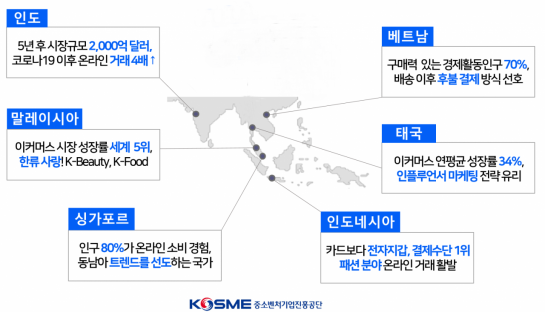

India, Indonesia, Thailand

Vietnam, Malaysia, Singapore

Report by the Small and Medium Business Corporation

[Asia Economy Reporter Kim Daeseop] The e-commerce markets in new southern countries such as India and Indonesia are emerging as export expansion hubs for Korean small and medium-sized enterprises (SMEs). Especially after the outbreak of the novel coronavirus disease (COVID-19), the contactless (untact) market has rapidly grown among the younger generation, creating new opportunities for Korean SMEs to pioneer new markets in conjunction with the Korean Wave (Hallyu).

According to the 'E-commerce Market Analysis of Major New Southern Countries' report released by the Small and Medium Business Corporation on the 14th, the e-commerce markets in India, Indonesia, Thailand, Vietnam, Malaysia, and Singapore are growing significantly. The combined e-commerce market size of these six countries reaches $116.8 billion, with a total population of 1.8415 billion.

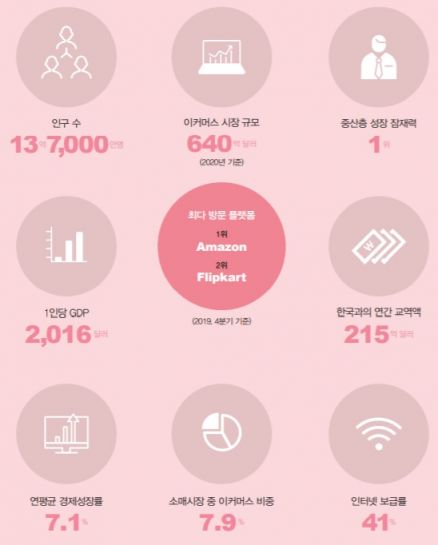

India's E-commerce Services Quadruple

Rapid Increase of 440 Million Smart Users

Looking at each country, India's demand for e-commerce services has increased about 3 to 4 times compared to before due to the spread of COVID-19. This growth is faster than the annual average online sales growth rate of 50%. The local e-commerce market size is expected to grow from $38.5 billion in 2017 to $64 billion in 2020, reaching $200 billion by 2026.

India has a population exceeding 1.37 billion. More than 375 million internet users and 220 million smartphone users have significantly contributed to the rapid growth of the e-commerce market. The number of smartphone subscribers increased from 340 million in 2019 to 440 million in 2020, nearly 100 million in one year.

In particular, K-pop and Hallyu culture are spreading nationwide, centered around major cities. Korean cosmetics brands have steadily gained popularity since entering the Indian market in 2013. The most preferred Korean cosmetic product among local consumers is the mask pack. Additionally, there is a high preference for functional whitening products based on organic ingredients.

An official from a local Indian distribution corporation said, "India is the world's largest domestic market, considered the next China. Indian consumers are beginning to see Korean domestic brands in various fields beyond cosmetics. Aggressive marketing is necessary for SME products. Considering India's vast area and increasing online demand, approaching the Indian market through online platforms is inevitable."

Indonesia's E-commerce Grows at 88% Annual Rate

High Proportion of Online Transactions in Fashion Sector

Indonesia's e-commerce market is expected to grow to $82 billion by 2025. According to the '2019 Southeast Asia Digital Economy' report published by Google and Temasek, Indonesia's e-commerce market showed an average annual growth rate of 88% from 2015 to 2019.

This growth is attributed to the rising purchasing power of the middle class due to over 5% annual economic growth, increased internet users, and the emergence of mobile banking and e-wallets. Indonesia ranks fourth in the world for the number of smartphone users, following China, India, and the United States.

Korean products listed on Indonesian e-commerce platforms mainly include fashion items, beauty products, food, and daily necessities. While e-commerce market transactions were concentrated in metropolitan areas such as Jakarta, they are gradually expanding to regions outside the metropolitan area. Among product categories, fashion accounts for the highest proportion of transactions.

Due to COVID-19, contactless purchases, delivery, and cashless transactions via online shopping have surged explosively. Particularly, interest in immunity and physical strength enhancement has increased, leading to a 20% rise in demand for vitamin C and natural health supplements compared to usual.

Indonesia is the largest Muslim country, with 87% of its population being Muslim. Obtaining halal certification is a crucial factor determining success in entering the local market. Additionally, the seller's location and delivery distance are important factors in product selection. Indonesia consists of over 18,000 islands, causing differences in delivery distance and time depending on the sales region, which significantly affects delivery costs.

Thailand's Mobile E-commerce Growth Noteworthy

Active Use of Influencers for Awareness Strategy

Thailand's e-commerce market accounted for about 3% of the total distribution market last year. Although still small, the average growth rate exceeds 34%, indicating very high future growth potential.

Especially due to the spread of COVID-19, residents' activity radius has shrunk, and offline activities have decreased as people avoid unnecessary contact, leading to a rapid increase in usage. Even those with little or no prior online shopping experience are starting to use e-commerce, accelerating this trend.

Most Thai consumers purchase products on e-commerce platforms using smartphones. E-marketplace companies are actively introducing shopping applications specialized for mobile, so the share of mobile e-commerce in the overall market is expected to increase further. Among local e-commerce items, clothing and footwear sales account for a high proportion.

A local IT industry official in Thailand emphasized, "Recently, hiring famous celebrities to create promotional videos and exposing them through social media and various channels has been gaining attention in the marketing market. Actively utilizing influencers to raise brand awareness will be a strategy to approach consumers."

Thailand is the center of the Korean Wave in Southeast Asia, with dozens of Korean dramas consumed annually. Cosmetics are also a traditional Hallyu product that cannot be overlooked. Since 2013, Thailand's imports of Korean cosmetics have increased by double digits annually.

Vietnam's Growth Despite E-commerce Companies' Deficits

Electronic Payment Share Exceeds 40% in 2023

Vietnam's e-commerce market size reached $9.3 billion last year. According to the Ministry of Industry and Trade's E-commerce Digital Economy Department, Vietnam's e-commerce market size is expected to reach between $13 billion and $15 billion by 2020. The local e-commerce market has maintained double-digit annual growth since $3.9 billion in 2015.

According to Vietnam's comprehensive e-commerce development plan for 2020-2025, by 2025, 55% of the total population will participate in the e-commerce market, with annual per capita online shopping expenditure of $600, a B2C e-commerce market growth rate of 25%, reaching $35 billion, accounting for 10% of Vietnam's retail industry sales.

Vietnam has over 70 million mobile phone users. The relatively high proportion of young people and mobile phone penetration, combined with increased internet speed, are leading the growth of the e-commerce market. It is also notable that mobile-based e-commerce is more active than web-based.

Aggressive marketing by e-commerce companies and the younger generation's familiarity with online platforms have increased the electronic payment ratio from 16% in 2017 to over 40% in 2023, supported by government policies promoting electronic payments. The online fresh food market is showing high growth rates due to COVID-19.

Although Vietnam's e-commerce market size is expanding, excessive competition has led to continued deficits among major e-commerce companies, which is noteworthy. There are increasing calls for service improvements within Vietnam's e-commerce platforms. Introducing a secure payment system for transactions within open markets is necessary to enhance the trustworthiness of shopping malls themselves.

Malaysia Establishes Digital Free Trade Zone

Health Supplements Popular in E-commerce Market

The Malaysian government is implementing various support policies to encourage existing distributors to shift to e-commerce and increase their contribution to the national economy. In particular, to become a regional e-commerce gateway, Malaysia has been cooperating with China's Alibaba since 2017 to establish a digital free trade zone.

According to the German market research firm Statista, Malaysia's e-commerce market sales reached $3.7 billion last year. Growing at an annual rate of about 11.8%, it is expected to reach $5.7 billion by 2023.

Due to insufficient public healthcare services, Malaysians tend to manage their health through health supplements. Vitamins, minerals, herbs, meal supplements, and organic products are popular. Organic and natural health supplements are still growing gradually, and their share is expected to increase due to halal and vegetarian product preferences among the Muslim population. Popular Korean health supplements in Malaysia include bamboo salt, red ginseng products, and probiotics.

Korean SMEs interested in entering the Malaysian e-commerce market need to establish entry strategies considering local conditions. First, Malaysian consumers prefer products that are hot in Korea. Second, as a multiethnic country, product preferences vary by ethnicity. Third, active use of social networking services (SNS) is necessary. Fourth, fast delivery is preferred. Fifth, promotional marketing is effective. Sixth, competition is intense on large platforms, so utilizing local specialized stores is worth considering.

Singapore: 80% of Population Experienced Online Services

Online Grocery Shopping Growing Rapidly

The number of e-commerce users in Singapore is expected to reach 4.4 million in 2023. According to the German market research firm Statista, Singapore's e-commerce market is growing at 14.7% annually and is expected to reach $8.6 billion in 2023.

About 80% of Singapore's population has experience using online services. Singaporeans actively use social media and prefer online shopping, with the main age group using e-commerce being 25 to 34 years old. Especially, online grocery shopping is the fastest-growing category in Singapore's e-commerce market.

The Small and Medium Business Corporation plans to support overseas expansion of SMEs by publishing quarterly global e-commerce market analysis reports, starting with the New Southern countries edition. In October this year, editions on the Commonwealth of Independent States (CIS) and North America/Europe will be published, followed by editions on Japan/China, Latin America/Middle East, and South Asia in January next year.

Jo Wooju, head of the online export department at the Small and Medium Business Corporation, said, "The e-commerce market has been rapidly growing since COVID-19, and demand for Korean products is increasing in line with Korea's elevated status through K-quarantine and K-culture. We hope the Small and Medium Business Corporation's e-commerce market analysis reports will serve as a map to understand overseas markets and a compass leading to successful local market entry."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.