KB Kookmin Bank Recently Recovered Loan Amounts

Foreign Firms Account for Over 40% of Total Borrowings

[Asia Economy Reporter Kiho Sung] SsangYong Motor stands at a crossroads between life and death. Since the major shareholder Mahindra announced that it would relinquish its stake if a new investor is found, there are concerns that financial institutions may call back the funds they lent to SsangYong Motor. The fate of the company is now in the hands of foreign financial institutions holding more than 40% of the total borrowings. If foreign financial institutions also call back their loans amid difficulties in finding a new investor, SsangYong could face the worst-case scenario of court receivership.

According to industry sources on the 13th, KB Kookmin Bank recently fully repaid its loans to SsangYong Motor and withdrew from the creditor group. This naturally occurred as SsangYong's Seoul Guro Service Center, which was collateral for the loan, was sold. KB Kookmin Bank's loan amount was 8.75 billion KRW as of the end of the first quarter. This repayment to KB Kookmin Bank is not large compared to loans from other banks. Woori Bank, holding 15 billion KRW in claims as of the end of the first quarter, decided to extend the loan maturity until the end of the year. Additionally, the Korea Development Bank also extended the maturity of 90 billion KRW, originally due in July, until the end of the year. These measures follow the government's request to refrain from corporate loan recalls amid the COVID-19 pandemic.

The problem lies in the funds borrowed from foreign financial institutions. As of the end of the first quarter, SsangYong's short-term borrowings (due within one year) amounted to 389.9 billion KRW. Among these, short-term funds were borrowed through the major shareholder, India's Mahindra Group, from JP Morgan (89.999 billion KRW), BNP Paribas (47 billion KRW), and Bank of America (29.99997 billion KRW), accounting for 42.7% of the total borrowings.

The borrowings from foreign financial institutions come with the condition that Mahindra must maintain more than a 51% stake in SsangYong. If Mahindra relinquishes management rights of SsangYong, foreign financial institutions may immediately demand loan repayment from SsangYong. This could also be a burden for potential new investors.

In the worst case, if SsangYong fails to find a new investor, its future will inevitably become more uncertain. It is difficult for SsangYong to overcome the current situation without external assistance. Samjong Accounting Corporation raised doubts about SsangYong's ability to continue as a going concern and expressed a 'disclaimer' opinion on the first quarter financial statements. In fact, SsangYong's sales in July this year were 7,498 units, a 30.6% decrease compared to the same month last year (10,498 units). The cumulative sales from January to July this year show domestic sales of 47,557 units and exports of 9,351 units, down 26.4% and 43.0%, respectively, compared to the same period last year (64,657 units and 16,406 units). However, due to the impact of COVID-19, global demand for finished vehicles has sharply contracted, making it increasingly difficult to find new investors.

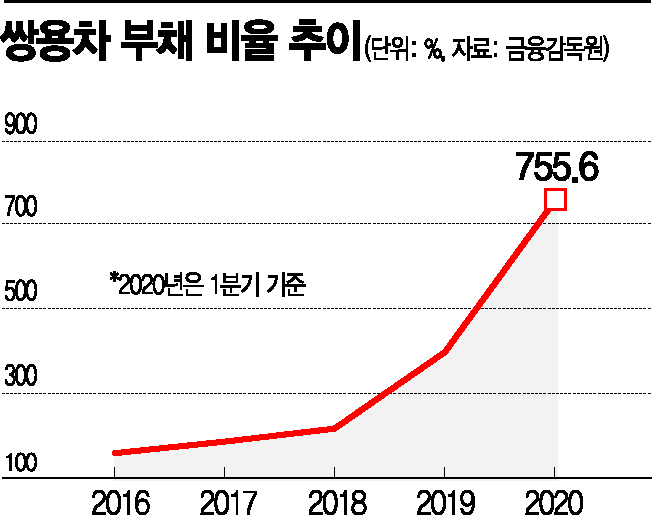

After recording losses for 14 consecutive quarters, SsangYong is raising emergency funds by selling non-core assets such as the Guro Service Center and the Busan logistics center land. SsangYong plans to negotiate with the creditor group regarding the borrowings from foreign banks once a new investor is secured. Currently, Chinese automakers Geely, BYD, and Chery are reportedly showing interest, but high debt ratios and poor business performance are obstacles.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)