[Asia Economy Reporter Changhwan Lee] Over the past five years, the number of Korean companies included in the global top 500 research and development (R&D) firms has remained unchanged, while the number of Chinese companies has nearly doubled. It is analyzed that Chinese companies are significantly expanding their R&D operations backed by the government's bold support policies. There are calls for the Korean government to also substantially increase support for corporate R&D.

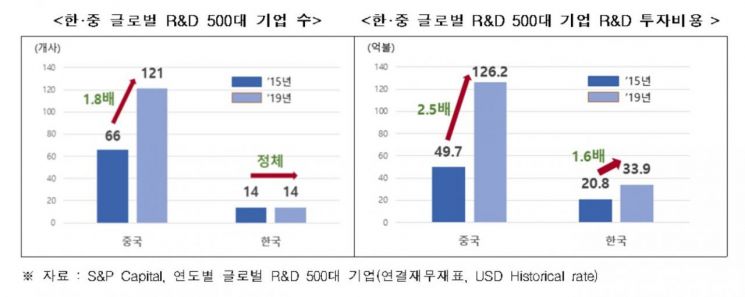

According to the Korea Economic Research Institute on the 13th, the number of Korean companies included in the global top 500 as of last year was 14, the same as five years ago in 2015. In contrast, China’s number increased significantly from 66 to 121 during the same period.

R&D investment costs of these companies also increased from $2.08 billion to $3.39 billion in Korea, a 1.6-fold increase, while China’s rose from $4.97 billion to $12.62 billion, a 2.5-fold increase.

The remarkable growth of Chinese R&D companies is attributed by the Korea Economic Research Institute to the country’s strategic and bold R&D tax support policies.

China allows companies to additionally recognize 50% of the amount spent on R&D as expenses. From 2018 to 2020, this was temporarily increased to 75% for deductions.

The “Super Deduction” system, implemented since 2008, allows companies to recognize an amount higher than their actual R&D investment as expenses, thereby reducing taxable income. There is no limit on the deduction amount.

Furthermore, the scope of R&D eligible for additional deductions is defined using a negative list approach. The negative list means that everything is allowed except what is prohibited by law. Previously limited to new technology and new industry sectors, since 2015, industries excluded from deductions (such as tobacco, lodging, and food service) and activities (such as routine product upgrades and simple application of R&D results) have been legally specified, expanding benefits to all other R&D activities.

Companies recognized as “advanced technology enterprises” also receive reduced corporate tax rates. These enterprises must own core intellectual property rights and meet certain criteria regarding the proportion of R&D expenses and income from high-tech products. Certified companies are subject to a reduced corporate tax rate of 15%, which is 10 percentage points lower.

The procedures for aggregating R&D expenses have also been simplified. Companies are required to open sub-accounts for R&D projects to accurately aggregate and calculate actual R&D expenses incurred, significantly simplifying account management and enhancing convenience in utilizing the system.

On the other hand, the conditions for corporate R&D investment in Korea are challenging. First, the tax credit rate for general R&D by large corporations has been continuously reduced.

The maximum limit for the general R&D tax credit rate (current year) for large corporations was 6% in 2011, but it decreased to 4% in 2014 and further to 2% in 2018. Actual R&D credit amounts reported by companies also declined from 1.8 trillion won in 2014 (large corporations, reporting basis) to 1.1 trillion won in 2018.

The tax credit for new growth and original technology R&D is difficult to utilize due to stringent requirements. Since the end of 2009, a separate credit system has been operated to expand investments in new growth engines and original technology sectors with significant external effects, distinct from general R&D. However, contrary to its original intent, the eligible technologies are limited to 223 technologies in 12 fields, and companies must establish dedicated departments, making it difficult to meet credit requirements.

Choo Kwang-ho, Director of Economic Policy at the Korea Economic Research Institute, emphasized, “China is expanding incentives to strengthen corporate R&D capabilities. Korea should gradually restore the drastically reduced general R&D credit rate for large corporations to previous levels and improve conditions for corporate R&D investment by switching the new growth R&D credit target technologies to a negative list approach.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.