Why Are Retail Investors Buying Stocks on Margin?

Investment Boom After the COVID Crash

Real Estate Investment Blocked by Government Regulations, Seen as Alternative Financial Strategy

Despite Concerns Over Rapid Increase in Margin Loans, Stock Market Rally Expected to Drive More Margin Trading

[Asia Economy Reporters Song Hwajeong and Lee Minwoo] As the stock investment craze among individual investors intensifies, the number of investors engaging in 'debt investment'?borrowing money to invest?is also increasing. With the credit loan balance surpassing 15 trillion won for the first time ever, concerns are rising that the scale of debt investment has reached a dangerous level. In particular, it is pointed out that if volatility increases, investors may face forced liquidation risks and suffer unexpectedly huge losses.

According to the Korea Financial Investment Association on the 14th, the total credit loan balance exceeded 15 trillion won for the first time on the 7th. It has continued to increase daily, reaching 15.6287 trillion won as of the 12th. The KOSPI market accounted for 7.5048 trillion won, and the KOSDAQ market reached 8.1238 trillion won. The credit loan balance had fallen to around 6.4 trillion won in March when stock prices plummeted due to the novel coronavirus disease (COVID-19), but as the market quickly rebounded, it doubled within four months and has continued to rise since then.

The credit transaction loan balance has typically been higher in the KOSDAQ market than in the KOSPI market. This is because short-term trading tends to concentrate on KOSDAQ stocks, which have relatively higher price volatility. On April 3rd, the difference in credit transaction loan balances between the KOSDAQ and KOSPI markets was 35.4 billion won, but by June 9th, it had widened to 962.6 billion won. This gap has been maintained at around 700 to 800 billion won even this month.

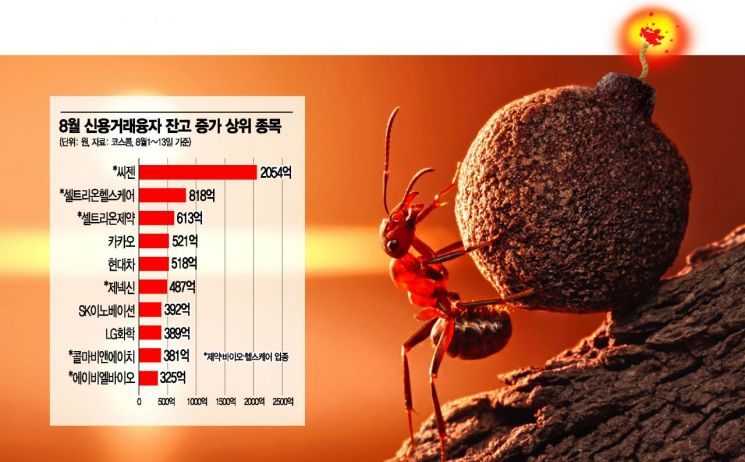

The stocks that debt investors have focused on are mainly in the pharmaceutical and bio sectors. According to KOSCOM, among the top 10 stocks with the largest increase in credit transaction loan balances across both KOSPI and KOSDAQ markets up to the previous day this month, six were pharmaceutical and bio-related. The top stock was Seegene, a COVID-19 diagnostic kit manufacturer, which saw an increase of 205.4 billion won this month alone. This is about 2.5 times more than Celltrion Healthcare, ranked second with 81.8 billion won. In terms of total credit transaction loan balance, Seegene ranked second with 332.8 billion won.

Following were Celltrion Pharm (61.3 billion won, 3rd) and Genexine (48.7 billion won, 6th), ranking high in net increase. These outperformed stocks considered market leaders after COVID-19, such as Kakao (52.1 billion won, non-face-to-face), Hyundai Motor (51.8 billion won, automobile), and LG Chem (38.9 billion won, secondary batteries). When limited to KOSDAQ, 90% of the top 10 stocks were pharmaceutical and bio-related. Webzen, a game company, was the only stock from a different sector with 24.1 billion won.

The rapid increase in debt investment is due to the stock investment craze among individual investors following COVID-19. As stock prices plummeted due to COVID-19, individual investors continued a net buying spree targeting low-priced stocks. This year, individuals have net purchased 47.2182 trillion won in the domestic stock market. Considering that foreigners sold 26.3029 trillion won and institutions sold 20.9425 trillion won during the same period, the rise in the domestic stock market was driven by individuals.

As prices of large blue-chip stocks sharply dropped due to COVID-19, individual investors quickly entered the market. The perception spread that these prices would not be available again, prompting massive net buying by individuals, even borrowing money to buy stocks. Subsequently, the buying targets expanded to include non-face-to-face related stocks and pharmaceutical and bio stocks, which surged significantly due to COVID-19.

As the market continues its bullish trend, the number of individuals joining stock investment steadily increases. The KOSPI has risen 67.22% from its yearly low (closing price basis) recorded on March 19th. The KOSDAQ has surged 99.5%. Securities firms have recently raised the upper end of the expected KOSPI range to the 2,500 level, emphasizing further gains, so individual investors' stock investments are expected to continue increasing for the time being.

With real estate investment blocked by regulations, the perception that stocks are the only remaining financial investment option has also fueled this individual stock investment craze. A private banker (PB) at a securities firm explained, "Many clients are selling their real estate assets, such as apartments, and investing the proceeds in stocks," adding, "Due to multi-homeowner regulations and heavy tax burdens, investors are switching their investment targets from real estate to stocks."

However, as debt investment rapidly increases, concerns are also growing. Losses are inevitable if the market suddenly turns bearish. Kim Minki, a research fellow at the Korea Capital Market Institute, said, "Purchasing stocks through credit loans can yield excess returns compared to market returns if stock prices rise, but if prices fall, losses can be greater, making it a riskier investment method than regular cash transactions." He added, "If market volatility expands in the future, stock purchases through borrowing may be exposed to forced liquidation risks. Short-term sharp price increases not driven by special positive factors or events are likely to reverse quickly, and in some cases, investors may have to bear losses exceeding their risk tolerance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.