Easier Comparison and Analysis of Bank Products with Open Banking Introduction

Woori Bank to Update and Launch Real Estate Secured Loan Refinancing Product

K Bank Confirms Launch of 100% Non-Face-to-Face Apartment Secured Refinancing Loan

[Asia Economy Reporter Park Sun-mi] With the breakthrough in non-face-to-face applications for refinancing loans (switching loans), an endless competition has begun among banks to poach loan customers from each other. The introduction of open banking (a service that allows transfer and inquiry of other banks' accounts through a single bank application) has made it easier to compare and analyze loan products between banks, making the competition for customer acquisition expected to become even fiercer.

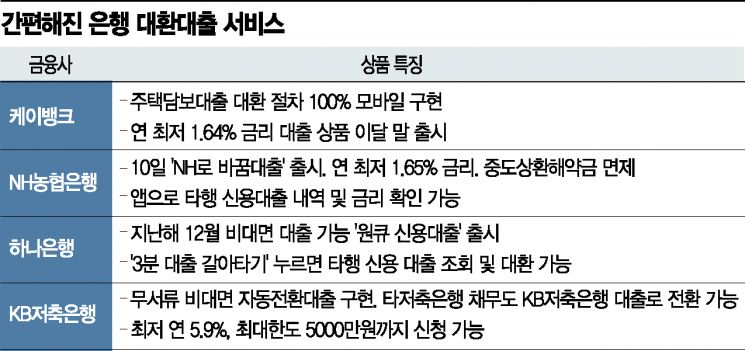

According to the financial sector on the 12th, Woori Bank is preparing to launch an updated version of its existing non-face-to-face real estate secured loan product. The key feature is the simplification of the refinancing loan process to enhance customer convenience. The strategy is to encourage customers with real estate secured loans from other banks to switch to Woori Bank using the refinancing loan service. Shinhan Bank is also reviewing systems to launch a non-face-to-face refinancing loan service.

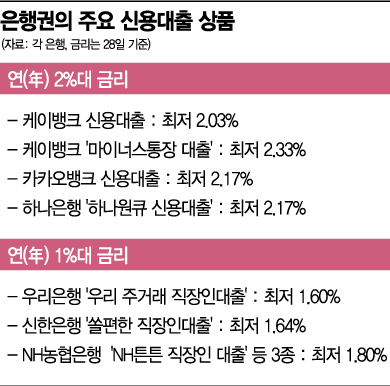

There is already a bank that has confirmed the launch of a 100% non-face-to-face refinancing loan product and declared its intention. K-Bank, an internet-only bank, announced at a press conference last week that it will soon introduce a refinancing loan service that can be applied for and processed entirely online. Customers can check the estimated loan limit and interest rate without any documents, and spousal and household member consent procedures, as well as the delegation procedures required for refinancing, can all be completed non-face-to-face. Customers with existing apartment-secured loans can refinance up to 500 million KRW, and apartment-secured loans for living expenses can be refinanced up to 100 million KRW. The interest rate will be applied at a minimum annual rate of 1.64%, which is among the lowest in the banking sector.

NH Nonghyup Bank has launched and is promoting the 'NH Switch Loan' refinancing loan application service starting this month. It is a mobile-only service that allows customers to easily switch credit loans from other banks to Nonghyup Bank loans. Through the app, customers can instantly check credit loan details, loan limits, and interest rates from multiple banks, and after applying for a loan, refinancing is possible with just one visit to a branch. To drive switching demand, the loan interest rate is set at a minimum of 1.65%, and early repayment penalties are waived.

Savings banks are also actively pioneering the refinancing loan market. KB Savings Bank introduced the 'Kiwi Switch Loan,' a no-document non-face-to-face automatic conversion loan system that converts debts from other savings banks into loans from KB Savings Bank. When a customer applies for the Kiwi Switch Loan, KB Savings Bank links with the Credit Information Center database to display refinancing-eligible loans from other companies on the screen. With a single click, the repayment amount is automatically transferred to the virtual account of the respective savings bank.

Intense Competition Among Banks Due to Rapid Spread of Open Banking

While there has been competition to attract new loan customers among banks, it is unusual to see product and service competition focused on refinancing loans. As bank loan interest rates have decreased, more people are taking out loans to invest in real estate and stocks, leading to competition among banks to attract existing loan customers from each other.

Banks have traditionally offered preferential interest rates to loan customers on the condition of using credit cards, salary transfers, and automatic transfers, so banks that lose these hard-won loan customers inevitably face significant losses. This is why banks are actively competing to poach loan customers. As competition for refinancing loans intensifies among banks, the interest rate gap is also likely to narrow further. From the banks' perspective, they need to pay attention not only to simple interest rates but also to other service elements such as convenience.

The rapid spread of open banking is fueling the customer acquisition battle among banks. Open banking is a service that allows transfer and inquiry of other banks' accounts through a single bank app. Officially launched on December 18 last year, open banking has entered its eighth month since introduction, providing consumers with various product and service comparison and selection options, thereby weakening the concept of a 'main bank.' Banks are competing to attract customers by revamping their apps to suit the open banking era and deploying various events.

Meanwhile, in the industry, K-Bank, which has no offline branches and has just resumed operations, is evaluated to have pulled the trigger on the non-face-to-face refinancing loan service competition with a 'shut up and attack' strategy. A bank official explained, "The banking sector is still skeptical about the possibility of 100% non-face-to-face refinancing loans," adding, "In the worst case, banks trying not to lose loan customers might make repayment of existing loans inconvenient by creating obstacles."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.