Galaxy Phones, Tablets, and Wearables Eligible for Enrollment

Warranty Extended Up to 1 Year, Phone Damage Covered Up to 3 Times

Available for Unlocked and Budget Phones... Loss Also Covered

[Asia Economy Reporter Han Jinju] Samsung Electronics has launched its own insurance product that extends the product warranty period by one year and provides compensation for Galaxy mobile device damage and loss. This is welcome news for consumers who want to prepare for loss when purchasing Galaxy smartphones through unlocked or budget phone options.

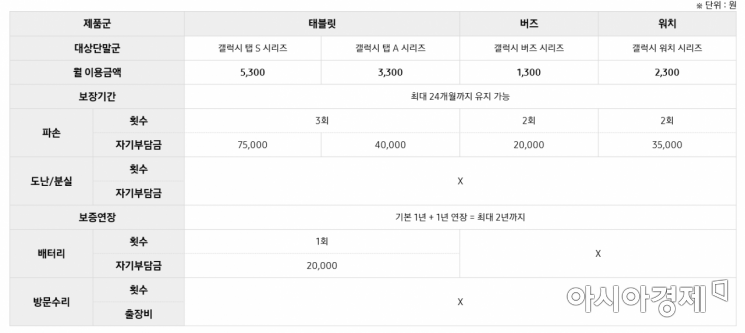

The insurance is available for users of unlocked smartphones, tablets, smartwatches, and wireless earphones. The warranty period can be extended from the basic 2 years to 3 years for smartphones, and from 1 year to 2 years for tablets, laptops, and wearable devices. Battery replacement service is also available once for smartphones, tablets, and laptops. The deductible is 20,000 KRW.

The launch of Samsung Care+ is also good news for consumers who mainly purchase smartphones unlocked. Especially for budget phone smartphone insurance products, loss insurance is often not covered, but Samsung Care+ guarantees this coverage as well. Carrier-operated smartphone insurance products usually require subscribers to use a plan and sometimes refuse enrollment if using an LTE plan.

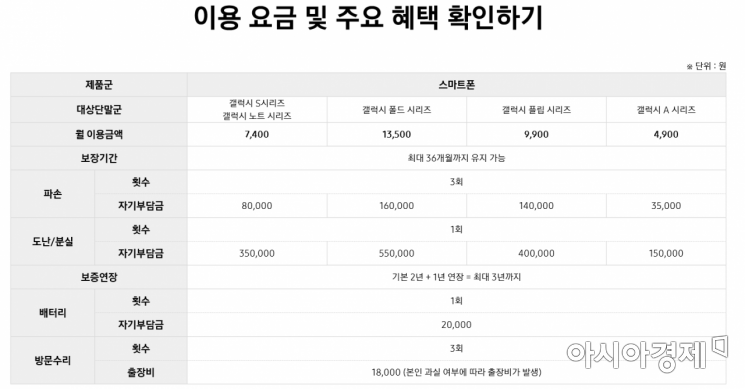

The Samsung Care+ fee varies by device. The Galaxy A series costs 4,900 KRW per month, the S and Note series 7,400 KRW per month, and the Fold series 13,500 KRW per month. The Galaxy Tab S series costs 5,300 KRW per month, the Galaxy Tab A series 3,300 KRW per month, Buds 1,300 KRW per month, and Watch 2,300 KRW per month.

In case of damage, repairs can be made at Samsung Electronics service centers at a discounted cost. There is no need to go through separate paperwork or claim processes for insurance. Damage coverage is available up to 3 times, with a deductible of 80,000 KRW for the Galaxy S and Note series. When reporting a lost smartphone, the device is automatically locked to prevent unauthorized use. The deductible for loss is 350,000 KRW for the Galaxy S and Note series. However, loss coverage and battery replacement service do not apply to wearable devices.

There is no need to visit a service center for A/S. The on-site repair service, where Samsung service center staff visit the desired location for repairs, can be used up to 3 times. However, depending on the user's fault, a service call fee of 18,000 KRW must be paid.

The enrollment period is the same as carrier insurance products, within 30 days of purchase. Smartphones must be enrolled within 30 days of the first call date. Tablets, wireless earphones, smartwatches, and laptops must be enrolled within 30 days of purchase. Only products purchased domestically can be enrolled. The same service name operates in the US and UK, but coverage periods and details differ. On-site repair benefits and loss compensation apply only domestically.

Meanwhile, Apple's insurance product "AppleCare+" costs 269,000 KRW for the iPhone 11 Pro and must be paid in a lump sum. Although the total fee is higher than Samsung Care+, the deductible for repairs is lower. The deductible for display repairs is 40,000 KRW. However, loss is not covered. It provides up to 2 replacements and offers free battery replacement if battery performance falls below 80%. Enrollment is possible within 60 days of purchase.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.