Health Insurance Controversy <Part 2> Strengthening Health Insurance Finances

[Asia Economy Reporter Choi Dae-yeol] In the early 2000s, the National Health Insurance (NHI) deficit exceeded 2.5 trillion won. This was due to a combination of factors including the increase in medical fees following the separation of prescribing and dispensing in 2000, increased use of medical services, and financial integration, which raised concerns about financial collapse at the time. To compensate, insurance premiums were raised by double digits in 2001 (21.4% for workplaces, 15% for regions) and increased again by 6.7% the following year.

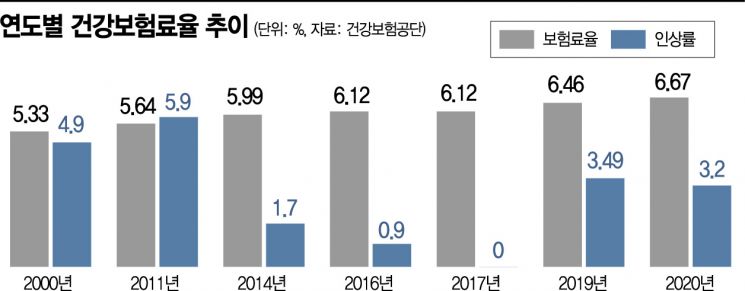

Since the 2000s, the health insurance premium rate was frozen twice, in 2009 and 2017, as a measure considering the tightened wallets due to economic crises. Then, in 2010, premiums were raised by 4.9%, and by 5.9% the following year. As aging increases health insurance expenditures while the economically active population declines, it is necessary to appropriately raise premiums to strengthen NHI finances. Since 2018, the increase rate has been maintained in the mid-3% range annually. Although expenditures sometimes exceed the increase in premium income, resulting in a deficit in the current balance, the accumulated reserves have been used to determine the increase rate.

If Health Insurance Premiums Are Lowered or Frozen, Increase Rates Will Surge Within a Few Years

As the COVID-19 pandemic enters a prolonged phase expected to last at least until next year, public opinion is gaining momentum to strengthen NHI finances. This is because the pandemic response demonstrated that a financially sound health insurance system serves as a reliable social safety net. Typically, during economic downturns, calls to lower or freeze premiums arise, but doing so immediately could lead to a sharp increase in premium rates within a few years. Gradually raising premiums within an acceptable range can help distribute the burden.

Government Support Rate at 13.5% Over 3 Years... Falls Short of 20% Regulation

There are also calls for government treasury support to back social consensus on premium increases. According to regulations, the government should support 20% of health insurance revenue, but government support has actually declined. The current Moon Jae-in administration’s average over three years is about 13.5%, which is 1.5 to 3.0 percentage points lower than the previous administration. Negative perceptions about premium increases persist mainly among subscriber groups because the government is seen as unwilling to expand financial support and instead seeks to easily increase revenue by raising premium rates.

Under the current administration’s plan to strengthen coverage, health insurance expenditures are expected to increase with 800 billion won allocated for new coverage expansion next year and 900 billion won for fee increases. However, if the government support rate and premium increase rate remain at this year’s levels (14% and 3.2%, respectively) next year, the current balance deficit is likely to exceed this year’s approximately 2.8 trillion won. If this trend continues, maintaining the 10 trillion won health insurance reserve by around 2023 will become difficult.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.