Samjong KPMG Publishes Report on 'Post-COVID Era: Changes and Opportunities in the Retail Competitive Environment'

[Asia Economy Reporter Minji Lee] Amid changes in demand and consumption patterns due to the spread of the novel coronavirus infection (COVID-19), the competitive environment of online and offline distribution is evolving. An analysis has emerged that domestic distribution companies need to reestablish business strategies across the entire value chain to prepare for the post-COVID era.

Samjong KPMG (Chairman Kim Kyotae) stated in its report published on the 14th, titled "Changes and Opportunities in the Distribution Competitive Environment in the Post-COVID Era," that retail sales across the distribution industry continue to decline due to reduced consumption caused by COVID-19. It suggested that domestic distribution companies must devise new business strategies to seek opportunities for generating new revenue.

With the spread of contactless consumption trends due to COVID-19, online distribution sectors have maintained continuous sales growth. In contrast, offline distribution sectors have consistently recorded negative growth rates, deepening the polarization between online and offline distribution industries.

In March, department store retail sales (1.696 trillion KRW) dropped sharply by -36.8% compared to the same month last year due to COVID-19. However, as the pandemic prolonged and consumers began going out more, May retail sales (2.466 trillion KRW) decreased by only -7.5% year-on-year, showing a reduced decline. The department store industry is responding to changes in consumption patterns caused by COVID-19 by expanding non-face-to-face services such as subscriptions, contactless offline shopping, and live commerce.

Large supermarkets maintained consumer demand for essential food ingredients, and food and beverage sales were relatively less affected by COVID-19. On the other hand, clothing, cosmetics, entertainment, hobbies, and sports goods experienced relatively significant sales impacts due to social distancing and reduced outings. Large supermarkets are focusing on customer acquisition through strategies such as expanding home meal replacement (HMR) product lineups and maximizing sales at warehouse-type stores.

Convenience stores and supermarkets/corporate supermarkets (SSM) saw relatively smaller sales declines compared to other distribution sectors due to increased consumer preference for neighborhood stores amid emphasized social distancing. Supermarkets and SSMs recorded a 10.3% increase in retail sales in May compared to the same month last year, continuing a sales growth trend since the outbreak of COVID-19.

In the domestic duty-free industry, the sharp decline in foreign tourists and reduced domestic travel activities due to COVID-19 resulted in the largest negative growth rate among distribution sectors. As of May this year, foreign duty-free store visitors decreased by 94.7% year-on-year, and domestic visitors decreased by 84.4%. The duty-free industry has implemented temporary store closures as a self-help measure, but prolonged closures are expected to cause rapid expansion of losses. The decline in inbound and outbound travelers continues, making it difficult for duty-free operators to recover performance in the near term.

Online shopping has maintained steady growth, recording growth rates of around 13.0% year-on-year in both April and May despite consumption contraction caused by COVID-19. However, due to a sharp decline in spending on cultural and leisure services, the overall growth rate has somewhat slowed compared to before the COVID-19 outbreak.

As consumer purchasing patterns shifted toward online due to COVID-19, online purchases of items that were previously not bought online, such as fresh food and furniture, have expanded. Additionally, the influence of the 40s and 50s consumer demographic within the online market has increased, while the 20s and 30s consumer demographic shows high interest in real-time broadcast-based 'live commerce.'

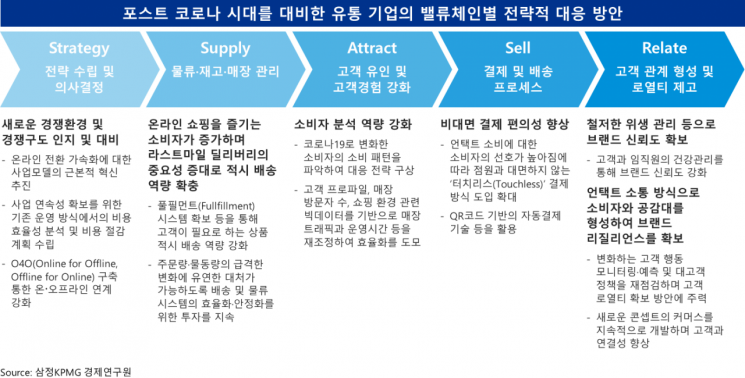

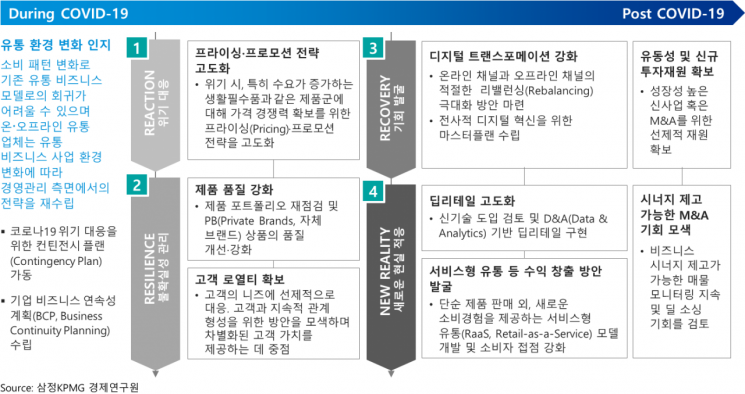

The report emphasized that with the rise of online shopping and intensified competition between online and offline channels due to COVID-19, it is necessary to review strategies across the entire value chain of distribution companies and establish sector-specific response strategies according to changes in customer experience to prepare for the post-COVID era. In particular, it advised the need for ▲ awareness and preparation for new competitive environments and structures ▲ expansion of delivery capabilities in response to increased online shopping consumers ▲ strengthening consumer analysis capabilities ▲ improving convenience of contactless payments ▲ securing brand trust through thorough hygiene management.

Hansang Il, Vice President of the Distribution and Consumer Goods Industry Headquarters at Samjong KPMG, said, "To prepare for the post-COVID era, the introduction of service-oriented distribution and the realization of deep retail are important." He added, "Distribution companies should utilize various Fourth Industrial Revolution-based technologies such as artificial intelligence (AI) and D&A to analyze consumers' lifestyles, purchasing behaviors, and preferences in detail, and strengthen touchpoints with consumers by providing new purchasing experiences beyond simple product sales to each individual consumer."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)