On the 11th, KOSPI Index Surpasses 2400 Level for the First Time in 2 Years and 2 Months

[Asia Economy Reporter Kum Bo-ryeong] The stock price rally led by individual investors, commonly referred to as 'ants,' continues. On the 11th, the KOSPI surpassed the 2400 mark for the first time in 2 years and 2 months since June 2018. Accordingly, bets on inverse products by individual investors, who anticipate an imminent stock price correction, are also increasing.

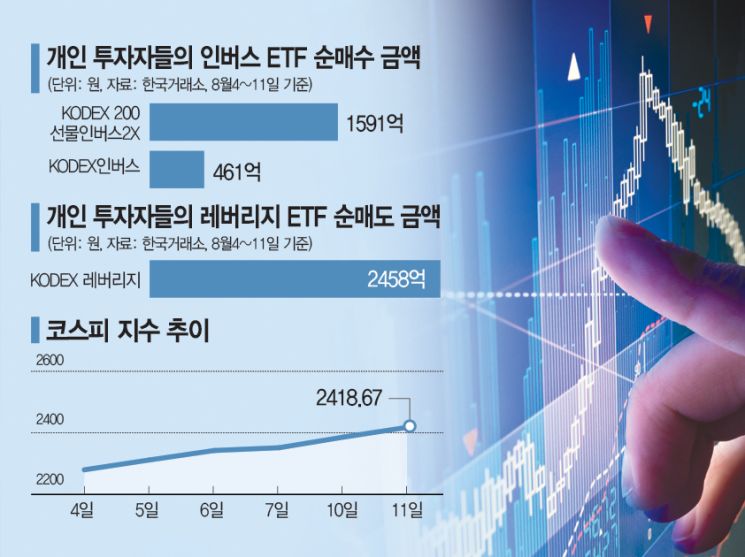

According to the Korea Exchange on the 12th, individual investors purchased a net amount of 159.1 billion KRW worth of the 'KODEX 200 Futures Inverse 2X,' a leveraged inverse exchange-traded fund (ETF) that yields twice the profit of the decline, over six trading days from the 4th to the 11th. This amount is comparable to the net purchase amount of Hyundai Motor (161.5 billion KRW), which ranks sixth among the top net purchase stocks by individual investors in the KOSPI market. Meanwhile, institutional investors (financial investment) net sold 167 billion KRW worth of this product.

During the same period, individuals also net purchased 46.1 billion KRW worth of 'KODEX Inverse.' The net purchase scale of 'TIGER Inverse' was 2.2 billion KRW. This contrasts with the net selling of 245.8 billion KRW worth of 'KODEX Leverage,' which invests in rising markets, indicating an increasing number of individual investors are concerned about a downturn.

The enthusiasm for the stock market is hotter than ever. Since the KOSPI index first broke its yearly high (2279.97) on the 4th, it has maintained a rally with daily increases of around 1%, except for one day. On the 11th, it closed above 2400 for the first time in 2 years and 2 months. As of the 10th, investor deposits exceeded 51.12 trillion KRW, and credit loan balances reached as high as 15.17 trillion KRW. Notably, individuals purchased stocks worth 2.2724 trillion KRW from the 4th to the 11th, driving the domestic stock market. As the rapid rise continues, more individuals are preparing for a downturn, anticipating a correction phase due to the short-term surge.

Han Mo (39), an office worker who started investing in stocks since March after the outbreak of COVID-19, said, "Although I have been enjoying a decent return in this continuously rising market, the rapid rise is so steep that it wouldn’t be surprising if it falls anytime, which is making me increasingly anxious. I have been buying a little bit of inverse products for several days, hoping that if a downturn comes and the returns on my holdings drop, the inverse products might offset some of the losses."

A financial investment industry official explained, "Looking at the psychology of individual investors, they think 'the current KOSPI index has risen too much,' so they are hesitant to buy stocks or leverage products. When looking at the inverse charts, since they have already dropped significantly, investors think, 'How much more can it fall from here?' and are buying." The official added, "Individuals tend to reach for the 'already significantly dropped' side, which feels psychologically safer, rather than jumping on a running horse."

On the 12th, the KOSPI index opened at 2414.78, down 0.16% (3.89 points) from the previous session. It briefly rebounded, surpassing 2420, but then reversed and fell below 2400 during the session. By 10:20 a.m., it was at 2408.93, down 0.4% (9.74 points) from the previous day, showing no significant drop. Both inverse and leverage investors are now in a wait-and-see mode.

Park Sang-hyun, a researcher at Hi Investment & Securities, said, "Although there is controversy over overheating in the KOSPI index, liquidity flows and policies around domestic and international stock markets are expected to remain favorable for the time being." He analyzed, "Given the unpredictability of COVID-19 re-outbreaks and vaccine development, three key variables to watch are the pace of China's economic recovery, the U.S. presidential election, and the timing of the semiconductor industry rebound."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.