptance of the proposal for consumer protection on a magnanimous level, although some board members reportedly oppose it.

A distributor official said, "We have decided to prioritize 100% compensation on the grounds of contract cancellation due to error," adding, "Concerns about breach of trust have also been alleviated, so we understand that the board members will accept it."

The FSS Dispute Mediation Committee passed a mediation proposal in June recommending full compensation of the invested principal. The basis for 100% compensation was applied under 'contract cancellation due to error.' Article 109 of the Civil Act stipulates that if there is an error in an essential part of a contract or legal act, the contract can be canceled.

Recognition of Responsibility for 'Inducing Investor Error'

Potential Impact on Other Fund Cases

The FSS explained that this concept can be applied even if gross negligence by the distributor is not confirmed. Since the distributor induced investment by explaining the contents of a falsely prepared investment proposal as is, it can be argued that they bear responsibility for causing investor error.

If distributors accept the mediation proposal, the FSS will set a milestone in the history of financial dispute mediation by protecting consumers through full compensation for the first time. However, from the financial sector's perspective, it would leave the worst precedent where distributors bear virtually all responsibility for disputes.

Nonetheless, distributors are reportedly leaning toward acceptance due to the considerable burden of confrontation with the FSS. Especially for Hana Bank and Woori Bank, which are currently engaged in legal disputes with the FSS over sanctions related to overseas interest rate-linked derivative-linked funds (DLF), there is concern that rejecting the proposal could lead to significant disadvantages.

Facing public criticism as 'financial companies neglecting consumer protection' is also cited as an unwelcome factor.

Distributors' Burden of Confrontation with FSS

Claiming Recourse Against Lime Asset Management, but Effectiveness is Uncertain

Distributors maintain the position that "we are also victims of Lime Asset Management's illegal acts," and there were concerns that accepting the mediation proposal could embroil them in breach of trust controversies with shareholders.

However, ongoing legal reviews since the mediation proposal was issued have reportedly alleviated this issue to some extent. Since compensation is made based on the dispute mediation system rather than arbitrarily, there is no significant problem.

Distributors plan to execute compensation first and then claim recourse against Lime Asset Management. However, considering Lime Asset Management's financial condition, this is expected to be challenging. Among distributors, there is talk that "in principle, the possibility is kept open, but expectations for the outcome are very low."

Analysis of FSS Governor Yoon Seok-heon's 'Pressure and Incentives'

Strengthening Consumer Protection Policy Including 'Unilateral Binding Proposal'

It is also analyzed that FSS Governor Yoon Seok-heon's pressure message at the executive meeting the day before, stating "it will be reflected in management evaluations," influenced some board members who were negative about acceptance. A financial sector official said, "The remark came not immediately after the mediation proposal was reached but with only two days left before the decision deadline, so it likely had significant meaning," adding, "On the surface, it was a hopeful statement, but no one probably took it at face value."

Meanwhile, some interpret that Governor Yoon's order to "improve the system so that efforts to protect consumers, such as accepting the mediation decision by the Dispute Mediation Committee, can be reflected in financial consumer protection evaluations and management evaluations of financial companies" provided some justification for hesitant distributors to accept the proposal. A representative from a commercial bank said, "Among financial companies, there has always been dissatisfaction that faithfully implementing FSS supervisory guidelines does not bring any significant benefits."

The FSS's drive under the banner of consumer protection is expected to intensify further. In particular, Governor Yoon's advocacy and Democratic Party lawmaker Lee Yong-woo's proposed related bill are expected to give momentum to the unilateral binding proposal. This would stipulate that dispute mediation proposals for cases below a certain scale take effect regardless of the financial company's consent once accepted by the consumer.

The FSS and lawmaker Lee are considering including cases under 20 million KRW in this category. If implemented, financial companies would lose the right to request a trial in 80% of all dispute mediation cases. A financial sector official pointed out, "If the full compensation mediation proposal related to Lime is established and the unilateral binding proposal is institutionalized in the future, it could be interpreted as the full realization of the FSS dispute mediation system."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.