Hana Bank Launches Dedicated Asset Management Team for T1, Home to Pro Gamer Faker

Customized Services Including Real Estate Tax Savings Tailored to Athletes

In-House YouTuber Selected Among Employees to Target Future MZ Generation Customers

[Asia Economy Reporter Kangwook Cho] #. Hana Bank recently launched a dedicated asset management team for players belonging to the eSports company SK Telecom CS T1. 'Faker' Lee Sang-hyeok, a professional 'League of Legends (LoL)' gamer affiliated with T1, is considered the highest-paid professional sports player in Korea, reportedly earning an annual salary of about 5 billion KRW. Hana Bank signed a partnership with T1 last month to support the growth of eSports and promote a young and future-oriented image.

#. KB Kookmin Bank signed an advertising model contract with the global idol group BTS in early 2018 and launched advertisements for the bank’s flagship application 'KB Star Banking' featuring them. The official YouTube channel of KB Kookmin Bank surpassed 100 million views last month, becoming the first in the banking sector to do so.

Commercial banks are strengthening their strategies to target the 'MZ generation (Millennials + Generation Z born after 1995),' a key future customer base. With the advent of the fintech era (a blend of finance and technology), banks are shedding their conservative image and actively using YouTube to communicate with young customers. They are even offering asset management services for athletes, whose income is concentrated in their youth. Each bank has already established independent departments dedicated to producing YouTube content, leading to the coining of the term 'EunTube' (a blend of 'Eun' meaning bank and 'Tube' from YouTube).

According to the financial sector on the 14th, the dedicated asset management team for T1 players launched by Hana Bank yesterday is based at the Gangnam Club 1 PB Center and Gangbuk Sales 1 PB Center, composed of professional private bankers, tax accountants, lawyers, and real estate experts. The team will provide specialized asset management services tailored to the characteristics of athletes, whose income generation and consumption periods often do not align. Especially for players interested in real estate and tax savings, the team offers customized services, including joint site visits to key investment areas and full support from property inspection to contract signing.

Kim Kyung-ho, Head of Digital Finance Business Division at Hana Bank, said, "Through the partnership with T1, we plan to provide total financial services including exclusive financial products for T1 fans, as well as asset management and accident insurance for T1 players."

YouTube activities in the banking sector are also becoming more diverse. Especially with the COVID-19 pandemic boosting the popularity of non-face-to-face channels, commercial banks have evolved from simply introducing financial products on YouTube to offering investment strategies, lectures by instructors, financial tips, and talk shows. Unlike TV commercials, YouTube allows conveying all intended messages without restrictions on time or format, which is evaluated to have a higher brand marketing effect.

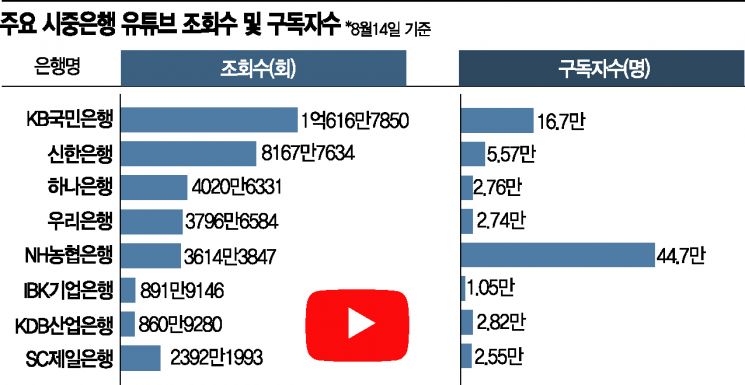

The competition to increase subscribers and views is fierce. NH Nonghyup Bank, which selects and promotes employees as in-house YouTubers ('NH Tubers'), plans to award active employees at the end of the year to encourage company-wide interest in its YouTube channel. As of today, NH Nonghyup Bank ranks first in the banking sector with 447,000 official YouTube channel subscribers. KB Kookmin Bank ranks second with 167,000 subscribers but leads in total views with over 101 million, far ahead of Shinhan Bank, which is second in total views by about 20 million.

Shinhan Bank has allocated an independent budget for YouTube production starting this year. Notably, two short film-style advertisements titled 'The Ultimate Money Management' posted in April have each recorded nearly 10 million views (9.99 million and 9.89 million respectively). Thanks to these efforts, Shinhan Bank’s YouTube subscribers have grown from less than 10,000 in June last year to 55,700 currently. During the same period, Woori Bank’s YouTube subscribers surged nearly fourfold from 7,000 to 27,400, while Hana Bank (27,600) and IBK Industrial Bank (10,500) also expanded their subscribers by about 7,000 each over the past year.

A financial industry official explained, "With the acceleration of digital transformation, targeting and communicating with the MZ generation, the main consumers of media content, has become a key task. Especially with the recent spread of untact (contactless) culture, strategies to expand social value management through digital channels and encourage subscriber participation have become even more important."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.