Average Sale Price per Household in Seoul Doubled Since 2013

Gangnam 3 Districts and Mayongsung Lead the Era of 1 Billion Won Average Sale Price

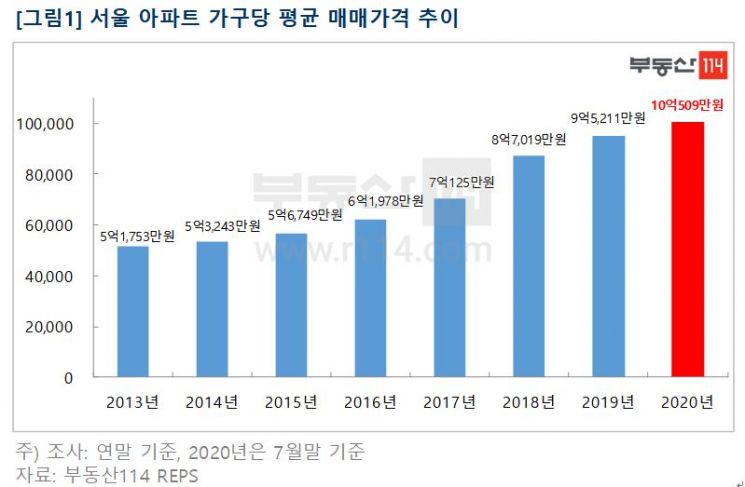

[Asia Economy Reporter Yuri Kim] The average sale price per household for apartments in Seoul has surpassed 1 billion KRW. The average sale price, which remained in the low 500 million KRW range in 2013, has nearly doubled in seven years.

According to Real Estate 114 on the 12th, as of the end of July 2020, the average sale price per household for apartments in Seoul reached an all-time high and exceeded 1 billion KRW for the first time. Gangnam-gu was the first to surpass 2 billion KRW, and the Gangnam 3 districts (Gangnam, Seocho, Songpa) along with Mayongseong (Mapo, Yongsan, Seongdong) saw relatively significant increases, driving up the average price across Seoul.

The background for the average sale price per household surpassing 1 billion KRW includes strong price trends in the Gangnam 3 districts, Mayongseong, and Gwangjin-gu. Real Estate 114 explained, "Gangnam-gu, which surpassed 2 billion KRW per household, and Seocho-gu, which is about to surpass 2 billion KRW, have recently led the overall Seoul market by transforming old apartments into new apartment complexes through reconstruction over the past 2-3 years."

Looking at the districts where the average sale price in Seoul exceeded 1 billion KRW per household, the order is ▲Gangnam (2,017,760,000 KRW) ▲Seocho (1,954,340,000 KRW) ▲Songpa (1,477,380,000 KRW) ▲Yongsan (1,452,730,000 KRW) ▲Gwangjin (1,096,610,000 KRW) ▲Seongdong (1,075,480,000 KRW) ▲Mapo (1,056,180,000 KRW) ▲Gangdong (1,032,820,000 KRW) ▲Yangcheon (1,017,420,000 KRW). The remaining 16 districts, including Yeongdeungpo-gu and Jung-gu, have not yet reached the 1 billion KRW level.

After briefly declining due to the December 16 real estate measures and the economic downturn, Seoul apartment sale prices reversed to an upward trend at the end of May and have shown continuous increases for 11 consecutive weeks as of August. Despite various government policy announcements, apartment transaction volumes in June exploded due to low-interest liquidity and tax-saving listings, and the monthly increase in July recorded a 0.96% change, the highest since December last year (1.08%). Real Estate 114 assessed, "The buying momentum among homebuyers is still ongoing."

In particular, after the significant increase in transaction volume, prime properties desired by buyers have been withheld (listing freeze), reshaping the market in favor of sellers. As a result, even when sellers list properties at prices higher than previous peaks, demand continues to push prices to new highs. However, after the government's August 4 supply measures were announced, the rate of increase has slightly slowed, and some of the 30-40 age group buyers are turning cautious, signaling that the moving season in September and October may act as a turning point for the market direction, according to Real Estate 114.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.