Over 240 P2P Companies Proliferate

Legal Enforcement Begins 'Sorting the Wheat from the Chaff'

First Hurdle: Submission of Audit Reports on the 26th

[Asia Economy Reporter Kim Min-young] The Online Investment-Linked Finance Business Act, also known as the ‘P2P Finance Act,’ will take effect from the 27th. This marks the emergence of a new type of financial business for the first time in 17 years since loan businesses were incorporated into the tertiary financial sector in 2003. Attention is focused on whether controversies surrounding P2P finance companies outside the regulatory framework?such as ‘eat-and-run,’ ‘rolling over,’ and delinquency rates?will subside.

According to financial authorities and the P2P industry on the 26th, the P2P Finance Act will be enforced starting the next day. This legislation comes more than four years after the first proposal by Min Byung-doo, a member of the Democratic Party of Korea, in 2016. Riding the wave of fintech (finance + technology) innovations such as internet-only banks, simple remittances, and easy payments, P2P finance has finally been institutionalized.

Institutionalization Four Years After the Emergence of P2P Industry... But

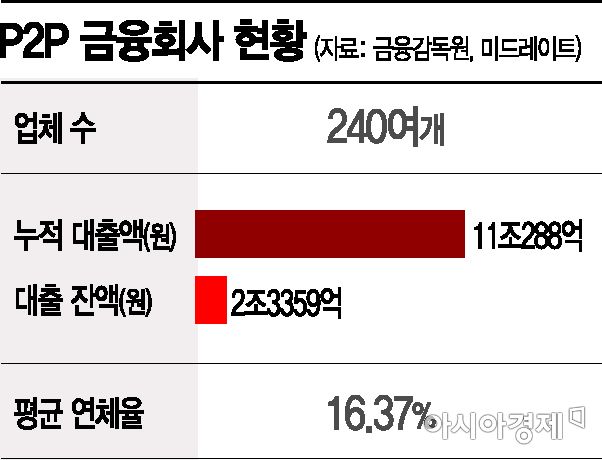

The future is not entirely bright. With about 240 companies flooding the market, criminals resembling ‘scammers’ have been rampant, and incidents such as company CEO arrests, business closures, and delinquencies have repeatedly occurred. The government’s tightening of mortgage loans by banks has also led to suspicions that some people are borrowing money from P2P platforms to buy houses.

Recently, ‘Popfunding,’ a movable collateral loan company cited by the Financial Services Commission as an example of innovative finance, is under prosecution investigation for allegedly rolling over 55 billion KRW in investment funds. Last month, the CEO of ‘Nexrich Funding,’ a used car collateral loan company, was arrested on charges of fraud and embezzlement. Companies like Siso Funding and Top Fund, which have recently experienced frequent redemption delays, are also abundant.

Delinquency rates are also serious. According to P2P statistics firm Midrate, as of the 25th, the average delinquency rate of 141 P2P companies was 16.26%, higher than the average yield of 12.87%. This means investing in products with a high risk of default to earn about 130,000 KRW from a 1 million KRW investment. The financial sector considers a delinquency rate of 10% as the maximum limit for investment products, so P2P companies are expected to make every effort to reduce delinquency rates going forward.

Capital Requirements and Strengthened Consumer Protection

With the enforcement of the law, P2P companies must register with the Financial Services Commission (Financial Supervisory Service) within one year to operate legally. They must also meet requirements such as a minimum capital of 500 million KRW, preparation of regulatory measures for business activities including post-loss compensation for investors, and appointment of compliance officers. Failure to meet these requirements will result in registration refusal or cancellation.

If they fail to register within one year, they will be converted to existing loan businesses and will not be allowed to attract investment funds from unspecified multiple investors.

Once the law is enforced, an Online Investment-Linked Finance Association with corporate status is also expected to be established. Currently, the P2P Finance Association, a voluntary organization, is actively preparing to transition into a statutory association.

The newly enforced law provides a grace period until August 26 of next year. This gives new and existing companies time to adapt to the law, but before strict enforcement, financial authorities will implement a revised P2P guideline starting on the 27th.

Revised P2P Guidelines Focus on Investment Limit Restrictions

First, the investment limit for general individual investors will be reduced from 20 million KRW to 10 million KRW per company. The investment limit for real estate-related investments will be tightened from 10 million KRW to 5 million KRW.

Additionally, handling of P2P loans and investment products secured by assets such as loan receivables and principal and interest collection rights will be restricted. P2P loans to loan businesses or special purpose companies (SPCs) are also prohibited.

The loan limit to the same borrower is restricted to the smaller amount between 7% of the loan receivables balance of the relevant company and 7 billion KRW.

Financial authorities have aligned the maturity, interest rate, and amount of investment products with the loans executed using the funds raised from those investment products to restrict unhealthy business practices such as rolling over.

Furthermore, acts that unfairly favor or discriminate against specific investors in relation to borrower information provision and investor recruitment, or provide or receive excessive financial benefits to or from investors, are prohibited.

It is also prohibited to mislead consumers by promising compensation for investment losses or profits in P2P investment products where principal protection is not guaranteed.

The industry argues that the revised guidelines are too strict to conduct proper business, but since the investment limit applies per company, there is a clear limitation in preventing investors from dividing their money and investing in multiple companies.

Audit Reports Due by the 26th... Many Companies Likely to Fail Submission

Meanwhile, the Financial Supervisory Service has requested about 240 P2P companies to submit audit reports on loan receivables by today. However, only about 20 companies are known to have submitted reports, suggesting that many companies will fail to pass even the first hurdle to operate within the legal framework.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.