Life Insurers' Net Increase of 2 Trillion Won by May... "Can Borrow More Than Banks"

P2P, July Mortgage Loans Up 7.5%, 45% Increase Compared to End of Last Year

[Asia Economy Reporters Oh Hyung-gil and Kim Min-young] As the government tightens regulations on banks' mortgage loans, loan demand is shifting to the secondary financial sector, which is subject to relatively lighter regulations.

Real demand borrowers who are blocked from bank loans are flocking comprehensively to insurance companies, savings banks, and peer-to-peer (P2P) finance companies, causing a surge in mortgage loans.

With borrowers' economic conditions worsening due to the novel coronavirus disease (COVID-19), concerns are rising over the deterioration of household debt quality in the secondary financial sector and the worsening soundness of financial institutions due to increasing delinquency rates.

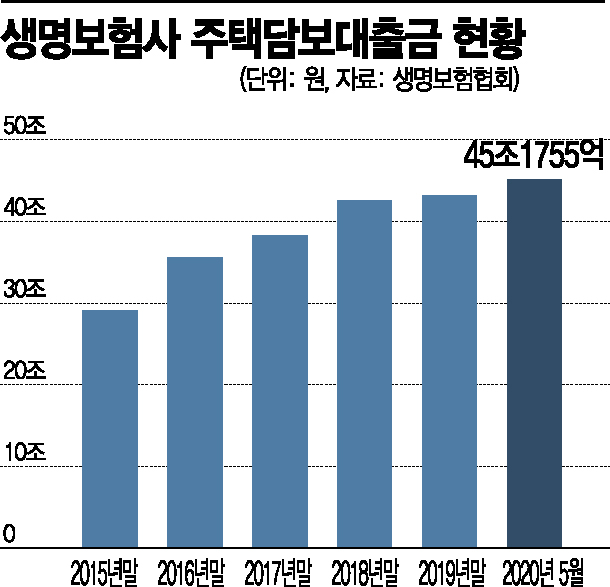

According to the Life Insurance Association on the 24th, the scale of mortgage loans by 24 domestic life insurance companies increased by KRW 1.9126 trillion (4.4%) from KRW 43.2629 trillion at the beginning of this year to KRW 45.1755 trillion as of the end of May.

This figure is 40 times higher than the 0.1% increase in the same period last year. Life insurers' mortgage loans have been on the rise. They increased from KRW 29 trillion in 2015 to KRW 35 trillion in 2016, KRW 38 trillion in 2017, and surpassed KRW 40 trillion for the first time in 2018.

In particular, this year, as the government announced successive measures to strengthen banks' mortgage loans, loan demand through insurance companies is analyzed to have increased further.

In fact, other loans by life insurers remain relatively sluggish. During the same period, credit loans increased by only KRW 170 billion (0.5%) compared to the beginning of the year, while policy loans shrank by about KRW 920 billion (2.5%).

Additionally, the prolonged low-interest-rate environment is interpreted as a factor, as mortgage loan interest rates, which have solid collateral, were lowered to increase investment returns. The lowest mortgage loan interest rates of major insurance companies are in the mid-2% range, lower than the 3-5% rates of savings banks.

"It is still too early to view the shift in loan demand from banks to insurance companies as a balloon effect"

However, non-life insurance companies, especially small and medium-sized ones, have collectively reduced their mortgage loan businesses to cut costs, resulting in a slight decrease in balances. During the same period, non-life insurers' mortgage loans stood at KRW 26.4913 trillion, down KRW 361.5 billion from KRW 26.8528 trillion at the beginning of the year.

The significant increase in life insurers' mortgage loans is because they can borrow relatively larger amounts compared to banks. According to the government's December 16 real estate measures announced last year, banks apply a strict 40% debt service ratio (DSR) limit without exception on mortgage loans for houses exceeding KRW 900 million in speculative and overheated speculation areas.

On the other hand, the DSR for the secondary financial sector, including insurance companies, is 60%. This means they have more leeway in lending than banks. However, this will be gradually lowered to 50% next year and 40% by 2022. The average interest rate on bank mortgage loans (2.60% per annum) is not significantly different, which is also considered a factor.

The insurance industry does not expect the mortgage loan growth trend to continue for a long time. A life insurance company official said, "It is still too early to say that a balloon effect is occurring where loan demand is shifting from banks to insurance companies based on loan size," adding, "We understand that the demand for loans from existing customers is increasing as loan interest rates fall due to the base rate decline."

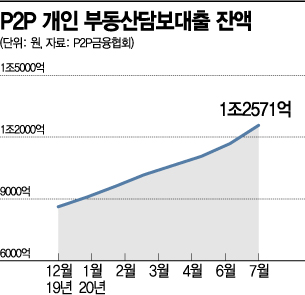

Real estate secured loans by P2P finance companies, which are on the verge of entering the regulated market, are also surging. According to the P2P Finance Association, the cumulative individual real estate secured loan amount of 44 member companies reached KRW 1.2571 trillion at the end of last month. This is a 7.5% increase from KRW 1.1686 trillion in the previous month and a 45.7% increase compared to KRW 862.4 billion at the end of last year.

Some P2P companies are attracting customers by offering a maximum loan-to-value ratio (LTV) of 85%, and some are reportedly offering loans up to KRW 1 billion. Loans from non-member companies are not even tracked. When the Online Investment-Linked Finance Business Act (P2P Finance Act) is enforced on the 27th, the LTV will be limited to within 70%, but this is still higher than banks.

Meanwhile, loans are also surging at savings banks. According to the Bank of Korea's economic statistics system, as of the end of June, the loan balance of 79 savings banks was KRW 69.3475 trillion. This is an increase of KRW 10 trillion in one year and two months since surpassing KRW 60 trillion in April last year. The financial authorities report that there are many cases where individual business owners take out loans using apartments as collateral for business funds but end up buying houses.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.