Financial Services Commission Announces Formation of Joint Green Finance Promotion TF with Financial Sector

Financial Firms Already Supporting Korean New Deal with Trillions... Increasing Burden

Concerns Over Repetition of Green Finance from MB Administration

[Asia Economy Reporter Kangwook Cho] As financial authorities announced plans to promote green finance involving private financial companies as part of the government's 'Green New Deal,' concerns are growing within the financial sector. There are worries that the 'green finance' initiative, which was ambitiously attempted by the Lee Myung-bak administration over a decade ago but ultimately fizzled out, might be repeated. Particularly, there is added pressure and burden as the sector has already pledged trillions of won in financial contributions for the 'Korean New Deal,' and now faces further demands for support.

According to the financial sector on the 12th, Sohn Byung-doo, Vice Chairman of the Financial Services Commission, announced at the Financial Risk Response Team meeting held the previous day that a 'Green Finance Promotion Task Force (TF)' will be formed jointly with the financial sector. Vice Chairman Sohn stated, "To support the Green New Deal, a pillar of the Korean New Deal, we will establish the institutional foundation for green finance and create favorable investment conditions."

Major financial companies have already pledged to release trillions of won for the government's 'Korean New Deal.' Hana Financial Group announced it would provide 10 trillion won in financial support for the 'Korean New Deal Financial Project.' Woori Financial Group also revealed plans for 10 trillion won in loans and investment support for the Korean New Deal, and KB Financial Group and Shinhan Financial Group made similar commitments at comparable levels. This large-scale financial support plan was announced immediately after Financial Services Commission Chairman Eun Sung-soo met with the heads of the five major financial holding companies at the end of last month.

In this context, the financial authorities' renewed push for green finance is not welcomed. There are concerns not only about the burden of support but also about the possibility of repeating the failures of green finance from the Lee Myung-bak administration, which has now become a liability. In April 2009, domestic financial institutions including the Korea Federation of Banks, Korea Financial Investment Association, General Insurance Association of Korea, Life Insurance Association of Korea, and Credit Finance Association, together with the Green Growth Committee, Financial Services Commission, and Financial Supervisory Service, established the 'Green Finance Council.' The Korea Federation of Banks served as the chair and secretariat of the council, and the financial sector launched various related products such as the Green World Savings, Eco-friendly Green Savings, Passenger Car Day-of-the-Week Card, Eco Mileage, and Eco Frontier carbon emission rights-backed convertible bonds, covering savings, cards, and funds.

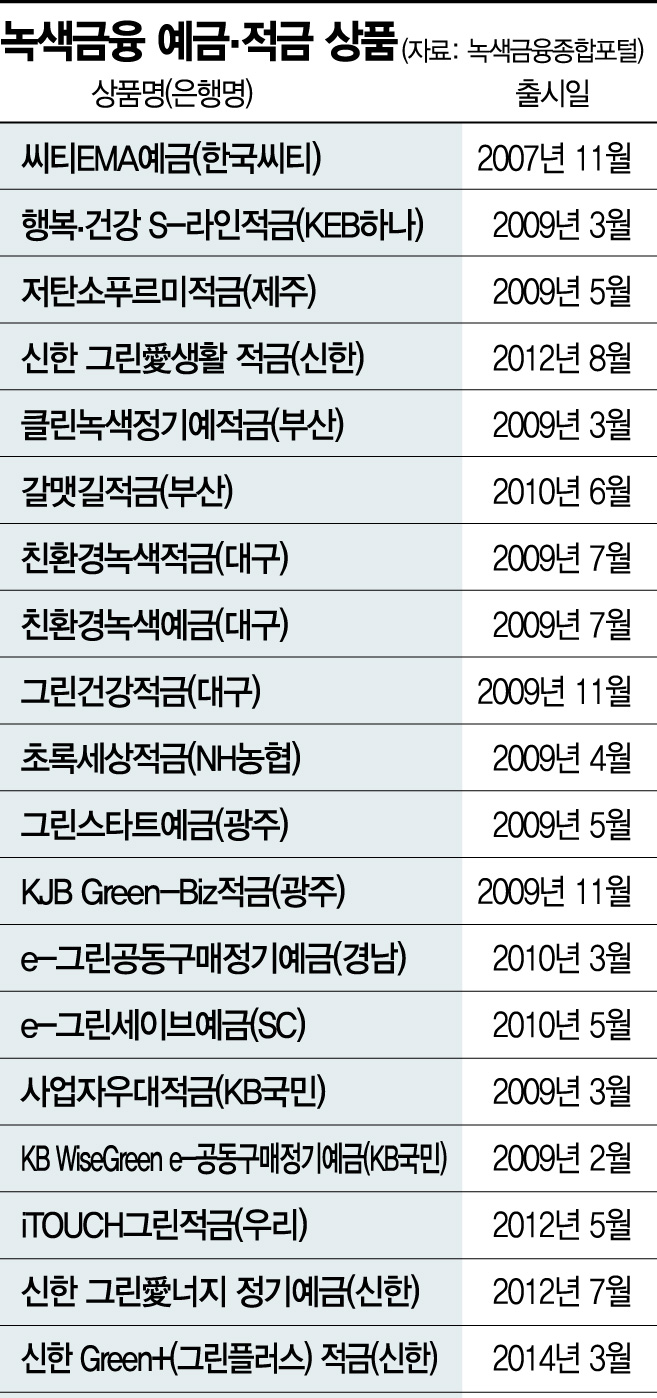

However, after the Park Geun-hye administration took office, activities of the Green Finance Council dwindled. The council has been effectively inactive since its 7th meeting in April 2012. According to the Green Finance Comprehensive Portal, there were 19 types of green savings and deposit products introduced by commercial banks, but none have been launched since March 2014. Most banks have discontinued or consolidated related products, and green finance has become a neglected item in the market. The Green Finance Comprehensive Portal explains, "Currently, green savings are not being sold by financial companies, and product development and sales will be pursued in consideration of the implementation progress of the green certification system in the future."

The 'Unification Finance' initiative, which showed brief success during the Park Geun-hye administration, has suffered a similar fate. Financial products related to unification, launched to align with government policy, once approached sales of 1 trillion won but are now mostly discontinued.

Some voices are even calling for the establishment of a more specialized and dedicated investment institution called the ‘Green Investment Finance Corporation (tentative name)’ following the announcement of the Korean Green New Deal policy. During the Lee Myung-bak administration, the establishment of a ‘Green Growth Finance Corporation (tentative name)’ was also proposed but ultimately failed. The Financial Services Commission is currently reviewing the establishment of the Green Investment Finance Corporation but emphasizes the need for discussions on securing sufficient funding and addressing risks and side effects.

A financial sector insider said, "For products launched in line with government policies, banks often bear more financial burdens than with existing products, so it is true that there are concerns about repeating past mistakes," adding, "The proposal for joint public-private promotion essentially means placing that much burden on commercial banks, so handling the aftermath will be a concern."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.